Bitcoin Fear & Greed Index Plunges to March Lows - Here’s Why That’s Actually Bullish

Extreme fear grips crypto markets as sentiment indicators hit rock bottom.

Market Psychology Shift

When the Fear & Greed Index crashes to levels not seen since March, seasoned investors start paying attention. These sentiment extremes often signal major turning points - the kind that separate emotional traders from strategic accumulators.

Contrarian Opportunity

History shows these fear-spikes precede some of Bitcoin's most powerful rallies. The current reading suggests we're approaching maximum pain threshold - exactly when smart money starts building positions while traditional finance pundits predict the end of crypto (again).

Technical Reset

Market resets flush out weak hands and create healthier foundations for next leg up. This sentiment washout mirrors classic bull market behavior - two steps forward, one step back toward higher highs.

Wall Street's timing remains impeccable as always - showing up late to the party then complaining about the music.

Bitcoin Fear & Greed Index Drops To 28

This week has been tough for many cryptocurrencies, especially Bitcoin. Bitcoin, which started the week above $115,000, entered into an extended decline that saw it break below $110,000, which in turn led to liquidations of over $1 billion worth of positions across the industry. This move also saw ethereum break below $4,000, alongside altcoins likes XRP, Solana extending to the downside.

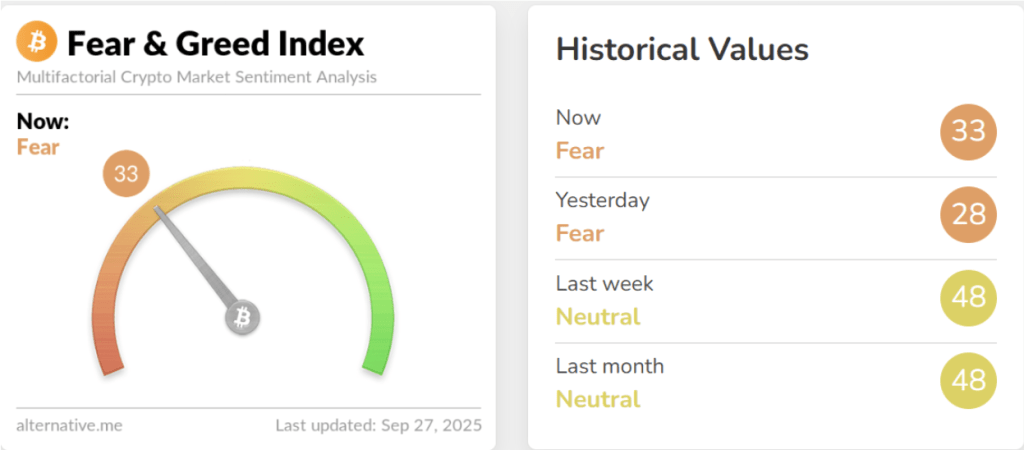

Taken together, these moves erased the cautious Optimism of last week, when the index sat at a neutral level of 48. Instead, Bitcoin’s Fear and Greed Index fell to as low as 28, which is a dramatic 16 point plunge in a single day.

This crash in the Bitcoin Fear and Greed Index shows just how fast sentiment can reverse when important price thresholds fail to hold. However, while the fearful mood might appear to be a bearish hint, these conditions could be an opportunity for long-term traders. The Fear and Greed Index has historically been a contrarian indicator, with extreme fear levels typically appearing before significant rebounds.

Earlier in March, when the index last reached similar depths, bitcoin was trading at a relative low around $83,000. Today, even after breaking below 30 on the index again, Bitcoin is about $27,000 higher than it was in March.

Bitcoin Fear And Greed Index. Source: Alternative.me

Constructive Outlook For The Coming Weeks

The broader takeaway from this sentiment shift is that the crypto market may be closer to its next recovery phase than many expect. The index’s slight rebound to 33 today from yesterday’s low of 28 shows that some traders are already positioning for a turnaround. For one, Bitcoin’s current prices could give savvy investors the chance to accumulate Bitcoin at discount prices.

Bitcoin rarely sustains rallies in conditions of overwhelming greed. Instead, consolidations and corrections reset sentiment and make room for healthier growth. For instance, crypto analyst Michael Pizzino said in a post on X, that the most recent fear could be the turning point Bitcoin and crypto has been waiting for.

In this sense, the fearful environment may be setting the stage for Bitcoin, Ethereum, and other altcoins to build bullish momentum once selling pressure eases.

Now, the most important thing is for the Bitcoin price to reestablish itself above $110,000. At the time of writing, Bitcoin is trading at $109,220.

Featured image from Unsplash, chart from TradingView