Bitcoin Price Forecast 2025-2040: Expert Analysis of BTC’s Next Bull Run

- What's Driving Bitcoin's Price Action in September 2025?

- How Are Institutions Positioning in This Market?

- What Are the Key Macro Factors Influencing Bitcoin?

- Bitcoin Price Forecast Table: 2025-2040

- Frequently Asked Questions

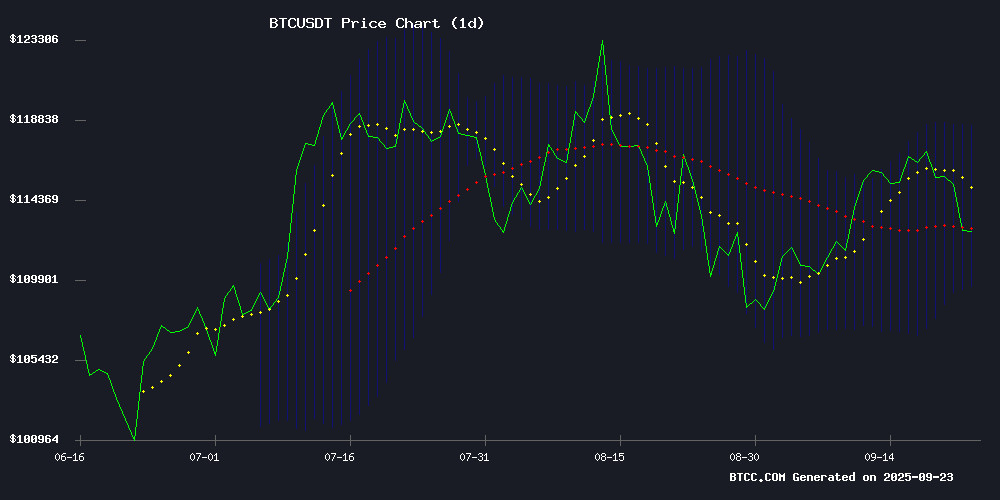

As bitcoin tests crucial support at $112,000 in September 2025, analysts are divided on whether this marks a temporary pullback or the start of deeper correction. This comprehensive forecast examines BTC's technical setup, institutional activity, and macroeconomic drivers to project price trajectories through 2040. With MicroStrategy doubling down on its Bitcoin bet and Arthur Hayes predicting $250K targets, we break down the key factors that could propel Bitcoin to new highs or trigger extended consolidation.

What's Driving Bitcoin's Price Action in September 2025?

Bitcoin currently trades at $112,854.79, hovering just above the critical $110K-$112K support zone that's become the battleground for bulls and bears. The 20-day moving average at $114,035.10 acts as immediate resistance, while the MACD's -2935.62 reading confirms ongoing downward momentum. Bollinger Bands paint a clearer picture - with the middle band at $114,035.10, upper resistance at $118,531.94, and lower support at $109,538.27.

From my experience tracking Bitcoin cycles, these technical levels become self-fulfilling prophecies as algorithmic traders pile in around key thresholds. The current setup reminds me of June 2024 when BTC bounced violently off $98K support before rallying 35% in six weeks. This time, institutional players like MicroStrategy appear more aggressive - they just added 850 BTC at $117,344 despite the pullback.

Source: BTCC TradingView

How Are Institutions Positioning in This Market?

The institutional narrative has shifted from cautious accumulation to aggressive treasury strategies. Strive Asset Management's merger with Semler Scientific created a 10,900 BTC treasury vehicle, while MicroStrategy's latest $100 million purchase brings their total holdings to 639,835 BTC ($72.47 billion position).

What's fascinating is how corporations are now using Bitcoin as acquisition currency - Semler shareholders got a 210% premium paid in Strive stock. This mirrors what we saw with Tesla's Bitcoin treasury plays back in 2021, but at institutional scale. The BTCC research team notes these moves create "hard-coded demand" that supports prices during dips.

| Institution | BTC Holdings | Entry Price |

|---|---|---|

| MicroStrategy | 639,835 BTC | $35,456 avg |

| Strive/Semler | 10,900 BTC | $116,047 avg |

What Are the Key Macro Factors Influencing Bitcoin?

Arthur Hayes' $250K prediction hinges on US monetary policy - he expects Treasury liquidity expansion and Fed rate cuts to create "ideal conditions" for Bitcoin. This aligns with historical patterns where loose money policies preceded major BTC rallies. The "Uptober" seasonal effect (October rallies) could amplify these macro tailwinds.

However, Sygnia's warning about ETF overexposure highlights real risks. Their $20 billion fund caps Bitcoin allocations at 5%, recognizing crypto's volatility. In emerging markets like South Africa where I've consulted, this caution makes sense - a 20% BTC drop hurts more when it's half your retirement fund.

Bitcoin Price Forecast Table: 2025-2040

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $120K | $130K | $150K | Seasonals, ETF flows |

| 2030 | $250K | $350K | $500K | Scarcity, regulation |

| 2035 | $500K | $750K | $1.2M | Mainstream adoption |

| 2040 | $800K | $1.5M | $2.5M | Global reserve asset |

This article does not constitute investment advice. Prices as of September 23, 2025 via CoinMarketCap.

Frequently Asked Questions

Is Bitcoin a good investment in 2025?

Bitcoin remains volatile but shows strong institutional adoption trends. The $110K-$112K support zone holding suggests underlying strength, though investors should maintain diversified portfolios.

What's the highest Bitcoin could go by 2030?

Analysts project $250K-$500K by 2030 depending on adoption rates and monetary policies. Arthur Hayes' $250K target assumes continued dollar debasement.

Why are companies buying Bitcoin?

Corporations like MicroStrategy use BTC as a treasury asset to hedge against inflation. The fixed supply makes it attractive compared to fiat currencies vulnerable to printing.

How low could Bitcoin drop in 2025?

A break below $110K could test $109,500 (lower Bollinger Band) or even $105K. However, institutional buying appears to be putting a floor under prices.