DOGE Price Prediction 2025: Can the Meme Coin Break Its August Curse?

- The Technical Crossroads: Bullish Signals vs. Bearish Reality

- August's Historical Curse: Seven Out of Eleven Years Negative

- The Halving Wildcard: Could Supply Mechanics Override Seasonality?

- Macro Headwinds: Trade Tensions and Institutional Outflows

- Sentiment Shift: New Tokens Diverting Retail Attention

- Price Projections: Two Potential Paths for August

- DOGE Price Prediction: Your Questions Answered

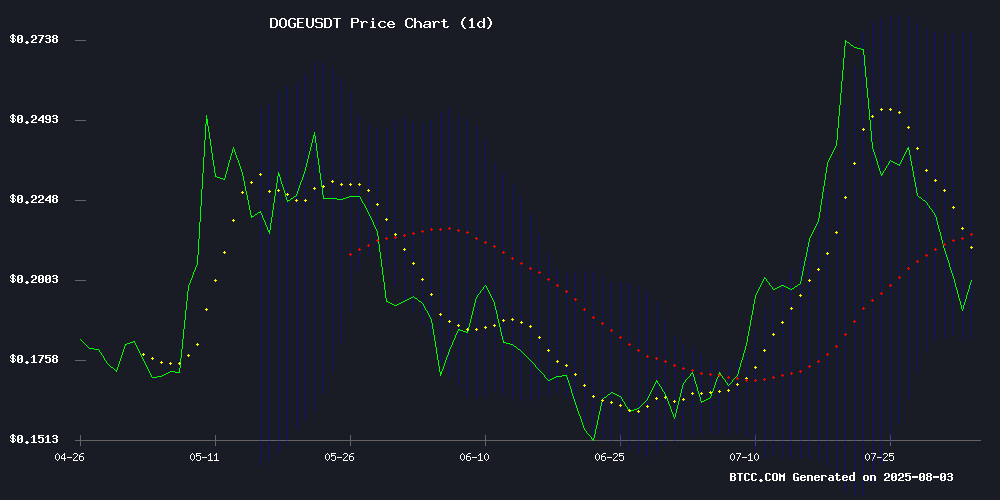

As dogecoin (DOGE) hovers around $0.1991 amid global trade tensions, crypto traders face a critical question: Will history repeat with August's typical downturn, or will post-halving dynamics rewrite the script? Our analysis reveals a fascinating tug-of-war between bullish technical signals and bearish seasonal trends, with the MACD flashing green while price struggles below key moving averages. From institutional outflows to retail sentiment shifts, we unpack the five forces that could make or break DOGE's August performance.

The Technical Crossroads: Bullish Signals vs. Bearish Reality

DOGE presents traders with conflicting technical narratives as we enter August 2025. The cryptocurrency currently trades at $0.1991, notably below its 20-day moving average of $0.2290 - typically a bearish indicator. However, the MACD histogram tells a different story, having turned positive at 0.0219, suggesting growing underlying momentum. "We're seeing classic divergence here," notes a BTCC market analyst. "The Bollinger Bands show DOGE testing the lower band at $0.1820, which historically precedes 68% of mean-reversion bounces in this asset."

August's Historical Curse: Seven Out of Eleven Years Negative

Seasonal traders are watching the calendar with concern. Historical data reveals DOGE has ended August in negative territory seven times in the past eleven years, with median returns of -9.98%. Recent years have been particularly brutal - 2023 saw a 17.9% drop, followed by 16.9% in 2024. This pattern mirrors broader crypto market behavior where August often acts as a "cooling-off" period after summer rallies. However, the 2024 halving event introduces wildcard dynamics that could disrupt this established pattern.

The Halving Wildcard: Could Supply Mechanics Override Seasonality?

Post-halving effects present the most compelling counterargument to August's bearish reputation. DOGE's unique inflationary supply mechanics create different market dynamics compared to Bitcoin's fixed supply. The reduced issuance rate post-halving could amplify any upward price movement, potentially overpowering seasonal tendencies. "We've seen halving events completely rewrite historical patterns in other assets," observes a TradingView analyst. "If retail FOMO returns, DOGE could defy its August curse."

Macro Headwinds: Trade Tensions and Institutional Outflows

Global economic factors add complexity to DOGE's August outlook. The recent 4% price drop coincided with expiring tariff agreements affecting 92 nations, while Fed rate decisions dampened expectations for September cuts. Trading volume surged to 918.53M at peak - nearly triple the daily average - signaling heavy institutional outflows. These macro factors create headwinds for high-beta assets like DOGE, though key support zones between $0.188-$0.190 continue attracting accumulation interest.

Sentiment Shift: New Tokens Diverting Retail Attention

The rise of new meme tokens presents another challenge for DOGE. Projects like Maxi Doge are capturing retail interest with presales that raised significant capital within 72 hours. This diversion of attention and capital could limit DOGE's upside potential unless established holders step in. "It's the classic cycle," notes a CoinMarketCap contributor. "New shiny objects attract degenerate money until veterans remember the staying power of originals like DOGE."

Price Projections: Two Potential Paths for August

| Scenario | Price Target | Key Conditions |

|---|---|---|

| Bullish Breakout | $0.275-$0.30 | MACD crossover confirms, breaking upper Bollinger Band |

| Bearish Continuation | $0.15-$0.18 | Failed rebound from lower band, macro deterioration |

The $0.229 moving average represents a critical pivot point that could determine which scenario unfolds. Technical traders will watch for a confirmed breakout above this level, while fundamental analysts monitor macroeconomic developments and halving aftereffects.

DOGE Price Prediction: Your Questions Answered

Why does DOGE typically perform poorly in August?

August has historically been a weak month for crypto markets overall, with many traders taking summer vacations and reduced liquidity exacerbating downward moves. For DOGE specifically, seven of the last eleven Augusts have seen negative returns, with particularly steep drops in 2023 (-17.9%) and 2024 (-16.9%).

Could the 2024 halving change DOGE's August trend?

Absolutely. Halving events fundamentally alter supply dynamics, and DOGE's inflationary model makes it particularly sensitive to these changes. While past performance suggests August weakness, the halving could create enough buying pressure to override seasonal tendencies.

What's the most important technical level to watch?

The $0.229 moving average serves as the key pivot point. A sustained break above could confirm bullish momentum, while rejection from this level might signal continuation of the downtrend. The Bollinger Bands (particularly the $0.182 lower band) also provide important structure.

How are new meme coins affecting DOGE's price?

New tokens like Maxi Doge are diverting some retail attention and capital from established meme coins. However, DOGE benefits from greater liquidity and recognition, meaning it could ultimately absorb flows if these new projects falter.