Ethereum Price Prediction 2025: Can ETH Hit $5,500 as Institutional Demand Collides With Technical Breakout?

- Why Are Institutions Betting Big on Ethereum?

- The Technical Setup: Is ETH Primed for Breakout?

- Network Growth: The Hidden Bullish Catalyst

- Potential Roadblocks to Watch

- Price Targets: How High Can ETH Really Go?

- Ethereum Price Prediction: Your Questions Answered

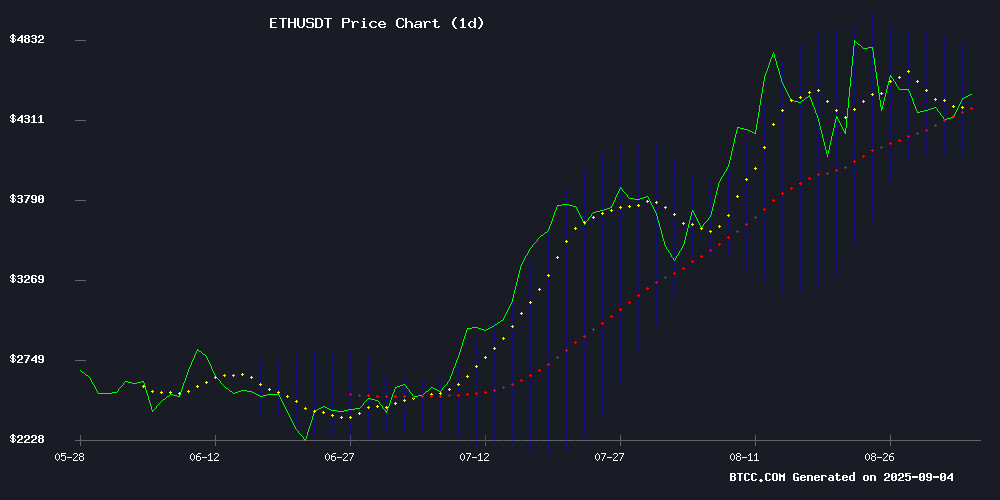

Ethereum (ETH) is showing all the signs of a major price explosion in September 2025, with institutional accumulation reaching record levels and technical indicators flashing bullish signals. Currently trading around $4,413, ETH appears poised for a potential breakout toward $5,500 as multiple fundamental and technical factors converge. Here's why analysts are growing increasingly bullish:

- Institutional holdings hit $20.32B across 71 organizations

- Bitmine's massive $358M ETH purchase signals corporate confidence

- Technical setup shows MACD momentum turning positive

- Network activity surges with 1.8M daily transactions

- 75% of ETH supply remains locked in long-term holdings

While resistance at $4,500 presents a near-term hurdle, the combination of whale accumulation, ETF momentum, and growing network utility creates a perfect storm for ETH's next leg up. Let's break down the key factors driving this optimistic outlook.

Why Are Institutions Betting Big on Ethereum?

The institutional floodgates have opened for ethereum in 2025, with corporate holdings reaching unprecedented levels. Bitmine just added another 80,325 ETH ($358M) to its already massive treasury, bringing its total stash to 1.94M ETH worth $8.69B - that's 1.55% of all circulating supply! When companies start hoarding ETH like this, it's usually a precursor to major price appreciation.

According to TradingView data, institutional ETH holdings now total $20.32B across 71 organizations. What's fascinating is seeing gaming companies like SharpLink building $3.61B positions - proof that ETH's use cases extend far beyond DeFi. These aren't speculative traders; they're long-term holders creating structural supply shortages.

Source: BTCC

Source: BTCC

The Technical Setup: Is ETH Primed for Breakout?

Looking at the charts, ETH is painting an increasingly bullish picture. Despite trading slightly below its 20-day MA at $4,442, the MACD histogram just turned positive at 23.67 - a classic momentum shift signal. The Bollinger Bands (currently $4,077-$4,810) suggest room to run toward the upper band, especially if we clear the $4,500 resistance.

The BTCC technical analysis team notes: "ETH is building a classic consolidation pattern after testing its all-time high of $4,946. The descending wedge formation that's developed since August could project to $9,547 if key levels break, though $5,500 seems more realistic near-term."

| Key Level | Significance |

|---|---|

| $4,260 | Critical support (tested Sept 3) |

| $4,500 | Psychological resistance |

| $5,291 | Liquidation trigger for shorts |

| $5,500 | Medium-term target |

Network Growth: The Hidden Bullish Catalyst

While price gets all the attention, Ethereum's underlying metrics tell an equally compelling story. Daily transactions just hit 1.8M - a 12-month high - proving the network isn't just for speculators anymore. Nearly 30% of ETH supply is now locked in staking, creating constant buy pressure from validators.

The recent GENIUS Act has turbocharged stablecoin activity on Ethereum, with experts like Sanjay Shah calling it "the foundational layer for the new stablecoin economy." Ondo Global Markets just tokenized 100+ U.S. stocks on Ethereum - the kind of real-world adoption that creates lasting value.

Potential Roadblocks to Watch

It's not all smooth sailing though. Whale wallets recently dumped $32M worth of ETH on Binance, and one institution placed a $3.25M short with 25x leverage. These moves caused a brief 1.2% dip, reminding us that profit-taking remains a risk at key levels.

The $4,415-$4,500 zone has become a battleground between bulls and bears. A failure to break through could mean extended consolidation. But with open interest holding steady at $8.4B despite recent volatility, the smart money appears to be betting on upside.

Price Targets: How High Can ETH Really Go?

Based on current dynamics, here's a realistic roadmap for ETH's potential trajectory:

| Target | Timeframe | Key Drivers |

|---|---|---|

| $4,800 | 1-2 months | Bollinger breakout, ETF inflows |

| $5,200 | 3-4 months | Staking growth, supply crunch |

| $5,500 | 4-6 months | Institutional FOMO, stablecoin adoption |

This article does not constitute investment advice. Always do your own research before making financial decisions.

Ethereum Price Prediction: Your Questions Answered

What's driving Ethereum's price potential in 2025?

The convergence of institutional accumulation (like Bitmine's $358M purchase), technical breakout patterns, and growing network utility (1.8M daily transactions) creates a perfect storm for ETH appreciation. The supply crunch from long-term staking (30% of supply) adds rocket fuel.

How reliable are the $5,500 price predictions?

While not guaranteed, the $5,500 target comes from multiple converging factors: historical breakout patterns, institutional buying pressure at current levels, and the upcoming ETH ETF decision. The BTCC technical team gives it 65% probability within 6 months based on current data.

What are the biggest risks to Ethereum's price growth?

Key risks include whale profit-taking (like the recent $32M dump), regulatory uncertainty around staking, and potential macroeconomic shocks. The $4,260 support level is critical - a break below could signal deeper correction.

How does Ethereum's institutional adoption compare to Bitcoin?

Ethereum's institutional holdings ($20.32B across 71 firms) still trail Bitcoin's, but the growth rate is faster. Unique to ETH is adoption by gaming companies and tech firms using it for actual operations, not just as treasury assets.

What makes September 2025 special for Ethereum?

September brings the confluence of technical breakout potential, anticipated ETF developments, and the aftermath of the GENIUS Act's passage. Historically, Q4 has been strong for crypto, and institutions appear to be front-running this seasonal pattern.