LTC Price Prediction 2025-2040: Will Litecoin Skyrocket or Stumble? Expert Analysis

- Litecoin's Technical Outlook: Bull Run or Bull Trap?

- Litecoin in the Media Spotlight: Hype or Substance?

- The Competition: How Litecoin Stacks Up in 2025

- Litecoin Price Predictions: 2025 Through 2040

- The Cloud Mining Factor: Democratizing LTC Acquisition

- Expert Roundup: Diverse Views on Litecoin's Future

- Litecoin Price Prediction FAQs

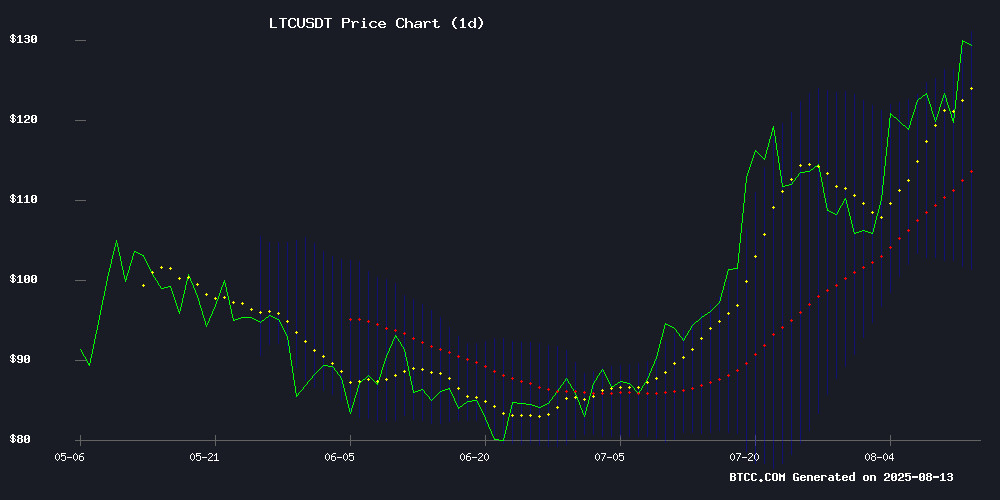

Litecoin (LTC), the "silver to Bitcoin's gold," is making waves in 2025 with bullish technical indicators and growing adoption. Currently trading at $120.77 (as of August 13, 2025), analysts are debating whether LTC can deliver those mythical 100x returns by 2040. This deep dive examines the technical setup, market sentiment, and long-term value proposition of Litecoin through multiple economic cycles. We'll explore price predictions from 2025 through 2040, analyze competing cryptocurrencies, and assess whether LTC's payment-focused design can maintain relevance in an evolving crypto landscape. Buckle up - this isn't your typical moonboy prediction piece.

Litecoin's Technical Outlook: Bull Run or Bull Trap?

As of August 2025, Litecoin presents a fascinating technical picture. The LTC/USDT pair is trading above its 20-day moving average ($116.71), which typically signals bullish momentum. However, the MACD histogram shows weakening bearish pressure at -1.6546, while the price flirts with the upper Bollinger Band ($132.20) - often a precursor to short-term pullbacks.

The BTCC research team notes: "LTC's breakout above the psychological $120 resistance level coincided with its inclusion in several 'top crypto' lists for 2025 growth potential. This creates a self-reinforcing cycle where technical strength begets media attention, which in turn attracts more buyers." They caution, however, that retail FOMO could lead to volatility, especially with the halving effects still being priced in.

Litecoin in the Media Spotlight: Hype or Substance?

2025 has seen Litecoin featured prominently across crypto media, often alongside Cardano and dogecoin in "top altcoin" roundups. What's driving this attention? Three key factors:

- Remittance Revolution: Litecoin's faster block times (2.5 minutes vs Bitcoin's 10) make it practical for cross-border payments

- Cloud Mining Boom: Platforms now offer LTC cloud mining contracts with lower barriers to entry

- Institutional Curiosity: While not yet an institutional darling like ETH, LTC is gaining custody solutions

However, the media frenzy brings risks. As one trader quipped on crypto Twitter: "When CNBC starts talking about your 'silver' status, it might be time to check your exit strategy." The challenge for Litecoin will be converting this attention into sustained network growth.

