Euronext’s Fixed Income & Commodities Arm Smashes Records—Traders Actually Read the Fine Print

Euronext just posted a revenue surge fueled by all-time-high FICC volumes—proving even crusty old fixed-income markets can catch a tailwind when central banks flip-flop on rates.

Behind the numbers: Their fixed-income, currencies, and commodities division saw record activity as institutional players scrambled to reposition. Turns out, volatility isn’t just a crypto thing—sometimes even bond traders need adrenaline.

The kicker? These ‘record volumes’ still pale next to crypto’s average Tuesday. But hey, progress is progress—even if it’s measured in basis points and Excel spreadsheets.

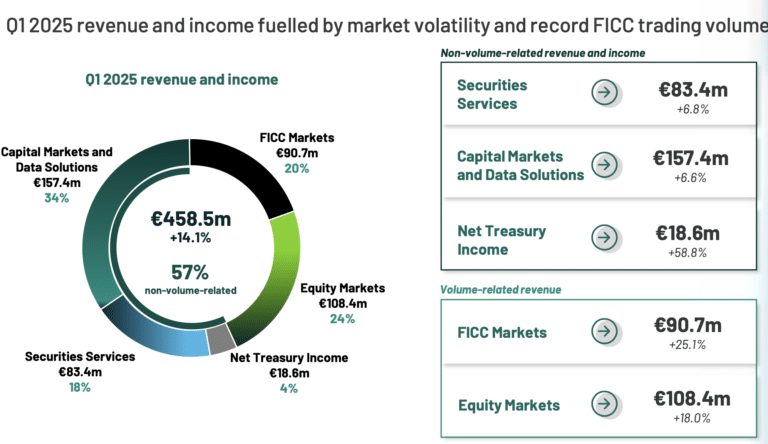

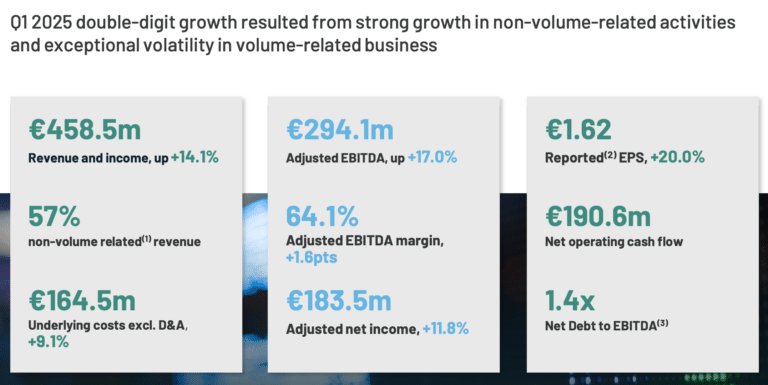

In the first quarter of 2025, Euronext reported record revenue and income of €458.5m, an increase of 14.1% from a year ago. Stéphane Boujnah, chief executive and chairman of the managing board of Euronext, said on the first quarter call on 15 May 2025 that the group delivered a “remarkable” performance as it reported the fourth consecutive quarter of double-digit top line growth.

Stéphane Boujnah, Euronext

Boujnah said performance was driven by initial successes of strategic initiatives, growth of non-volume-related revenue and “exceptional” volatility across trading and clearing activities, especially in cash equity, fixed income, foreign exchange, power and commodities.

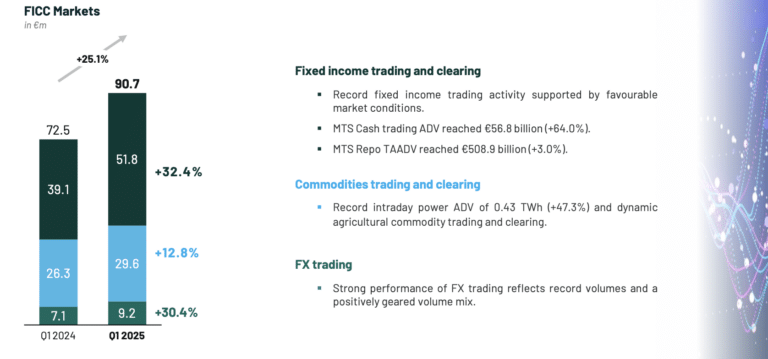

Fixed income trading and clearing revenue reached €51.8m in the first quarter which was one third, 32.4%, higher than the first three months of 2024. Euronext said this was driven by record fixed income trading activity supported by favourable market conditions.

