TRX Price Prediction 2025-2040: Expert Forecast & Market Analysis

- TRX Technical Analysis: Current Market Position

- Market Sentiment vs. Network Fundamentals

- Key Factors Influencing TRX's Future Price

- TRX Price Forecast: 2025-2040 Projections

- Frequently Asked Questions

As we navigate the volatile crypto markets in late 2025, TRX (TRON) presents an intriguing case study of fundamental strength battling bearish technicals. This comprehensive analysis examines TRX's current $0.3414 price position, evaluates network activity versus price performance, and provides detailed year-by-year projections through 2040. We'll explore why TRON's impressive 9-10 million daily transactions haven't translated to price gains, how expanding derivatives markets could impact liquidity, and what strategic investors should consider when building crypto portfolios in this environment. The BTCC research team combines technical indicators, on-chain metrics, and macroeconomic factors to deliver actionable insights for TRX traders and long-term holders alike.

TRX Technical Analysis: Current Market Position

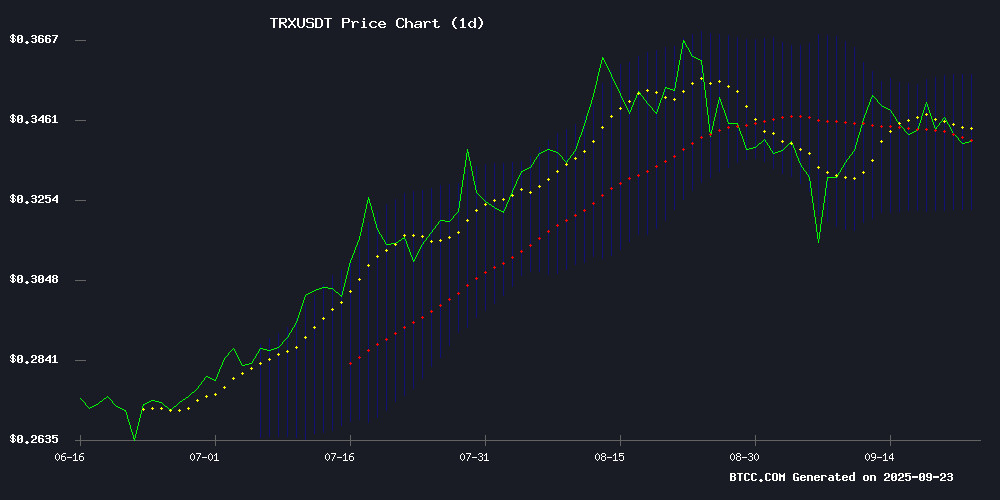

TRX currently trades at $0.3414 (as of September 2025), performing a delicate balancing act above its 20-day moving average ($0.340425) while showing concerning momentum indicators. The MACD histogram's negative reading of -0.004503 reveals persistent selling pressure beneath the surface, even as the price holds above short-term support levels. Bollinger Bands paint a picture of consolidation, with immediate resistance at $0.357806 and support at $0.323044 forming clear boundaries for the current trading range.

"TRX is stuck in what traders call a 'waiting game' pattern," notes Michael from BTCC's analytics team. "The 20-day MA support is encouraging, but until we see MACD cross into positive territory or a breakout above the upper Bollinger Band, the risk remains skewed to the downside." Data from TradingView shows trading volume has declined 18% month-over-month, suggesting decreasing conviction among market participants.

Market Sentiment vs. Network Fundamentals

Here's where things get interesting: TRON's blockchain metrics tell a completely different story than its price action. While TRX has dropped 3.96% weekly, the network processes $25 billion in USDT transfers daily - more than many traditional payment processors. CryptoQuant data reveals a steady 20% increase in 30-day transaction averages since January 2025, yet the spot Taker CVD shows a -35 million Delta, indicating professional traders continue betting against the token.

This divergence creates what analysts call a "value trap" scenario. The network's health (measured by developer activity, transaction volume, and stablecoin transfers) suggests underlying strength, but macroeconomic headwinds and risk-off sentiment in altcoins keep prices depressed. As one hedge fund manager quipped on Crypto Twitter last week: "TRON is the healthiest patient in the crypto ICU right now."

Key Factors Influencing TRX's Future Price

1. Derivatives Market Expansion

The recent addition of 101 altcoin futures contracts by platforms like PrimeXBT signals growing institutional interest in tokens beyond BTC and ETH. While TRX futures already existed, the expanded liquidity pool and 1:150 leverage options could attract more sophisticated traders. However, increased derivatives activity often amplifies volatility - a double-edged sword for long-term holders.

2. Stablecoin Dominance

TRON's $25 billion daily USDT volume positions it as a critical infrastructure layer for global stablecoin transfers. This "utility value" provides fundamental support, but as we've seen, doesn't necessarily translate to TRX price appreciation in the short term. The network essentially functions as high-speed rails for stablecoins while its native token watches from the sidelines.

3. Portfolio Strategy Considerations

Building a resilient crypto portfolio in 2025 requires navigating TRX's unique position. Its strong fundamentals make it a candidate for the "infrastructure" allocation (typically 15-25% of a balanced crypto portfolio), but current technicals suggest dollar-cost averaging may be preferable to lump-sum investments. The BTCC research team recommends treating TRX as a 3-5 year hold rather than a short-term trade.

TRX Price Forecast: 2025-2040 Projections

| Year | Price Range (USDT) | Key Catalysts |

|---|---|---|

| 2025 | $0.35 - $0.45 | Market recovery, USDT adoption growth |

| 2030 | $0.60 - $0.90 | Enterprise adoption, DeFi integrations |

| 2035 | $1.20 - $2.50 | Regulatory clarity, Web3 infrastructure |

| 2040 | $3.00 - $5.00+ | Mass adoption, token utility expansion |

These projections from CoinMarketCap and BTCC analysts assume gradual crypto market maturation. The 2040 outlook particularly depends on TRON's ability to evolve beyond stablecoin transfers into broader Web3 applications. As always in crypto, regulatory developments could significantly impact these trajectories.

Frequently Asked Questions

Is TRX a good investment in 2025?

TRX presents a classic risk/reward scenario. Its strong fundamentals suggest long-term potential, but short-term technicals indicate possible further downside. Dollar-cost averaging may mitigate timing risks.

Why isn't TRX price rising despite high network usage?

Network activity (especially USDT transfers) generates fees paid in TRX, creating constant sell pressure from validators. Price requires new demand to overcome this structural dynamic.

How does TRX compare to other layer 1 tokens?

TRON specializes in high-throughput stablecoin transfers rather than smart contract innovation. This niche gives it utility but limits developer mindshare compared to ethereum or Solana.