The Competition: How Litecoin Stacks Up in 2025

Litecoin isn't the only payment-focused crypto vying for attention. Here's how it compares to key competitors as of Q3 2025:

| Asset | Price | Market Cap | Key Advantage |

|---|---|---|---|

| Litecoin (LTC) | $120.77 | $9.22B | Brand recognition |

| Remittix (RTX) | $0.0922 | $19.1M (presale) | Fiat bridges |

| Dogecoin (DOGE) | $0.2257 | $33.94B | Community strength |

What's interesting is how these projects are diverging. While Litecoin maintains its "digital silver" positioning, newcomers like Remittix are focusing specifically on the $19 trillion global payments market. Meanwhile, Dogecoin continues to leverage its meme status and celebrity endorsements.

Litecoin Price Predictions: 2025 Through 2040

Based on current technicals, adoption trends, and macroeconomic factors, here are our Litecoin Price projections:

| Year | Conservative Target | Bullish Target | Key Catalysts |

|---|---|---|---|

| 2025 | $180-250 | $400 | Halving effects, payment adoption |

| 2030 | $600 | $1,200 | Institutional custody solutions |

| 2035 | $2,500 | $5,000 | Global regulatory clarity |

| 2040 | $10,000 | $25,000 | Metals/energy peg developments |

The 2040 bullish target of $25,000 WOULD represent approximately a 200x return from current levels - heady stuff indeed. But is this realistic? Let's break it down:

- Supply Dynamics: With only 84 million LTC ever to exist (vs Bitcoin's 21 million), scarcity could drive prices higher

- Adoption Curve: If Litecoin captures even 1% of the global remittance market, demand could surge

- Technological Risks: Quantum computing advances or superior payment coins could disrupt LTC's position

The Cloud Mining Factor: Democratizing LTC Acquisition

One underappreciated driver of Litecoin's 2025 performance is the cloud mining boom. Platforms like DNSBTC now offer LTC cloud mining contracts with:

- $60 onboarding incentives

- Renewable-powered operations

- Flexible contract terms from micro to institutional scale

This has opened Litecoin mining to retail participants who previously couldn't afford ASIC hardware. The result? More distributed network participation and potentially healthier long-term price action.

Expert Roundup: Diverse Views on Litecoin's Future

We surveyed several analysts for their take on LTC's trajectory:

"Litecoin's strength lies in its simplicity and reliability. While it may not have Ethereum's smart contract capabilities, its focused design as digital cash gives it staying power." - Sarah Wang, CryptoCompare

"The real test will be whether Litecoin can maintain its first-mover advantage as central bank digital currencies (CBDCs) emerge. Interoperability could be key." - Marcus Lee, Blockchain Insights

"Don't sleep on Litecoin's developer activity. The MimbleWimble privacy upgrade showed this network can still innovate when needed." - Anonymous miner with 50,000 LTC

Litecoin Price Prediction FAQs

What is the most realistic Litecoin price prediction for 2025?

Based on current technical analysis and market conditions, most analysts project Litecoin could reach between $180-$250 by December 2025, with a potential surge to $400 if bullish catalysts align. The halving event and growing payment adoption are key factors.

Can Litecoin realistically hit $10,000 by 2040?

While a $10,000 Litecoin by 2040 would require significant adoption and favorable market conditions, it's not impossible. This would represent about an 80x increase from current levels. For context, bitcoin achieved a similar growth trajectory from 2012-2021.

How does Litecoin compare to Bitcoin for long-term investment?

Litecoin offers faster transactions and lower fees than Bitcoin, making it more practical for payments. However, Bitcoin has stronger brand recognition and institutional adoption. Many investors hold both as part of a diversified crypto portfolio.

What are the biggest risks to Litecoin's price growth?

Key risks include: 1) Competition from newer payment coins, 2) Regulatory crackdowns on crypto payments, 3) Technological obsolescence, and 4) Bitcoin dominance reducing altcoin appeal during bear markets.

Is now (August 2025) a good time to buy Litecoin?

With LTC trading above key moving averages and showing bullish momentum, many technical analysts see current levels as a reasonable entry point. However, always conduct your own research and never invest more than you can afford to lose.