LTC Price Prediction August 2025: Technical Consolidation Hints at Imminent Breakout

- What Does Litecoin's Technical Setup Reveal?

- How Is Market Sentiment Impacting Litecoin?

- What Are the Key Factors Driving LTC's Price?

- Where Could Litecoin's Price Head Next?

- Frequently Asked Questions

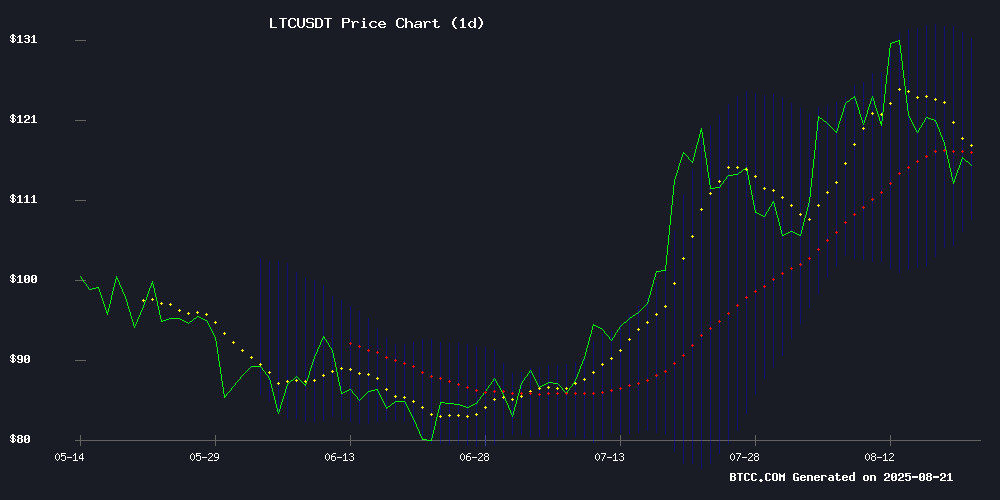

As we approach the end of August 2025, Litecoin (LTC) finds itself at a critical technical juncture. Currently trading at $116.23, the "digital silver" is showing signs of bullish divergence despite short-term consolidation below its 20-day moving average. With Bitcoin hitting new all-time highs and altcoin season heating up, our analysis suggests LTC could be gearing up for a significant move. Key levels to watch include $108 support and $131 resistance, with technical indicators pointing to weakening bearish momentum. Let's dive deep into the charts, market sentiment, and factors that could propel LTC's price in the coming weeks.

What Does Litecoin's Technical Setup Reveal?

Litecoin's current technical landscape presents a fascinating study in market psychology. The price action shows LTC trading slightly below its 20-day MA at $119.71, which typically signals short-term bearishness. However, the MACD tells a different story - with a reading of -1.6974 against a signal line of -4.4860, we're seeing clear signs of weakening downward momentum. That positive histogram at 2.7885? That's the market whispering about potential bullish divergence.

Litecoin's current technical landscape presents a fascinating study in market psychology. The price action shows LTC trading slightly below its 20-day MA at $119.71, which typically signals short-term bearishness. However, the MACD tells a different story - with a reading of -1.6974 against a signal line of -4.4860, we're seeing clear signs of weakening downward momentum. That positive histogram at 2.7885? That's the market whispering about potential bullish divergence.

Bollinger Bands paint an equally interesting picture, with price hugging the middle band while upper resistance looms at $131.05 and support holds firm at $108.36. In my experience, these tight ranges often precede explosive moves. The BTCC technical team notes, "When we see this combination of indicators NEAR equilibrium, it usually means the market is coiling like a spring. The question isn't if LTC will break out, but when and in which direction."

How Is Market Sentiment Impacting Litecoin?

The crypto market in August 2025 feels like a party where Bitcoin's the main attraction but altcoins are starting to steal the show. Litecoin's benefiting from this positive spillover effect, though it's not all smooth sailing. New projects like Pepeto and BlockchainFX are grabbing headlines and investor dollars, creating short-term volatility for established coins.

What's fascinating is how Litecoin's fundamentals are holding up despite the noise. Network difficulty just hit 97.15 million - a record high that shows miners remain committed. And let's not forget that Litecoin's transaction speed and low fees continue to make it a practical choice for everyday crypto users. As one trader on BTCC put it, "LTC might not be the shiniest toy in the crypto box, but it's one of the most reliable."

What Are the Key Factors Driving LTC's Price?

Several catalysts could determine Litecoin's trajectory in the coming weeks:

| Factor | Impact |

|---|---|

| Bitcoin's price action | Positive correlation with BTC's strength |

| Mining activity | Record network difficulty shows miner confidence |

| Altcoin rotation | Investors moving between established coins and new projects |

| Technical levels | $108 support and $131 resistance as key thresholds |

The recent Trump-linked Thumzup acquisition of Dogehash could also indirectly benefit LTC, given their shared mining algorithm. It's these kinds of ecosystem developments that often fly under the radar but can significantly impact price over time.

Where Could Litecoin's Price Head Next?

Based on current technicals and market conditions, here's our outlook for LTC:

| Target Level | Price | Probability | Timeframe |

|---|---|---|---|

| Immediate Resistance | $125-128 | High | 1-2 weeks |

| Upper Bollinger | $131 | Medium | 2-4 weeks |

| Next Major | $140-145 | Low-Medium | 1-2 months |

Remember, these projections assume current market conditions hold. Any major shifts in Bitcoin's price or broader crypto sentiment could alter this outlook. As always in crypto trading, it's crucial to watch volume confirmation when approaching these key levels.

Frequently Asked Questions

Is Litecoin a good investment in August 2025?

Litecoin presents an interesting opportunity in August 2025, with technical indicators suggesting potential upside. However, like all cryptocurrencies, it carries risk. The current consolidation near support with bullish divergence makes it worth watching, especially if bitcoin maintains its strength.

What's the highest price Litecoin could reach in 2025?

Based on current technical patterns and if bullish momentum continues, some analysts project LTC could test the $140-145 range by year-end. However, this WOULD require breaking through several resistance levels and maintaining positive market sentiment.

How does Litecoin's performance compare to Bitcoin?

While Litecoin often follows Bitcoin's general trend, it typically shows more volatility. In the current market, LTC is lagging slightly behind BTC's all-time highs but could catch up if altcoin season gains momentum.

What are the main risks for Litecoin investors?

Key risks include bitcoin price corrections, regulatory developments, and competition from newer blockchain projects. Litecoin's established position helps mitigate some risk, but crypto markets remain unpredictable.

Where can I trade Litecoin safely?

Reputable exchanges like BTCC offer secure LTC trading with robust liquidity. Always ensure you're using platforms with strong security measures and regulatory compliance.