After the first quarter, volumes continued to increase. In April cash average daily volumes on MTS, Euronext’s platform for institutional bond trading, rose 55.4% to €55.8bn and MTS repo term adjusted average daily volume stood at €723.1b, up 50.1% compared to the same month last year.

Source: Euronext

Boujnah said Euronext has launched significant initiatives in its ‘Innovate for Growth 2027’ strategic plan. These initiatives include the upcoming consolidation of settlement for Amsterdam, Brussels and Paris equity trades in Euronext Securities which Boujnah said represents a significant optimisation of the European post-trade landscape.

“We are positioning Euronext as the most consolidating, integrating, converging platform for settlement and custody,” he added. “We believe that the cutting edge platform we are building can be a ‘home sweet home’ for assets from other regions.”

Equities trade settlement in Europe is currently fragmented across more than 30 CSDs. From September 2026, Euronext Amsterdam, Brussels, and Paris will designate Euronext Securities as the central securities depository (CSD) for equity trade settlements. This aims to streamlines operations, enhances liquidity and helps adapt to the reduction in settlement in October 2027 in the European Union to T+1, one day after a trade,

“This MOVE represents a significant optimization of the European trade landscape with Euronext Securities as the CSD (central securities depository) of choice for Europe,” he added. “We have a very strong and intimate level of dialogue with all the relevant parties to make sure it happens by September 2026.”

Nicolas Rivard, Euronext

Boujnah continued that Euronext is focused on delivering the consolidation as Paris and Amsterdam are two of its top markets in terms of equities trading and issuers that are listed on the exchange. An analyst estimated that the three markets represent more than 50% of equity trades for the group.

Nicolas Rivard, head of cash equity and data services at Euronext, said on the call that the new CSD will contribute to lowering the overall cost of trading in Europe and remove frictions in other asset classes, such as listed derivatives.

“Integrating trading and clearing and providing a European offering creates healthy competition,” Rivard added. “It reduces cost and contributes to the building of capital markets in Europe.”

In April 2025 Euronext launched a European Common Prospectus in English, a standardized template for equity issuances which aims to integrate European capital markets more deeply. Euronext said this initiative seeks to reduce regulatory fragmentation, enhance transparency, and promote cross-border investment by streamlining the listing process and providing consistency and comparability across EU jurisdictions.

Boujnah said: “We are creating a sort of European S-1 to facilitate the integration of capital markets in the region.”

On 13 May 2025 Euronext completed the acquisition of 100% of Admincontrol for an enterprise value of NOK 4,650m, and which will be part of Euronext Corporate Solutions. Euronext said this deal supports its strategy to expand its software-as-a-service (SaaS) offering and increase Euronext’s share of subscription-based revenue.

Boujnah said: “This acquisition doubles the size of our governance solutions and further expands our footprint in the Nordics.”

Giorgio Modica, Euronext

In May 2025 Euronext also announced the implementation of a full set of initiatives to support investments in European strategic autonomy. This includes the creation of a new series of thematic indices covering companies that contribute to Europe’s strategic autonomy, tailored solutions to enhance equity financing of European aerospace and defence companies and facilitated issuance of European defence bonds.

Giorgio Modica, chief financial officer of Euronext, said on the call that the group had changed its reporting format, which will sharpen and simplify communication and better represent its business.

Source: Euronext

Non-volume-related revenue and income represented 57% of total revenue and income. Boujnah said: “We are implementing a double diversification strategy and, in this context, we are growing our non-volume related revenue.”

Source: Euronext