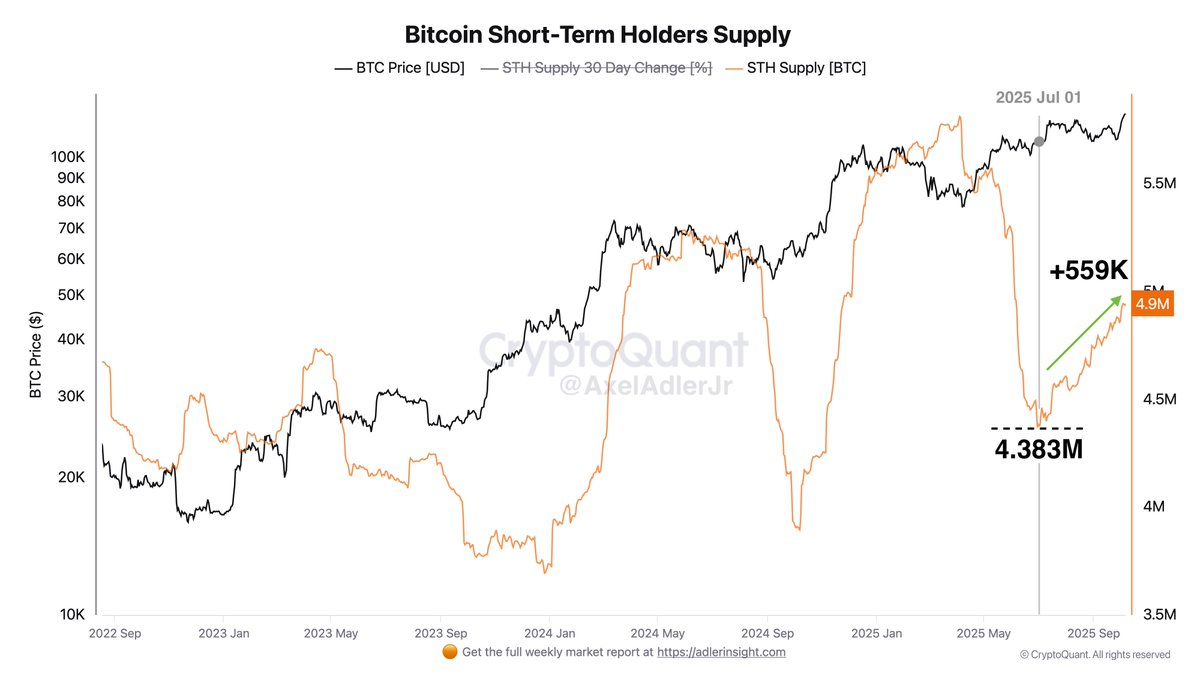

Bitcoin Short-Term Holder Supply Explodes: 559K BTC Influx Signals Massive New Buyer Wave

Bitcoin's getting fresh blood—and lots of it. Short-term holders just piled another 559,000 BTC into their wallets, marking one of the most aggressive accumulation phases in recent memory.

The New Money Arrives

Market newcomers are diving in headfirst, snapping up Bitcoin at a pace that's reshaping the holder landscape. This isn't just dip-buying—it's full-scale market entry.

Supply Shock Building

With half a million coins moving into short-term hands, the available float tightens. Less liquid supply means more volatility fuel—and potentially explosive price moves ahead.

Meanwhile, traditional finance types are still trying to figure out whether Bitcoin's a 'store of value' or 'digital gold' while missing the entire point. The revolution's happening whether they're watching or not.

Short-Term Holders Signal a New Phase for Bitcoin

Top analyst Axel Adler shared key insights revealing that over the past quarter, short-term holders’ supply has increased by 559,000 BTC, climbing from a low of 4.38 million to 4.94 million BTC. This rise marks a clear influx of new participants entering the market, a pattern often seen during the early stages of bullish expansions. The growth in short-term holder supply suggests that fresh demand is building up — as new investors accumulate Bitcoin, older coins are redistributed, creating a healthier market structure.

Historically, periods of rising short-term holder activity have coincided with momentum shifts, as fresh liquidity enters the system and fuels upward volatility. This dynamic reflects renewed market confidence following Bitcoin’s recent push to new all-time highs. More importantly, it shows that retail and short-term investors are re-engaging, positioning for what many analysts expect to be the next major impulse in the cycle.

While some caution that high short-term holder activity can also lead to faster profit-taking and volatility, the broader outlook remains constructive. With long-term holders maintaining strong conviction and institutions continuing to accumulate, the combination of new inflows and resilient fundamentals supports a bullish continuation setup.

Adler notes that this expansion in short-term supply typically precedes a new phase of market acceleration, as liquidity and Optimism return in tandem. If Bitcoin manages to reclaim and sustain levels above its previous all-time high, the growing base of active short-term investors could provide the momentum needed for another breakout. In short, the data suggests that the market isn’t exhausted — it’s recharging, setting the stage for the next leg of the bull cycle.

Bitcoin Holds Above Key Support Amid Healthy Pullback

Bitcoin is currently trading NEAR $122,600, showing resilience after a sharp rejection from the $126,000 area earlier this week. The 12-hour chart highlights that BTC has entered a consolidation phase following its explosive breakout, with the $120,000–$121,000 range now acting as a short-term support zone. The yellow line at $117,500, a previous resistance from earlier in the cycle, continues to serve as a key structural level that could define the next move.

The blue 50-period moving average is trending upward, reinforcing bullish momentum, while the 200-period moving average remains far below the current price, confirming that bitcoin is still in a strong uptrend. Despite the recent correction, the price structure remains constructive — higher highs and higher lows continue to form, suggesting that bulls are maintaining control.

A decisive rebound above $124,500 could mark the beginning of a renewed push toward all-time highs, while a breakdown below $120,000 could open the door for a deeper retest of $117,500. Overall, this chart reflects a healthy cooldown after an aggressive rally, allowing momentum indicators to reset. As long as BTC holds above its key supports, the broader trend remains firmly bullish, setting the stage for another attempt toward price discovery.

Featured image from ChatGPT, chart from TradingView.com