Ethereum ’Dirt Cheap’ Against Bitcoin—But Supply Glut Could Stall the Rally

Ethereum’s bleeding against Bitcoin might be overdone—but don’t pop the champagne yet. On-chain metrics scream undervaluation, yet a looming supply overhang threatens to keep ETH/BTC pinned down.

The Discount No One Wants

At current ratios, ETH trades at a multi-year low against BTC. Analysts point to network upgrades and institutional adoption as reasons for a reversal—if only the market would listen.

Too Much of a Good Thing?

Staking withdrawals and miner sales keep flooding the market. Until that pressure eases, even the most bullish ETH maxi might need to hedge with—gasp—actual Bitcoin.

The Bottom Line

Traders love a bargain, but crypto markets have a habit of ignoring ’fair value’ until Wall Street suits finally wake up and front-run the retail crowd—as usual.

Ethereum Flirts With $2,000 As Undervaluation Sparks Bullish Hopes

Ethereum is now approaching the critical $2,000 mark, a level that, if reclaimed and held, WOULD confirm a technical breakout and potentially usher in a broader bullish phase. After weeks of sluggish movement and bearish pressure, ETH is gaining momentum and showing signs of strength across both price action and on-chain metrics. A close above $2,000 would mark a major shift in sentiment, signaling renewed confidence among investors and traders alike.

However, risks remain. Ongoing tensions between the US and China continue to inject uncertainty into global markets, and the US Federal Reserve has shown no sign of pivoting. With interest rates expected to remain elevated and quantitative tightening (QT) still in effect, the macroeconomic backdrop remains a headwind. Should these geopolitical and monetary factors ease, Ethereum’s breakout could gain sustained traction.

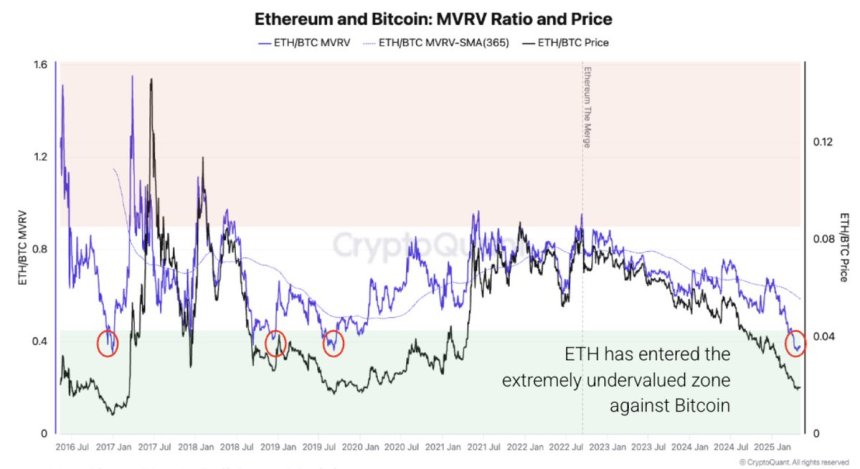

According to CryptoQuant, the Ethereum-to-Bitcoin MVRV (Market Value to Realized Value) ratio highlights that ETH is now extremely undervalued compared to BTC—the first time this has occurred since 2019. Historically, such conditions have led to strong periods of Ethereum outperformance.

Still, the bullish setup faces some internal friction. Supply pressure, weak on-chain demand, and flat network activity could stall momentum if market sentiment doesn’t improve further. While Ethereum’s current push is encouraging, confirmation will only come with sustained movement above resistance and stronger fundamentals. Until then, ETH remains at a critical juncture, with the potential to lead the next leg of the crypto rally—or slip back into consolidation if external and internal pressures persist.

ETH Price Analysis: Technical Details

Ethereum is trading at $1,933 after a strong breakout above the $1,900 resistance zone, marking its highest level since early April. On the 4-hour chart, ETH surged from around $1,850 with increased volume, breaking a multi-week consolidation range. This move confirms bullish momentum and puts the $2,000 psychological level clearly in sight.

The breakout is further supported by the price now trending well above both the 200-period EMA ($1,791) and the 200-period SMA ($1,700). These long-term moving averages had previously acted as resistance but have now been flipped into potential dynamic support. The strength of this rally indicates renewed buying interest and a potential shift in market sentiment.

However, the next challenge lies in maintaining this upward momentum. Ethereum must hold above the $1,900–$1,920 level to avoid a fakeout and confirm this breakout as sustainable. A clean push through $2,000 would further validate the bullish structure and open the door to higher targets.

Overall, the chart reflects a decisive technical breakout, backed by volume and structure. If bulls remain in control and macro conditions remain steady, ETH could be preparing for a stronger trend continuation in the days ahead.

Featured image from Dall-E, chart from TradingView