Data Indicates Surge in Solana Whale Transactions – Sign of Major Accumulation?

Recent on-chain metrics highlight a notable increase in large-scale Solana transactions, suggesting heightened activity among high-net-worth investors. This trend could potentially signal an accumulation phase, as whales appear to be positioning themselves in the SOL market. Analysts are closely monitoring these developments, as such movements often precede significant price action. The surge in whale activity coincides with broader market optimism surrounding Solana’s ecosystem growth and technological advancements.

Whale Accumulation Grows As Bulls Regain Momentum

Solana has been one of the hardest-hit assets during the recent market downturn. Since peaking in January, SOL has lost over 65% of its value, reflecting deep investor uncertainty and heightened selling pressure. As macroeconomic tensions between the US and China continue to grow, global markets have shifted toward a risk-off sentiment, with high-volatility assets like Solana taking the brunt of the damage. However, there may now be signs of relief.

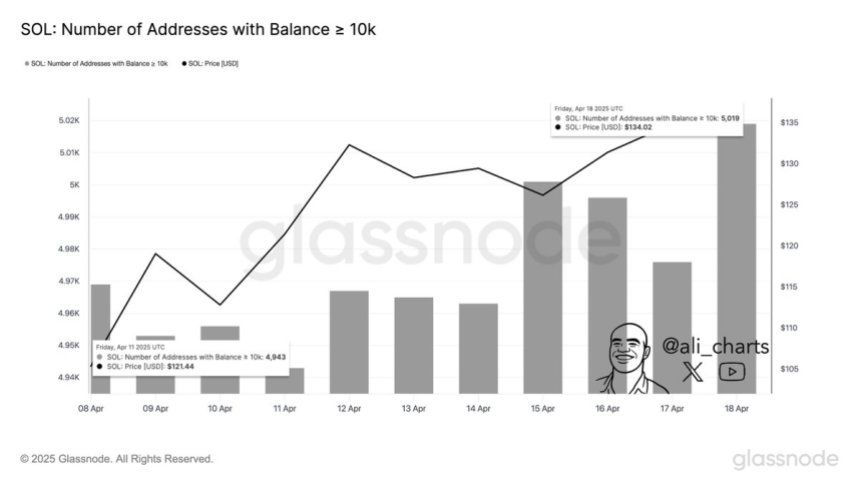

A possible resolution in the ongoing trade dispute and improving liquidity conditions are breathing fresh life into the broader altcoin market. In Solana’s case, the recovery narrative is gaining support from on-chain metrics. According to data shared by top analyst Ali Martinez on X, the number of wallets holding over 10,000 SOL has increased by 1.53% over the past week, rising from 4,943 to 5,019. This subtle but notable uptick in large-holder activity suggests growing institutional or whale confidence in Solana’s long-term potential.

This accumulation trend, paired with rising momentum among bulls, could mark the beginning of a shift in sentiment after weeks of relentless pressure. If global risk appetite improves and Solana can hold key support zones, this whale behavior could lead to a sustained rebound in price.

Solana Tests Key Resistance As Investors Aim For A Recovery

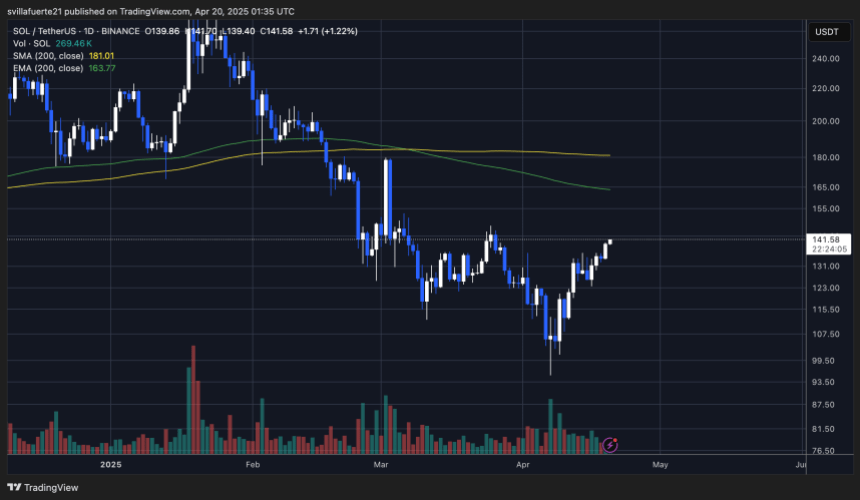

Solana (SOL) is currently trading at $140, just below a critical resistance zone that has capped price advances for weeks. After showing signs of strength in recent sessions, bulls are now attempting to push SOL above the $150 level—a key threshold that, if broken, could quickly propel the price toward the $180 mark. The current momentum is being closely watched, as reclaiming this resistance would signal a trend reversal and provide the foundation for a stronger bullish recovery.

To confirm an uptrend, SOL must break and hold above the $150 mark and then target the 200-day moving average, currently acting as a dynamic resistance. A decisive move above the 200-day MA would indicate a shift in sentiment and reinforce Solana’s breakout potential in the NEAR term.

However, if bulls fail to reclaim and defend these levels, bearish pressure could return. A rejection at current prices would likely open the door for a retest of lower demand zones. Losing support around the $125 level could take SOL back to $100—a level that previously served as a strong support during earlier selloffs. The next few days will be pivotal for determining Solana’s short-term trajectory.

Featured image from Dall-E, chart from TradingView