Litecoin Price Forecast 2025: Can LTC Really Hit $200 Amid Institutional Boom?

- Litecoin's Technical Setup: Bullish Signals Emerge

- Institutional Adoption: MEI Pharma's Game-Changing Move

- The Regulatory Wildcard: SEC's ETF Whiplash

- Competitive Landscape: AI Tokens Steal Whale Attention

- Price Projections: Road to $200

- Frequently Asked Questions

Litecoin (LTC) is making waves in July 2025, currently trading at $113.60 with bullish technical indicators and surprising institutional adoption. MEI Pharma's $100 million treasury commitment and Charlie Lee's strategic moves have ignited market optimism, though SEC's ETF flip-flop adds regulatory uncertainty. Our analysis dives DEEP into whether LTC can realistically achieve its $200 target, examining six crucial factors from whale activity to AI-powered competitors disrupting the space.

Litecoin's Technical Setup: Bullish Signals Emerge

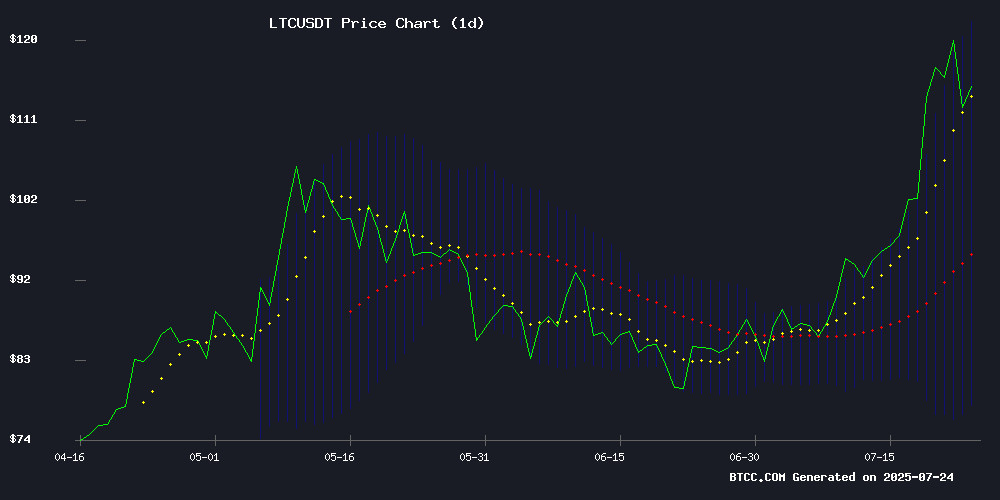

As of July 24, 2025, Litecoin presents a compelling technical picture according to TradingView data. The cryptocurrency trades comfortably above its 20-day moving average ($99.95), with the MACD showing convergence that typically precedes trend reversals. What's particularly interesting is how LTC is testing the upper Bollinger Band at $121.57 - a break above this level could trigger short-term targets around $125.

The weekly chart reveals even more promising developments - Litecoin has gained 20% in the past seven days, with daily volume spiking to $1.27 billion. Analyst Naveed from CoinMarketCap highlights a completed "fair value gap" pattern that historically precedes sustained rallies. However, traders should note the RSI approaching overbought territory at 68, suggesting potential near-term consolidation before any major upward moves.

Institutional Adoption: MEI Pharma's Game-Changing Move

The biotech sector just dropped a bombshell on crypto markets. MEI Pharma (NASDAQ: MEIP) announced a $100 million Litecoin treasury allocation on July 19, 2025, causing its stock price to double within days. This marks the first Nasdaq-listed company to hold LTC as primary reserves, with Litecoin creator Charlie Lee joining the deal through market maker GSR.

ParaFi Capital's managing partner commented: "MEI's MOVE validates Litecoin's position as a corporate reserve asset, combining Bitcoin's store-of-value properties with faster transaction capabilities." The deal structure reveals savvy timing - MEI acquired its LTC position through a private placement at $94.50, already showing 20% unrealized gains at current prices.

The Regulatory Wildcard: SEC's ETF Whiplash

Just as institutional interest peaked, the SEC delivered a curveball. On July 22, regulators initially approved then abruptly stayed Bitwise's multi-crypto ETF that included Litecoin among its holdings. Assistant Secretary Sherry Haywood invoked Rule 431, freezing the process despite staff recommendations that the proposal met investor protection standards.

This creates short-term uncertainty but reveals a fascinating pattern. The SEC has historically approved crypto products after prolonged scrutiny - bitcoin ETFs took eight years from first application to approval. Litecoin's inclusion in the Bitwise filing suggests regulators already view it differently from pure "meme coins," potentially positioning LTC favorably for eventual ETF inclusion.

Competitive Landscape: AI Tokens Steal Whale Attention

While Litecoin dominates headlines, blockchain analytics show whales accumulating positions in AI-powered projects like Unilabs. The DeFi platform has attracted $30 million in assets under management since launch, leveraging algorithmic strategies that promise 18-24% APY. This creates an interesting dynamic - will institutional LTC adoption outpace retail enthusiasm for next-gen AI tokens?

Cardano traders appear to be hedging their bets. Blockchain.com wallet integration sparked a 20% ADA rally, but on-chain data shows many participants rotating profits into both LTC and emerging AI projects. The market seems to be voting with its wallet - Litecoin for stability, AI coins for growth potential.

Price Projections: Road to $200

Reaching $200 WOULD require a 76% surge from current levels - ambitious but not unprecedented for Litecoin. Historical patterns suggest three potential scenarios:

| Scenario | Price Target | Catalyst |

|---|---|---|

| Bull Case | $262 | ETF approval + corporate adoption wave |

| Base Case | $180 | Current trend continuation |

| Bear Case | $94 | Market-wide correction |

The $120-$125 zone represents immediate resistance. A weekly close above this level could confirm the bullish case, while rejection might lead to retesting support at $100. Interestingly, derivatives data from BTCC shows open interest concentrating around the $120 strike price for August options, indicating traders expect decisive movement within weeks.

Frequently Asked Questions

What's driving Litecoin's price surge in July 2025?

Three main factors: 1) Technical breakout above key moving averages, 2) MEI Pharma's $100 million treasury allocation, and 3) Growing anticipation of eventual ETF inclusion despite the SEC's recent reversal.

How does Litecoin's current rally compare to previous cycles?

This rally shows unusual institutional participation. While LTC gained 820% in the 2021 bull run, current adoption by public companies suggests more sustainable demand rather than pure retail speculation.

Should investors worry about the SEC's ETF decision?

Short-term volatility is likely, but the precedent remains positive. The SEC eventually approved Bitcoin ETFs after multiple rejections - the initial approval of Bitwise's filing (even if stayed) suggests Litecoin meets certain regulatory thresholds.

What are the biggest risks to Litecoin's $200 target?

1) Broader market correction dragging down crypto, 2) Regulatory crackdown on corporate crypto holdings, and 3) Failure to break through the $120-$125 resistance zone convincingly.

How does MEI Pharma's move affect Litecoin's long-term value?

It establishes Litecoin as a viable treasury asset beyond Bitcoin, potentially opening doors for other cash-rich companies to allocate portions of their reserves to LTC. The market is valuing this development at roughly $15-$20 in current LTC pricing.