Bitcoin Price Alert: Could Still Plummet to $99,000 If This Critical Scenario Unfolds, Ostium Labs Warns

Bitcoin faces a potential reckoning despite current bullish momentum. Ostium Labs researchers identify a specific trigger that could send the cryptocurrency tumbling to $99,000—a level that would represent a significant correction from recent highs.

The Perfect Storm

Market analysts point to converging factors that could create the ideal conditions for a sharp downturn. Liquidity constraints combined with macroeconomic pressures form the dangerous cocktail Ostium Labs warns about.

Regulatory Domino Effect

Global cryptocurrency regulations remain fragmented, creating uncertainty that amplifies market volatility. One major jurisdiction's policy shift could trigger cascading sell-offs across international exchanges.

Institutional Whiplash

While institutional adoption has driven recent gains, the same large players could accelerate a downturn. Their automated trading systems respond to signals that retail investors might miss entirely.

Technical Breakdown

Key support levels must hold to prevent the predicted slide. Technical analysts watch specific price points that, if broken, could validate Ostium's $99,000 projection.

Because nothing says 'stable store of value' like potential 40% swings based on billionaire tweets and regulatory whims.

Bitcoin Crash To $99,000 Looms

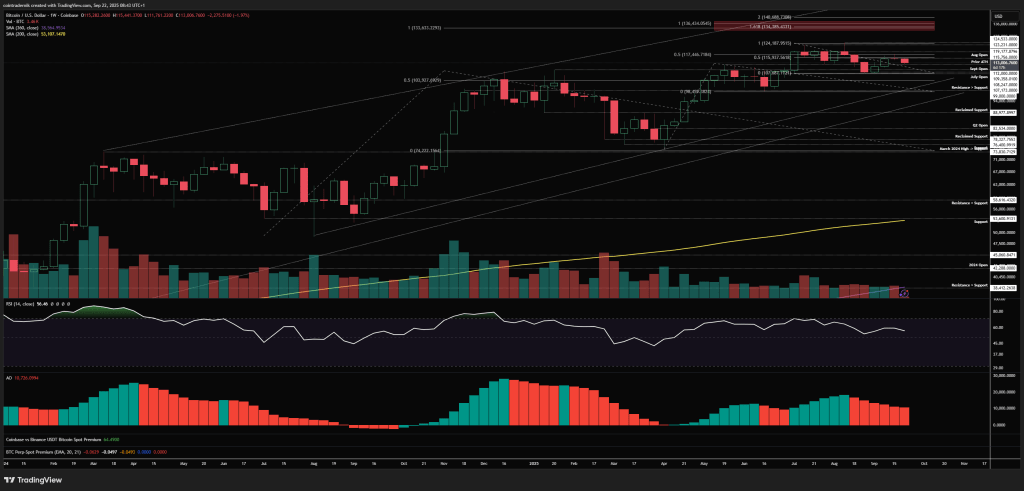

On the weekly chart, Ostium notes last week’s consolidation around the August open and a wick into “key resistance… at $117.5k,” followed by a close marginally below the open. Early-week price action then carried price beneath reclaimed support into the $111k handle, with the analysts highlighting “over $1.6bn in longs liquidated so far today.”

Two structural inflection zones anchor the bearish risk: “Acceptance below $107k on a weekly close WOULD open up more downside into $99k,” whereas on the topside “the weekly high at $115.3k… is at least revisited some time later in the week.”

On the daily timeframe, the August open at $115.7k is the pivot the market must reclaim to reassert momentum. As the authors put it, “that August open at $115.7k [is] a key level to flip into support to resume bullishness.”

The immediate battleground is the prior all-time high at $112k, where “a reclaim of $112k as support” would tilt probabilities toward a higher low and force shorts to cover into a MOVE back through $115.7k. Their base case, however, is for additional chop “between $112k-$115k before a second push lower below today’s low,” which will determine whether the market undercuts the June swing at $107k or marks out a bottom sooner.

Tactically, Ostium lays out both long and short triggers with unusual clarity. On the long side: “a sweep of today’s low early this week and then a reclaim of $112k as support,” riding momentum “back into the weekly high.” On the short side, they float what they call “a really nice short setup… a sharp v-reversal… back above the weekly high… before… rejecting and breaking back below $115.3k,” which would then target “$112k and lower.” In other words, a squeeze-then-fade path that punishes both late longs and late shorts.

Positioning and derivatives breadth round out the near-term blueprint. The note shares snapshots of 3-month annualized basis, bitcoin versus altcoin open interest, and one-week/one-month liquidation maps, underscoring how quickly liquidity pockets can flip into magnets in thin conditions.

This informs their near-term expectation that “the next leg lower or second liquidation event this week [could] be a high probability low,” followed by a retest of $115.3k that will act as the tape’s verdict on whether another down-leg or a bear-trap reversal is in play into quarter-end.

The house view remains probabilistic rather than doctrinaire. If $107k fails on a weekly close, the weakness window could extend into “$99k”; if it holds—and especially if the market can “flip $115.7k into support”—the higher-low narrative stays alive. In the authors’ words, for ethereum “nothing about this higher timeframe structure or momentum is currently giga-bearish,” and, by analogy, Bitcoin’s structure is best judged by the reaction around $111.7k–$112k this week.

Whether today’s flush proves to be prelude to capitulation or the trap before new highs, Ostium’s bottom line is clear: “we move much higher from early October” unless those weekly thresholds are accepted lower.

At press time, BTC traded at $113,002.