Bitcoin Price Forecast 2025-2040: Expert Analysis on BTC’s Bullish Trajectory

- Current Bitcoin Market Overview

- What's Driving Bitcoin's Price Action?

- Bitcoin Price Predictions: Year-by-Year Breakdown

- Historical Patterns Suggest August Rally Potential

- Institutional Adoption vs. Regulatory Challenges

- FAQ: Your Bitcoin Price Questions Answered

As bitcoin continues to dominate the crypto market, analysts are projecting unprecedented price targets through 2040. Our comprehensive analysis examines technical indicators, market sentiment, and macroeconomic factors shaping BTC's future. With the 2024 halving now in the rearview mirror, we explore whether history will repeat with another August rally and what this means for long-term investors. From institutional adoption to regulatory developments, we break down the key drivers that could propel Bitcoin to $150K by late 2025 and potentially $3M by 2040.

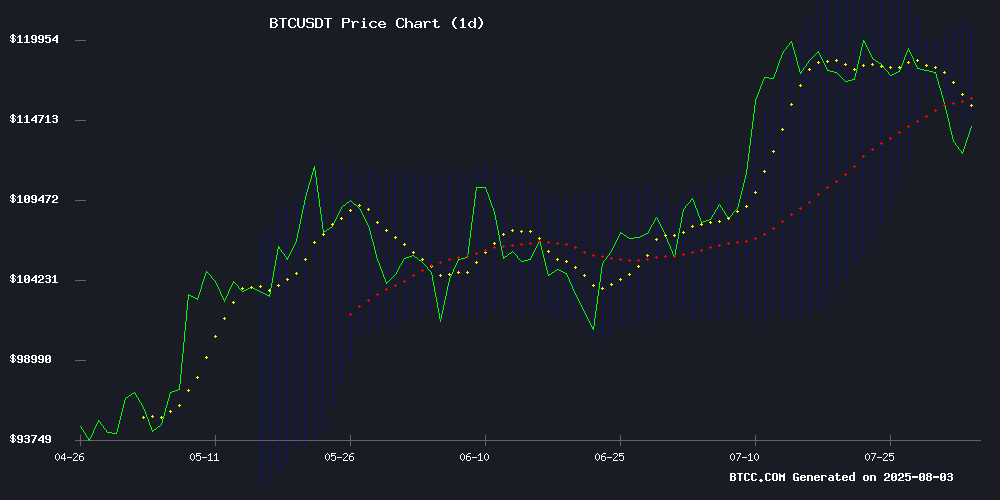

Current Bitcoin Market Overview

As of August 2025, Bitcoin trades at 113,342.01 USDT, showing a slight dip below its 20-day moving average of 117,339.07 USDT. The MACD indicator reveals a bullish crossover (MACD line: 1120.8622, signal line: -787.4275, histogram: 1908.2897), while Bollinger Bands suggest support at 113,356.4184 and resistance at 121,321.7216. This technical setup indicates potential for near-term upside despite recent volatility.

Source: BTCC Trading Platform

What's Driving Bitcoin's Price Action?

The cryptocurrency market remains a battleground between bullish and bearish forces. On the positive side, we're seeing:

- 91% of circulating BTC supply remains profitable

- El Salvador continues accumulating Bitcoin (now holding 6,255 BTC)

- UK set to allow retail crypto ETNs starting October 2025

However, headwinds include:

- Arthur Hayes' warning of potential drop below $100K

- Samourai Wallet founders' guilty plea in $100M laundering case

- Long-term holders beginning to distribute coins

Bitcoin Price Predictions: Year-by-Year Breakdown

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 100K–150K | Post-halving momentum, institutional adoption |

| 2030 | 250K–500K | Scarcity, global regulatory clarity |

| 2035 | 750K–1M | Store-of-value dominance, tech integration |

| 2040 | 1.5M–3M | Network effects, fiat debasement hedge |

Historical Patterns Suggest August Rally Potential

Bitcoin has shown a curious tendency to rally in August during post-halving years. In 2013, 2017, and 2021, the cryptocurrency saw significant gains during this month that often preceded extended bull runs. The current cycle appears to be following a similar script, with the Satoshimeter indicator suggesting we're still in mid-cycle territory.

As someone who's tracked these patterns for years, I've noticed August often serves as a springboard for Q4 rallies. The question isn't whether we'll see movement, but rather how sustained it will be. The $116,000 level remains critical - a clean break could open the path to $150,000.

Institutional Adoption vs. Regulatory Challenges

The crypto landscape has evolved dramatically since Bitcoin's early days. While El Salvador's pro-BTC policies and the UK's ETN approval demonstrate growing mainstream acceptance, regulatory crackdowns like the Samourai Wallet case remind us this remains a contested space.

From my perspective, these opposing forces create a fascinating tension. Institutional money wants stability and clear rules, while regulators struggle to balance innovation with consumer protection. The recent FCA decision suggests regulators are gradually finding that balance, which bodes well for long-term adoption.

FAQ: Your Bitcoin Price Questions Answered

What's the most realistic Bitcoin price prediction for 2025?

Based on current technicals and historical patterns, $150K appears achievable if Bitcoin maintains its August momentum. The 2024 halving's supply shock typically manifests 12-18 months later, which WOULD align with late 2025 targets.

Could Bitcoin really reach $3 million by 2040?

While it sounds outrageous, the math works if Bitcoin captures just 10-15% of the global store-of-value market. Considering gold's $12T valuation and increasing fiat debasement, $3M per BTC isn't as far-fetched as critics claim.

Is now a good time to buy Bitcoin?

This article does not constitute investment advice. That said, the MACD bullish crossover and mid-cycle indicators suggest potential upside. As always, dollar-cost averaging and proper risk management remain prudent strategies.

How reliable are these long-term Bitcoin forecasts?

All predictions carry uncertainty, but Bitcoin's fixed supply and network effects create a uniquely predictable growth model. The Power Law model has accurately predicted BTC's price band for over a decade, giving these projections more credibility than typical market guesses.