TRON’s USDT Explosion: From $254M to $78.5B Reshapes Crypto Valuation Landscape

TRON Network's valuation rockets as USDT dominance reaches unprecedented levels

The Stablecoin Takeover

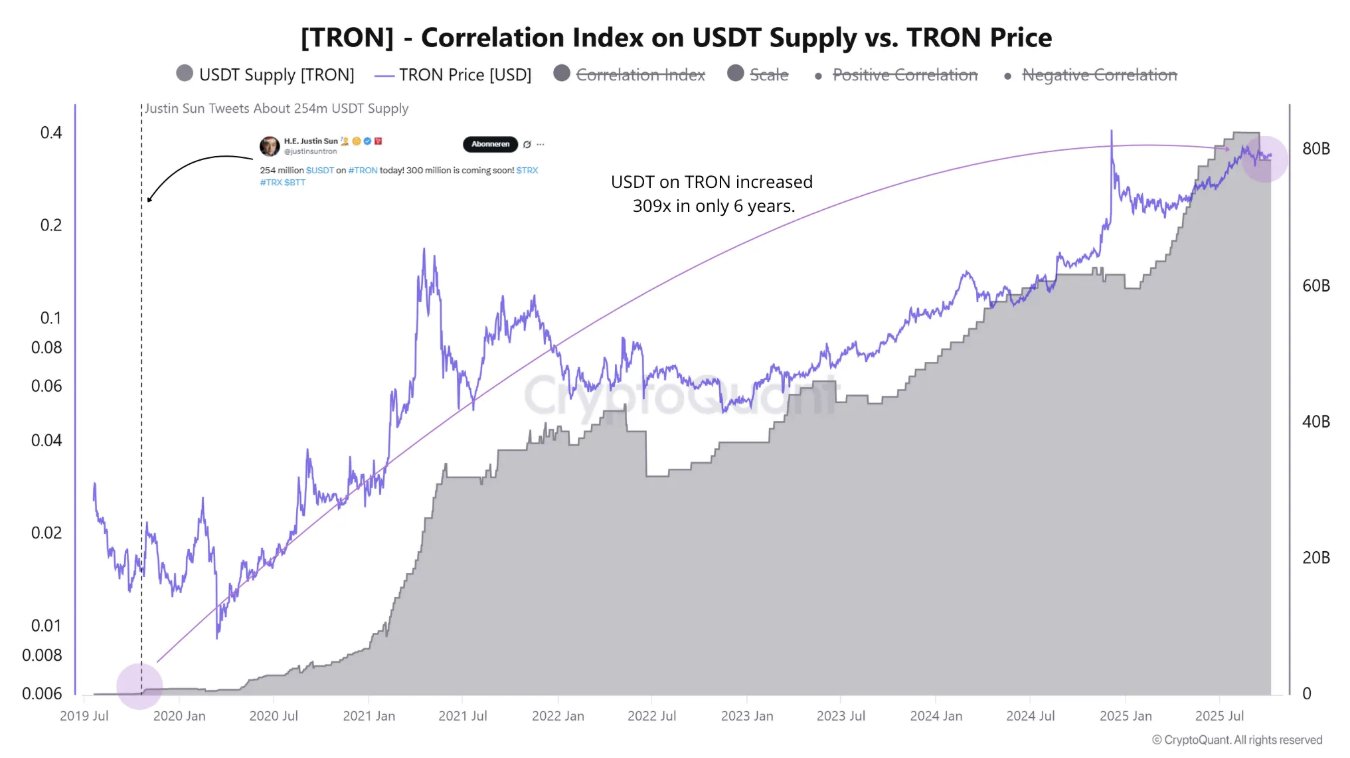

What started as a $254 million experiment has exploded into a $78.5 billion behemoth—TRON's USDT growth isn't just impressive, it's rewriting the rules of network valuation. While traditional finance still debates blockchain utility, TRON quietly built the world's most used dollar-on-ramp.

The Valuation Multiplier

Forget theoretical metrics—real value flows through stablecoin adoption. TRON's infrastructure now processes more dollar-pegged transactions than some small countries handle in GDP. The network transformed from crypto curiosity to financial utility player, proving that sometimes the boring stuff—moving money efficiently—creates the most explosive growth.

Traditional finance executives are probably still trying to figure out how a 'meme coin network' became more useful than their legacy systems—but then again, they're the same people who thought subprime mortgages were a good idea.

Tron Unprecedented Growth: The Power of Liquidity and Network Effects

According to Maartunn, the story of TRON is a perfect example of how fast the crypto industry can evolve. “Time in crypto has a strange rhythm,” he notes — what feels like a lifetime of change in traditional markets can unfold in just a few years on-chain. Six years ago, Justin Sun proudly celebrated a major milestone for TRON: reaching 254 million USDT on the network, with 300 million “coming soon.” At that moment, it represented a remarkable achievement for a still-developing ecosystem.

Fast-forward to today, and TRON’s growth has been nothing short of exponential. The network now hosts $78.58 billion in circulating USDT, a staggering 309x increase since that post. This transformation underscores TRON’s evolution from a niche blockchain to one of the most important infrastructures for stablecoin liquidity worldwide. Over the same period, TRX’s price rose from $0.0155 to $0.338, reflecting how price action and liquidity expansion often MOVE hand in hand.

Maartunn emphasizes that this correlation between USDT supply and TRX price illustrates a broader truth about crypto markets — liquidity drives adoption and valuation. When infrastructure, user demand, and network effects align, growth compounds at an astonishing pace. The key takeaway, he adds, is to zoom out: short-term volatility can obscure the far more powerful story of long-term innovation, adoption, and capital rotation. TRON’s rise proves how quickly a well-positioned network can become indispensable to the digital economy.

TRX Bulls Defend Key Support Amid Consolidation

Tron (TRX) is consolidating just above the $0.33 level, following months of steady gains and a strong uptrend that began in March 2025. The chart shows that after reaching a local high near $0.36, the price entered a sideways range, with buyers defending the 50-day moving average (blue line), currently acting as dynamic support. This region has proven crucial in maintaining the bullish market structure.

The 200-day moving average (red line) remains well below the current price, confirming a long-term bullish bias, while the 100-day MA (green) continues to serve as mid-term support around the $0.32 zone. As long as TRX holds above this area, the broader uptrend remains intact.

However, a clear breakout above $0.35–$0.36 is still needed to confirm renewed bullish momentum and open the door toward $0.38 and $0.40, levels not seen since early 2022. On the downside, a decisive drop below $0.32 could invite further corrections, potentially testing the $0.30 psychological level.

Overall, Tron’s chart structure remains healthy. Consolidation above support suggests that buyers are accumulating, waiting for stronger market conditions to push the price into a new bullish phase aligned with the broader crypto trend.

Featured image from ChatGPT, chart from TradingView.com