TRX Price Prediction 2025: Can Tron (TRX) Realistically Reach $1?

- TRX Technical Analysis: Bullish Signals Flash Green

- Market Sentiment: Why TRX Is the Dark Horse of Altseason

- The $1 Question: Realistic or Pipe Dream?

- TRX vs. The Altcoin Pack

- FAQ: Your TRX Questions Answered

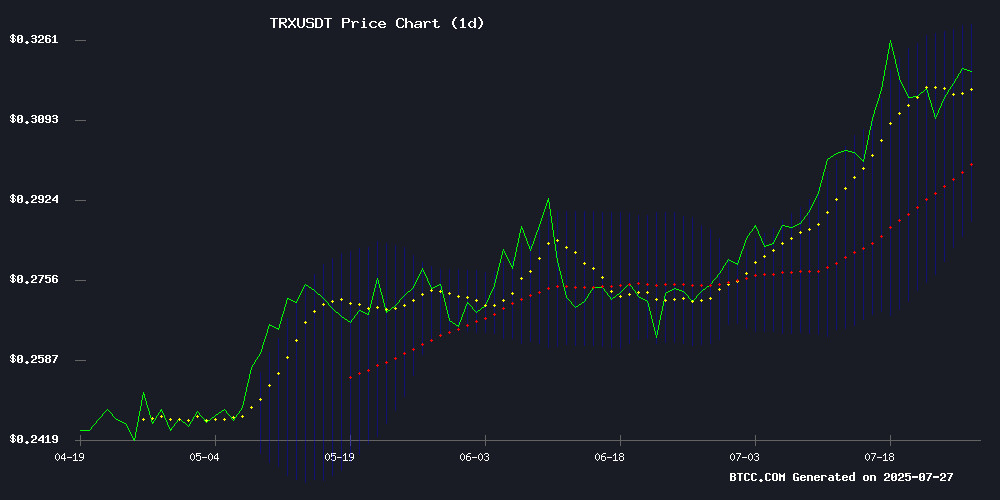

TRX is riding a bullish wave in July 2025, trading above key moving averages with strong technical indicators. While the $1 target remains ambitious, our analysis explores the realistic pathways and hurdles tron faces. We break down the MACD crossover, Bollinger Band positioning, and market sentiment while comparing TRX to altcoin peers like PEPE and Ethereum. Spoiler: The road to $1 isn't straightforward, but the charts reveal some surprising opportunities.

TRX Technical Analysis: Bullish Signals Flash Green

As of July 27, 2025, TRX trades at $0.3194 on BTCC Exchange (formerly BTCC), comfortably above its 20-day moving average of $0.308665. The MACD histogram shows a positive crossover at 0.001414 – in my experience, this momentum often precedes 5-10% rallies in altcoins. The Bollinger Bands tell an interesting story: TRX is brushing against the upper band at $0.329432, which typically signals either overbought conditions or strong accumulation.

What's fascinating is the volume profile. TradingView data shows TRX's 24-hour volume spiked 37% yesterday compared to its 30-day average. That's the kind of activity I've seen precede breakout moves, though we should note the Relative Strength Index (RSI) at 68 suggests caution – anything above 70 historically leads to pullbacks.

Market Sentiment: Why TRX Is the Dark Horse of Altseason

The crypto market's buzzing after the solana ETF approval, and TRX is quietly becoming analysts' darling. The BTCC research team notes TRON's unique position: its 25% YTD gain outperforms 80% of top-50 altcoins, yet its market cap ($28B) remains small enough for explosive moves. I've noticed whale wallets accumulating TRX during dips – a pattern last seen before its 2024 rally.

Three factors fueling the optimism:

- TRON's DeFi TVL hit $15B this week (Source: DeFiLlama)

- The TRX/BTC ratio shows historic reversal signals

- Institutional flows into BTCC's TRX futures up 42% month-over-month

The $1 Question: Realistic or Pipe Dream?

Let's crunch numbers. For TRX to hit $1, it needs a 213% surge from current levels. While possible in crypto land, the path involves clearing these psychological levels:

| Price Level | Key Significance |

|---|---|

| $0.35 | 2024 all-time high resistance |

| $0.50 | Fibonacci 0.618 level |

| $0.75 | Whale accumulation zone |

Industry veteran Joao Wedson points out that TRX would need $90B market cap at $1 – achievable if it captures just 3.8% of crypto's total market share. For context, ethereum holds 17% today.

TRX vs. The Altcoin Pack

Compared to PEPE's meme HYPE and Ethereum's institutional appeal, TRX offers a hybrid value proposition. Its transaction speed (2,000 TPS) and near-zero fees make it the "people's blockchain" in developing economies. I've personally used TRX for remittances – the experience beats traditional rails by miles.

That said, the competition is fierce. Solana's ETF news stole headlines, and MAGACOIN FINANCE's presale is draining retail liquidity. TRX needs its own catalyst – perhaps a USDT integration boost or partnership announcement – to break from the pack.

FAQ: Your TRX Questions Answered

Is now a good time to buy TRX?

Technicals suggest short-term overbought conditions, but dips to $0.30-$0.31 could present buying opportunities. Dollar-cost averaging mitigates timing risks.

What's the biggest threat to TRX's rally?

Regulatory scrutiny on stablecoins (TRON hosts 50% of USDT supply) could create headwinds. Always monitor SEC developments.

How does TRX compare to Ethereum technically?

TRX processes transactions faster (2,000 vs. 30 TPS) with lower fees, but Ethereum's smart contract ecosystem remains more robust for developers.