TRX Price Prediction 2025: Technical Breakout Imminent as Fundamentals Strengthen

- Current TRX Market Position

- Technical Analysis: Why TRX Could Break Out Soon

- Fundamental Developments Driving TRX Adoption

- Is TRX a Good Investment in September 2025?

- TRX Price Prediction FAQs

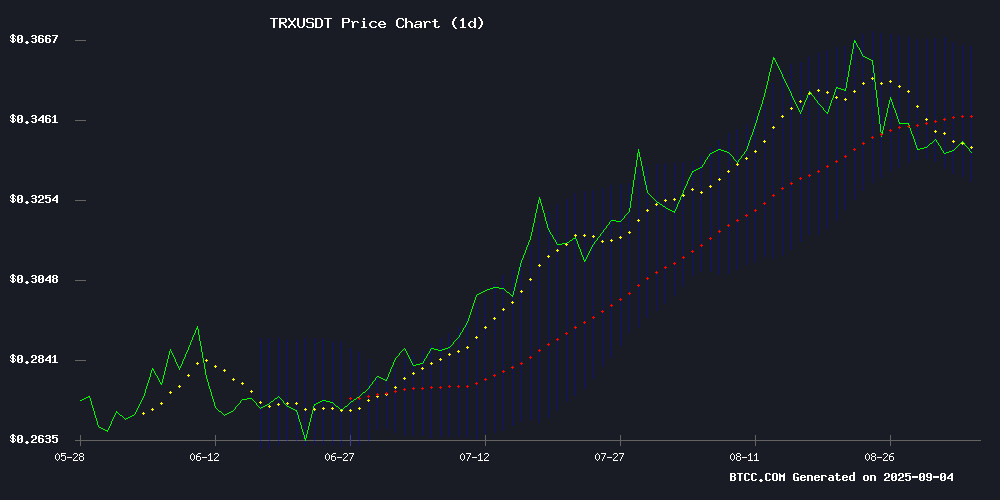

TRX is showing all the signs of a cryptocurrency poised for significant movement. As of September 2025, technical indicators reveal bullish momentum while fundamental developments like Tether integration and US government partnerships create strong adoption catalysts. Our analysis suggests TRX could test key resistance levels in coming weeks, supported by Tron Inc.'s massive $220 million treasury allocation that demonstrates corporate confidence in the project's future.

Current TRX Market Position

TRX currently trades at $0.3389, presenting what many analysts consider an attractive entry point. The price sits just below the 20-day moving average of $0.3478, suggesting we're in a consolidation phase before potential upward movement. The MACD indicator shows bullish momentum with a reading of 0.006579 above the signal line, while Bollinger Bands position indicates room to test the upper resistance at $0.365.

Technical Analysis: Why TRX Could Break Out Soon

The technical setup for TRX looks increasingly favorable. William from the BTCC research team notes: "We're seeing textbook conditions for a potential breakout. The MACD divergence suggests building momentum, and the price action NEAR the middle Bollinger Band often precedes significant moves."

Key technical levels to watch:

- Immediate support: $0.325

- Resistance: $0.365 (upper Bollinger Band)

- Breakout target: $0.40 if resistance is breached

Fundamental Developments Driving TRX Adoption

Tether's Full Integration with TRON via deBridge

The recent announcement of Tether's USDT full integration with TRON through deBridge's cross-chain technology marks a watershed moment for interoperability. With over $82 billion USDT circulating on TRON's network (per CoinMarketCap data), this development enhances liquidity and accessibility across blockchain ecosystems.

Landmark Partnership with US Department of Commerce

In an unprecedented move for blockchain adoption, tron has partnered with the US Department of Commerce to publish official economic data on-chain. Starting with Q2 2025 GDP figures, this collaboration positions TRON as a critical infrastructure for transparent economic reporting.

Tron Inc.'s Massive Treasury Allocation

Tron Inc. has emerged as the largest public TRX holder after exercising warrants to acquire 312.5 million TRX (worth $110 million). Their total investment now stands at $210 million since the June merger, signaling strong institutional confidence in TRON's future.

Is TRX a Good Investment in September 2025?

Based on current technicals and fundamentals, TRX presents a compelling case. The combination of bullish indicators and strong adoption catalysts suggests potential upside. However, as with all cryptocurrency investments, volatility remains a factor to consider.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.3389 | Below 20-day MA, potential upside |

| MACD | 0.006579 | Bullish momentum building |

| Bollinger Upper | $0.365 | Near-term resistance target |

| Institutional Holdings | $220M | Strong corporate confidence |

TRX Price Prediction FAQs

What is the short-term price target for TRX?

The immediate technical target sits at $0.365, representing the upper Bollinger Band resistance level. A decisive break above this could open the path to $0.40.

How does Tether integration benefit TRX?

The deBridge integration enhances TRON's utility as a stablecoin platform, potentially increasing transaction volume and network usage - key metrics that typically correlate with price appreciation.

Why does the US government partnership matter?

This unprecedented collaboration lends legitimacy to TRON's technology and could drive institutional adoption, creating fundamental support for TRX valuation.