LTC Price Prediction 2025: Technical Consolidation Meets Cautious Optimism

- What Does Litecoin's Technical Setup Reveal About Its Near-Term Trajectory?

- Why Is Market Sentiment Shifting Away From Established Cryptos Like Litecoin?

- How Do Emerging Competitors Like Layer Brett Impact Litecoin's Position?

- What Are the Key Price Levels Traders Should Monitor?

- Is Litecoin Still a Relevant Player in the Crypto Ecosystem?

- FAQ: Litecoin Price Analysis 2025

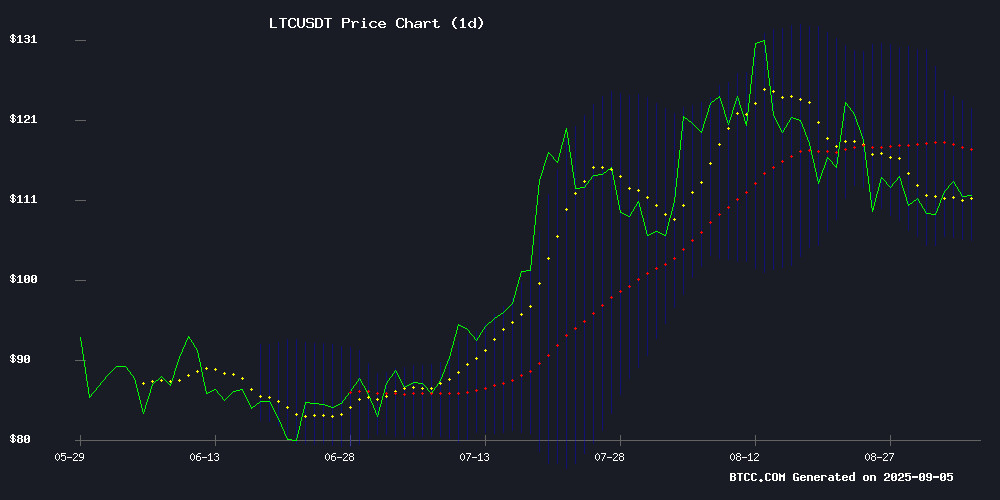

Litecoin (LTC) finds itself at a critical juncture in September 2025, trading at $112.22 with mixed technical signals and shifting market sentiment. While the MACD shows bullish momentum, resistance at the 20-day moving average ($113.97) creates short-term uncertainty. This analysis dives deep into LTC's current position, examining technical indicators, market dynamics, and emerging competitors like Layer BRETT and Remittix that are stealing investor attention. We'll explore whether Litecoin's established position in payments can overcome the "narrative fatigue" affecting older cryptocurrencies, and what price levels traders should watch in the coming weeks.

What Does Litecoin's Technical Setup Reveal About Its Near-Term Trajectory?

As of September 5, 2025, Litecoin presents a textbook case of technical consolidation. The cryptocurrency hovers just below its 20-day moving average ($113.97) with Bollinger Bands suggesting a normal trading range between $105.66 (lower band) and $122.28 (upper band). The MACD histogram shows a positive 0.5705 reading, indicating persistent bullish momentum despite recent sideways movement.

"LTC's current position represents a classic support-resistance conversion zone," notes the BTCC research team. "The $114 level has become a psychological battleground - a decisive break could trigger rapid movement toward $122, while rejection might test the $106 support area." TradingView data shows Litecoin's RSI at 54.72, comfortably in neutral territory without overbought or oversold pressures.

Why Is Market Sentiment Shifting Away From Established Cryptos Like Litecoin?

The crypto market in late 2025 shows distinct signs of "narrative rotation," with capital flowing toward newer blockchain concepts. While Litecoin maintains its fundamental utility for payments, projects like Layer Brett (an Ethereum L2 solution) and Remittix (RTX) are capturing investor imagination with promises of 40-60x returns.

CoinMarketCap data reveals Litecoin's market cap holding steady at $8.6 billion, but trading volume has declined 18% month-over-month. This contrasts sharply with newer tokens seeing triple-digit percentage volume increases. The shift reflects broader market dynamics where investors chase higher-risk, higher-reward opportunities during bull markets.

How Do Emerging Competitors Like Layer Brett Impact Litecoin's Position?

Layer Brett represents a new breed of ethereum Layer 2 solutions combining meme virality with technical utility. Unlike Litecoin's focus on payments, these projects target Ethereum's scalability issues - offering faster transactions and lower fees while riding the current wave of meme coin enthusiasm.

The BTCC team observes: "While Litecoin remains the 'digital silver' to Bitcoin's gold, the market is rewarding newer narratives. Projects like Layer Brett benefit from both technological innovation and community hype - a potent combination in the current environment."

What Are the Key Price Levels Traders Should Monitor?

For Litecoin traders, several critical levels emerge from the technical analysis:

| Level | Significance | Potential Action |

|---|---|---|

| $122.28 | Upper Bollinger Band | Take-profit zone |

| $114.00 | Psychological resistance | Breakout confirmation |

| $113.97 | 20-day Moving Average | Short-term trend indicator |

| $106.00 | Support zone | Buying opportunity |

| $105.66 | Lower Bollinger Band | Stop-loss trigger |

Is Litecoin Still a Relevant Player in the Crypto Ecosystem?

Despite newer competitors, Litecoin maintains several advantages. Its longevity (launched 2011) provides network stability, and its MimbleWimble upgrade enhanced privacy features. The cryptocurrency also benefits from widespread exchange support and merchant acceptance.

However, the BTCC analysis suggests: "LTC may need fresh catalysts to regain momentum. Potential triggers could include new exchange listings, protocol upgrades, or partnerships expanding its payments use case." The recent controversy surrounding Litecoin's comments about XRP also highlights the delicate balance projects must maintain in community relations.

FAQ: Litecoin Price Analysis 2025

What is Litecoin's current price and market position?

As of September 5, 2025, Litecoin trades at $112.22 with a market capitalization of $8.6 billion, ranking among the top 20 cryptocurrencies by market cap according to CoinMarketCap data.

What are the key technical indicators for LTC?

Critical indicators include: - 20-day MA at $113.97 (resistance) - MACD showing bullish momentum (0.5705 histogram) - Bollinger Bands between $105.66 and $122.28 - RSI at 54.72 (neutral)

How does Litecoin compare to newer projects like Layer Brett?

While Litecoin offers stability and established utility, newer projects combine technological innovation with meme coin virality, attracting speculative capital in the current bull market.

What price levels should traders watch?

Key levels are $114 (breakout point), $122 (upper target), and $106 (support). A close above $114 could signal upward momentum, while failure to hold $106 may indicate further downside.

Is Litecoin a good investment in September 2025?

Litecoin presents a moderate risk/reward profile. It may suit investors seeking relative stability in crypto, while those chasing higher returns might consider newer projects (with corresponding higher risk). This article does not constitute investment advice.