Dogecoin’s $1 Dream: Analyst Spots Bullish Signals Amid Meme Coin Mania

Dogecoin—the joke that outlived its punchline—is back in the spotlight as traders pile into the meme coin. One analyst sees a technical setup that could propel DOGE toward the elusive $1 mark, a 10x surge from current levels.

Key drivers? Whale accumulation patterns mirroring early 2021 behavior, plus renewed retail interest as Bitcoin flirts with all-time highs. The crypto casino’s roulette wheel keeps spinning, and DOGE bulls are betting on red.

But skeptics warn: This is the same asset that cratered 90% after its last hype cycle. As Wall Street bankers clutch their pearls, Dogecoin’s community-driven chaos proves crypto’s first rule—money flows where the memes go.

Is $1 Realistic For Dogecoin?

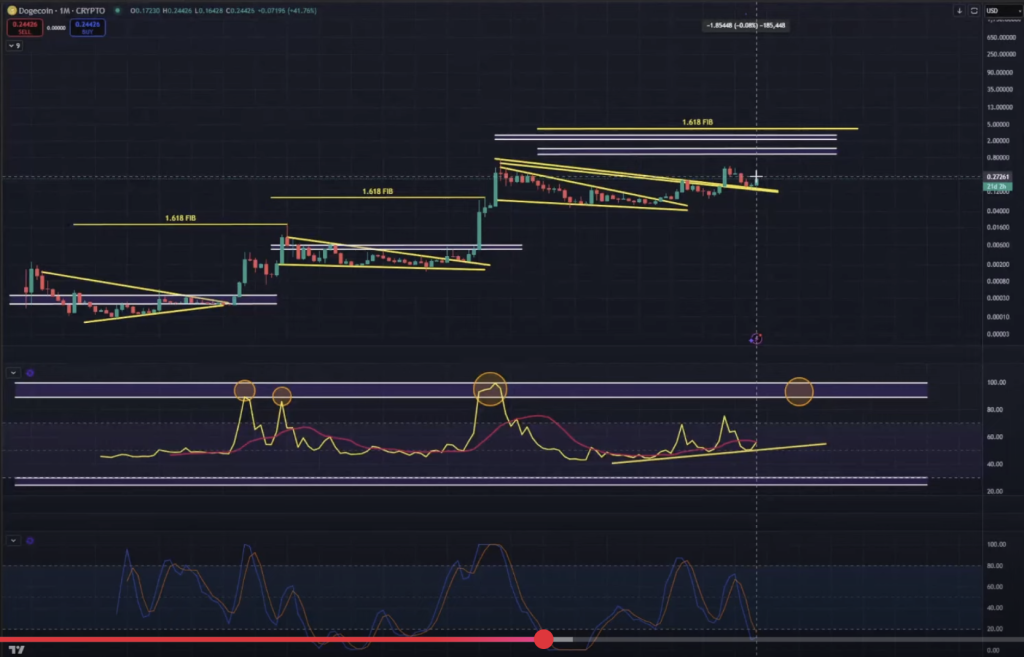

“Can Dogecoin hit $1 this cycle? The answer is yes, it absolutely can,” Kevin told his followers at the outset of the video. He argued that Dogecoin is now in its third major cycle and has historically advanced to the 1.618 Fibonacci extension on the monthly chart. That extension currently sits at roughly $3.80, “well above a dollar,” he noted, while stressing that citing the level is “not a price call” but a way to frame upside potential.

Kevin’s conviction rests on momentum gauges that, in his reading, show dogecoin barely warming up. On the monthly relative-strength index, he traced an ascending trend that has been intact since the post-Luna crash lows in June 2022. “We hit roughly 50 cents with the monthly RSI at 75,” he said, adding that in prior cycles the indicator climbed to at least 89.4. “Look how much room we have to go.” A fresh bullish crossover in the monthly stochastic oscillator would, in his view, confirm the move.

The analyst also linked Dogecoin’s prospects to a macro mix he characterises as increasingly benign: expectations for US rate cuts, a deceleration in quantitative tightening and a rise in global liquidity. He contended that these forces, coupled with a downturn in Bitcoin dominance that his desk called on 28 April at 65.45%, create the conditions for a classic “alt-season.” “Altcoins are oscillators to Bitcoin… monetary policy being easier on the economy is what drives that liquidity into the market,” he explained.

Key chart landmarks remain in focus. Kevin cited a “perfect inverse head-and-shoulders” accumulation which he entered at an average price of $0.15—now “up 65–70%”—and set sequential objectives at $0.48 and the previous all-time high near $0.74. The $1 level would follow only if liquidity trends continue to improve and bitcoin dominance “durably” breaks down. “Realistically, if we keep seeing this path of easing monetary policy… we can absolutely see Dogecoin at a dollar by the end of the year,” he concluded.

Sceptics might flag Dogecoin’s 2021 spike—fueled by social-media fervour and Elon Musk’s “Saturday Night Live” appearance—as a one-off event; Kevin counters that the same Pi-cycle moving-average pair that nailed prior tops is “nowhere NEAR crossing,” implying headroom before froth returns. The shorter-term yellow average, he said, “won’t even start moving higher until Dogecoin hits 40 to 41 cents,” leaving a notional 145% cushion between today’s price and $1 even in an advancing market.

Although Kevin acknowledged that “we’re here to make money, we’re not here to get attached,” he tempered expectations of parabolic targets circulating on social media. “We’re not going to turn this into a Dogecoin to $35 video… This is a video based on facts,” he told viewers, urging them to treat $1 as an ambitious but data-driven milestone rather than a guarantee.

With Dogecoin hovering near $0.25 at press time, the meme coin WOULD need a four-fold rally to tag the psychologically potent dollar mark.