Shiba Inu (SHIB) Price Prediction 2025: Will the Meme Coin Bounce Back or Crash Further?

- Technical Outlook: Is SHIB Primed for a Rebound?

- Ecosystem Developments vs. Team Turmoil

- Regulatory Storm Clouds Gather

- Historical Context: From Rags to Riches...and Back?

- Investment Considerations for 2025

- SHIB Price Prediction 2025: Your Questions Answered

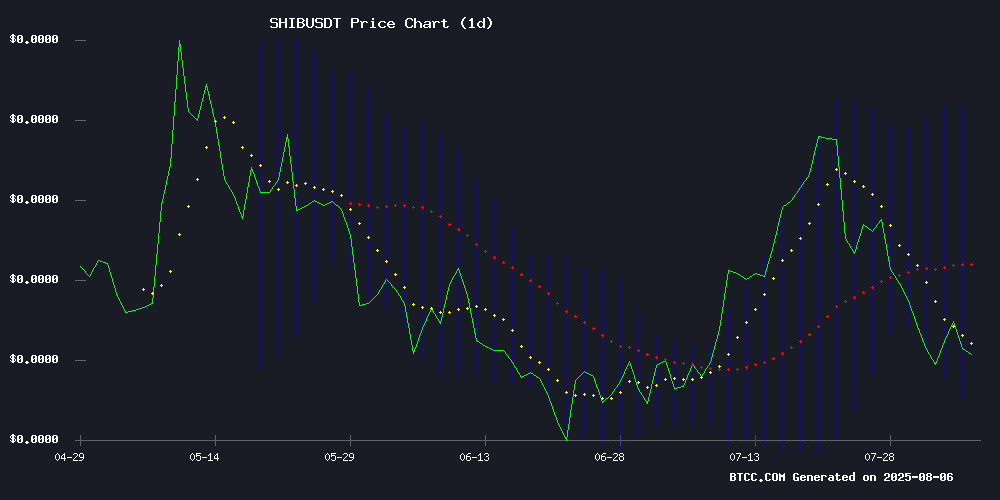

As shiba inu celebrates its 5th anniversary in 2025, investors are grappling with mixed signals - bullish technical patterns clash with internal team conflicts and looming regulatory scrutiny. Our analysis reveals SHIB currently trades 17% below its 20-day MA at $0.00001199, but the MACD's bullish crossover hints at potential recovery. The BTCC research team notes critical support at $0.000011 must hold to prevent further downside. With top wallets controlling 65% of supply and 30-day volatility averaging ±8%, this remains a high-risk asset requiring careful position sizing.

Technical Outlook: Is SHIB Primed for a Rebound?

The daily chart paints an intriguing picture for Shiba Inu. Currently hovering near the Bollinger Band's lower boundary at $0.00001107, SHIB shows classic oversold conditions that often precede mean reversion rallies. The MACD histogram's positive reading of 0.00000083 confirms building upward momentum, while the Chaikin Money Flow indicator detects increasing buying pressure despite price stagnation.

Sophia from BTCC's analytics team observes: "We're seeing positive divergence between price action and volume trends - when the spot price dipped last week, exchange inflows didn't spike proportionally. This suggests holders aren't panic selling, which typically creates a firmer foundation for rebounds." The 20-day moving average at $0.00001351 serves as the first significant resistance level, representing a potential 12% upside from current levels if bullish momentum sustains.

Ecosystem Developments vs. Team Turmoil

While technicals hint at recovery potential, fundamental factors present a mixed bag. The Shiba Inu ecosystem continues expanding, with the SHI stablecoin development progressing under new regulatory clarity from the Genius Act. Marketing lead Lucie's description of the project as a "massive city under construction" suggests ambitious infrastructure growth.

However, developer Kaal Dhairya's recent disclosures reveal concerning fractures. "Personal agendas have overtaken merit-based decision making," Dhairya stated, referencing how the once-unified K9 project era has devolved into competing factions. These internal struggles correlate with SHIB's slip to 22nd in market cap rankings (now $7.17B) amidst August's broader market downturn.

Regulatory Storm Clouds Gather

The CFTC's expanding oversight of spot crypto markets introduces new variables. Acting Chair Caroline Pham's push to apply Commodity Exchange Act provisions could subject SHIB to stricter compliance requirements. While this might enhance institutional credibility long-term, short-term adaptation pains could pressure prices.

Notably, exchange reserves remain NEAR yearly lows (1.04T SHIB vs June's 895.9B bottom), suggesting most holders are adopting a "wait-and-see" approach rather than capitulating. This reservoir of patient capital could buffer against extreme downside if regulations tighten abruptly.

Historical Context: From Rags to Riches...and Back?

SHIB's fifth anniversary highlights its extreme volatility. Early investors saw $20 transform into $1.6M during its 2021 peak (8,315,320% ROI), exemplified by a truck driver's $650 bet becoming seven figures. However, the token has struggled to reclaim its $0.00008616 all-time high, leaving recent entrants underwater.

The project's evolution from pure meme coin to aspiring ecosystem (complete with layer-2 Shibarium and stablecoin ambitions) demonstrates maturing fundamentals. Yet as BTCC's analysts caution, "Transitioning from viral sensation to sustainable project requires navigating team cohesion challenges while delivering tangible utility - SHIB remains in this proving ground phase."

Investment Considerations for 2025

| Factor | Status | Implication |

|---|---|---|

| Technical Position | Oversold | Near-term rebound potential |

| Team Dynamics | Fractured | Development delays risk |

| Regulatory Outlook | Increasing Scrutiny | Compliance costs may rise |

| Holder Concentration | Top 10 wallets: 65% | Whale-driven volatility |

This article does not constitute investment advice. cryptocurrency investments carry substantial risk.

SHIB Price Prediction 2025: Your Questions Answered

What's causing SHIB's recent price decline?

The August 2025 dip stems from three factors: 1) Broader crypto market weakness, 2) Internal team conflicts disclosed by developer Kaal Dhairya, and 3) Regulatory uncertainty as the CFTC expands oversight. Technicals suggest the selloff may be overextended near current levels.

Can SHIB regain its all-time high?

Reclaiming the $0.00008616 peak requires overcoming significant hurdles - notably achieving mass adoption of Shibarium and SHI stablecoin while resolving team governance issues. The BTCC team notes that while possible long-term, immediate ATH retests appear unlikely without major ecosystem breakthroughs.

How does SHIB's risk profile compare to other cryptos?

With 30-day volatility averaging ±8% and heavy whale concentration, SHIB remains higher-risk than established assets like BTC or ETH. However, its developing ecosystem infrastructure makes it less speculative than newer meme coins without utility roadmaps.