XRP Price Prediction 2025: Will XRP Hit $3 Amid Bullish Signals and Bearish Headwinds?

- Current XRP Market Position

- Technical Analysis: The Path to $3

- Fundamental Factors Influencing XRP

- Bullish vs Bearish Arguments

- Price Predictions and Analyst Views

- FAQ: Your XRP Questions Answered

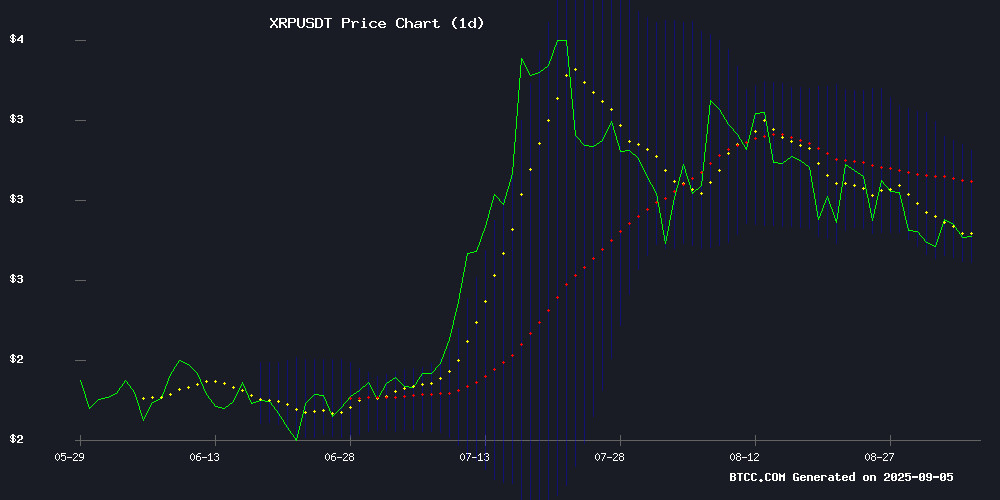

As of September 5, 2025, XRP stands at a crossroads - trading at $2.87 with clear technical signals pointing both up and down. The cryptocurrency shows promising bullish patterns including a potential bull flag formation and strong institutional interest, yet faces resistance at key moving averages and concerns about whale distribution. This comprehensive analysis examines all factors that could push XRP to the psychologically important $3 mark or potentially trigger a pullback.

Current XRP Market Position

XRP currently trades at $2.87, slightly below the critical 20-day moving average of $2.92 according to TradingView data. The MACD indicator shows a slight bearish crossover (signal line at 0.1167 above MACD at 0.1063), suggesting near-term consolidation. Bollinger Bands place immediate resistance at $3.13 and support at $2.71, with the middle band at $2.92 serving as a pivot point.

Source: BTCC Exchange

Technical Analysis: The Path to $3

The technical setup presents a mixed picture for XRP:

| Indicator | Value | Significance |

|---|---|---|

| Current Price | $2.87 | Base level |

| 20-Day MA | $2.92 | Immediate resistance |

| Upper Bollinger | $3.13 | Strong resistance |

| Psychological Target | $3.00 | Key barrier |

The BTCC research team notes: "XRP needs to break above the $2.92 MA level to challenge the $3.00 psychological barrier. The current technical setup suggests consolidation within the Bollinger Band range before the next significant move."

Fundamental Factors Influencing XRP

Several fundamental developments are impacting XRP's price action:

Institutional Adoption

Ripple continues making strides in institutional adoption, with ongoing SWIFT partnership trials and growing ETF speculation. Prediction markets currently assign an 87% probability to spot ETF approval, with Bloomberg analysts elevating this to 95%.

Whale Activity

Recent blockchain data shows conflicting whale behavior - a 257 million XRP transfer (worth ~$706 million) between exchange wallets sparked speculation, while other data shows whales reducing holdings from 13.12% to 11.88% of total supply since late July.

Regulatory Developments

The anticipated October passage of the CLARITY Act in the U.S. Senate could catalyze institutional inflows, setting the stage for potential parabolic momentum.

Bullish vs Bearish Arguments

The market presents compelling cases on both sides:

Bullish Factors

- Formation of ascending trendline with $3.40 target (20% upside)

- Bull flag pattern nearing breakout

- Growing institutional interest and ETF speculation

- Historical parallels to Amazon's post-dot-com boom

Bearish Factors

- Failure to hold $2.850 resistance level

- Declining whale support

- Exchange balances exceeding 3.55 billion XRP

- Active addresses dropping 54% from July's peak

Price Predictions and Analyst Views

Analysts remain divided on XRP's short-term trajectory:

Most analysts see $3 as achievable if current support holds, with $3.40 as next target. Failure to break resistance could see retracement to $2.50-$2.70 range.

Views range from conservative ($5-$7) to extremely bullish ($100-$200), though the latter WOULD require years to materialize according to historical patterns.

FAQ: Your XRP Questions Answered

What's the most likely price for XRP by end of 2025?

Based on current technicals and fundamentals, $3 appears achievable, with potential to reach $3.40 if bullish momentum continues. However, this depends on breaking through key resistance levels.

Is now a good time to buy XRP?

The current consolidation phase could present an opportunity, but investors should watch for confirmation of breakout above $2.92 or breakdown below $2.70 for clearer signals.

What's the biggest risk to XRP's price?

The combination of whale distribution and declining on-chain activity suggests weakening support at current levels. A break below $2.70 could trigger significant selling pressure.

How does the ETF speculation impact XRP?

ETF approval would likely bring substantial institutional inflows, but the market may have already priced in much of this expectation given the high probability estimates.