Ethereum And Solana Flash ’W Bottoms’: Bollinger Returns With Legendary Call

Technical patterns scream bullish as Ethereum and Solana chart classic reversal formations.

The W Bottom Breakout

Both major altcoins carve distinct W-shaped recoveries on daily charts—a pattern that typically signals strong momentum shifts from bearish to bullish territory. The double-tap of support levels followed by aggressive upward moves has traders buzzing.

Bollinger's Bold Prediction

John Bollinger, creator of the ubiquitous Bollinger Bands indicator, returns with what could become another legendary market call. His technical analysis framework now points toward sustained upward pressure for both assets.

Market Mechanics in Motion

The W bottom pattern completes as prices break through key resistance levels with conviction. Volume confirms the move—no phantom pump here. These aren't your average bounce plays; they're structural shifts in market sentiment.

Because nothing says 'sound investment strategy' like following lines on a chart drawn by someone who invented a technical indicator decades ago. But hey, when the pattern works, it works.

Ethereum And Solana Price: What To Watch Now

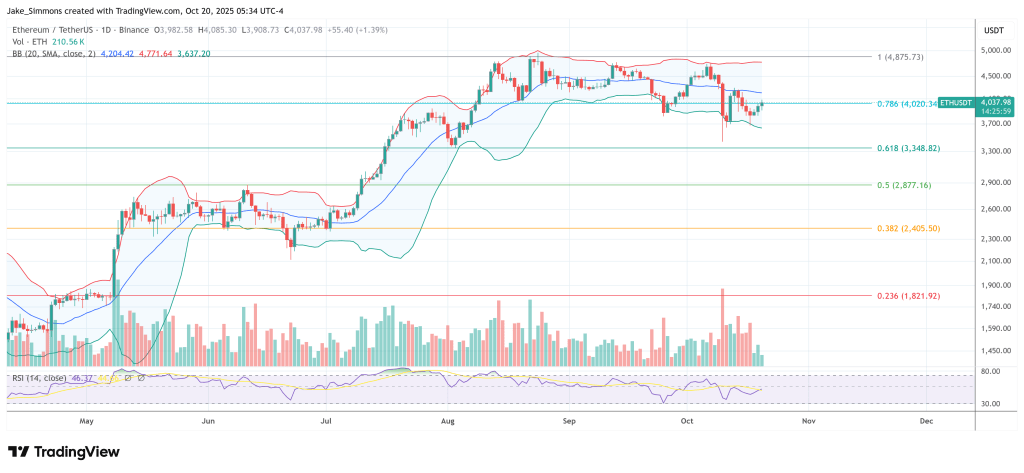

The emphasis on “Bollinger Band terms” is doing heavy lifting here. In classic Bollinger taxonomy, a W bottom is a two-trough reversal with the second low holding above the first, often accompanied by a volatility signature that includes a prior band expansion, subsequent contraction, and a failure to register a lower low at the bands on the second leg.

The more robust versions see the second low forming inside the bands or with a positive divergence against the lower band, followed by a band “pinch” and a MOVE through the middle band that transitions into an upper-band walk. Bollinger’s phrasing—“potential” and “time to pay attention”—signals that, in his framework, pattern recognition precedes confirmation, and that the validation trigger lies in subsequent price interaction with the middle and upper bands rather than in the raw shape of the price lows alone.

The rarity of Bollinger’s crypto commentary layered urgency onto the signal. As crypto trader Satoshi Flipper (@SatoshiFlipper) stressed, “John Bollinger, creator of Bollinger Bands, makes barely 1 crypto call per year and hasn’t made one for ETH in 3 years until yesterday. And each call he makes goes on to mark generational bottoms. He just told us SOL + ETH have bottomed, now imagine fading this legend.”

The same account detailed that Bollinger’s last notable ethereum call dates to September 9, 2022, noting that ETH “went on to pump from $1,290 to $4,000.” That historical reference captures the prevailing market psychology: Bollinger’s infrequent, technically disciplined alerts are perceived by many traders as cycle-defining.

Context from earlier this year also helps frame the setup. On April 10, Bollinger publicly flagged a similar structure in Bitcoin, saying: “Classic Bollinger Band W bottom setting up in BTCUSD. Still needs confirmation.” In the exact same week, BTC carved out a bottom at $74,508 and proceeded to log seven straight green weekly candles, advancing roughly 55%. From Bollinger’s call into the first week of October, BTC rallied more than 70%.

The market nuance in Bollinger’s latest readout is the explicit exclusion of Bitcoin. If ETHUSD and SOLUSD are printing W-like structures in Bollinger terms while BTCUSD is not, it implies a temporary decoupling in volatility structure and relative strength. In practical terms, a non-confirming Bitcoin can either lag into a later confirmation, remain range-bound in a mid-band churn, or fail its own setup if lower-band interactions persist without recapture of the middle band.

For Ethereum and Solana, confirmation would typically look like sustained closes above the 20-period moving average (the Bollinger middle band), followed by a disciplined advance that converts the upper band from resistance into a guide. A healthy W bottom sequence tends not to produce immediate, vertical band overthrows; rather, it builds a stair-step profile with periodic mid-band checks that hold.

Failure WOULD involve another lower-band excursion that undercuts the second trough or a volatility bloom that widens the bands without directional follow-through—both signatures of an incomplete base.

At press time, ETH traded at $4,037.