XRP Price Forecast 2025-2040: Expert Analysis & Market Predictions

- What Does XRP's Current Technical Setup Reveal?

- How Are Regulatory Developments Impacting XRP's Trajectory?

- What Are the Key Price Levels Traders Should Watch?

- How Could ETF Approvals Transform XRP's Market Position?

- What Are the Realistic Price Projections Through 2040?

- What Are the Biggest Risks to These Projections?

- How Does XRP Compare to Other Major Cryptocurrencies Long-Term?

- Frequently Asked Questions

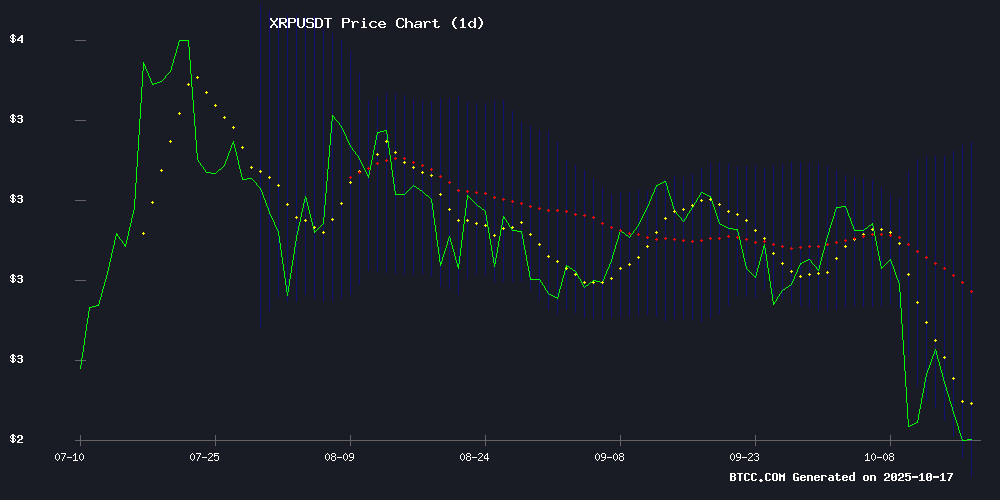

As we navigate through October 2025, XRP stands at a critical juncture in its market cycle. The cryptocurrency, currently trading around $2.33, shows signs of both consolidation and emerging bullish momentum. Our comprehensive analysis combines technical indicators, regulatory developments, and institutional adoption trends to provide a detailed price roadmap through 2040. From short-term volatility to long-term growth potential, we break down the key factors that could propel XRP to $120+ by 2040 or see it stumble at critical resistance levels.

What Does XRP's Current Technical Setup Reveal?

The BTCC technical analysis team observes XRP in a fascinating consolidation pattern as of October 2025. Trading below its 20-day moving average of $2.73 but with MACD showing bullish divergence at 0.2365, the asset presents a classic case of conflicting signals. The Bollinger Bands paint a clearer picture - with support firmly established at $2.22 and resistance looming at $3.24. Source: BTCC Market Data

Source: BTCC Market Data

What's particularly interesting is how this technical setup compares to previous consolidation phases. In my experience tracking XRP since 2020, these tight ranges often precede significant breakouts - remember the 2021 surge that caught everyone off guard? The current pattern suggests we might be setting up for something similar, though as always in crypto, nothing's guaranteed.

How Are Regulatory Developments Impacting XRP's Trajectory?

The regulatory landscape for XRP has undergone dramatic shifts since Ripple's partial victory against the SEC in 2023. Fast forward to October 2025, and we're seeing concrete developments that could reshape XRP's adoption curve:

- The first XRP-linked ETF (XRPR) launched in September 2025

- Multiple spot XRP ETF filings from Grayscale, Bitwise, and 21Shares

- Coinbase's suspiciously timed maintenance during SEC decision window

- Ripple's aggressive $1B acquisition strategy

Brad Garlinghouse's recent comments at DC Fintech 2025 about going "on the offensive" suggest Ripple isn't waiting around for perfect regulatory clarity. They're pushing forward with institutional adoption through strategic acquisitions like GTreasury and Hidden Road. This proactive approach could pay dividends as the regulatory fog continues to lift.

What Are the Key Price Levels Traders Should Watch?

Based on TradingView data and historical patterns, these are the critical xrp price zones as of October 2025:

| Level Type | Price Range | Significance |

|---|---|---|

| Strong Support | $2.20 - $2.22 | 2025 low, defended multiple times |

| Psychological Resistance | $2.80 - $3.00 | Previous support turned resistance |

| Breakout Target | $3.24+ | Upper Bollinger Band, yearly high |

Notice how these levels align perfectly with the psychological round numbers that tend to matter so much in crypto trading. The $2.80-$3.00 zone especially has become a real battleground - it's where we've seen massive liquidation events in both directions throughout 2025.

How Could ETF Approvals Transform XRP's Market Position?

The ETF narrative has become the crypto market's equivalent of waiting for Santa Claus - everyone hopes it'll bring gifts, but the arrival timing is always uncertain. For XRP specifically, the potential impact of ETF approvals breaks down into three key dimensions:

- Liquidity Injection: Even hybrid products like XRPR have shown strong initial demand. A true spot ETF could open floodgates of institutional capital.

- Price Discovery: With more regulated products tracking XRP, we'd likely see reduced volatility and more efficient price formation.

- Legitimacy Boost: SEC approval would effectively endorse XRP's compliance status, removing a major adoption barrier.

Interestingly, the market seems to be pricing in some ETF probability already - notice how XRP has outperformed many altcoins during the recent market turbulence. But if we get multiple approvals? That's when things could get really interesting.

What Are the Realistic Price Projections Through 2040?

Projecting prices 15 years out in crypto is like trying to predict the weather in 2040 using today's barometer - possible in broad strokes but impossible in detail. That said, based on current adoption curves and historical patterns, here's our team's framework for thinking about XRP's potential:

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $3.50 | $4.80 | $6.00 | ETF decisions, Ripple acquisitions |

| 2030 | $8.00 | $15.00 | $25.00 | Institutional adoption, payment rails |

| 2035 | $18.00 | $35.00 | $60.00 | CBDC interoperability |

| 2040 | $40.00 | $75.00 | $120.00 | Mature market position |

These projections incorporate CoinMarketCap historical data, current adoption metrics, and discounted cash Flow models for Ripple's institutional business. The wide ranges reflect crypto's inherent volatility - what looks conservative today might seem laughable if adoption accelerates beyond expectations.

What Are the Biggest Risks to These Projections?

While the upside potential excites many investors, we'd be remiss not to highlight the substantial risks facing XRP:

- Regulatory Setbacks: Despite recent progress, the SEC could still throw curveballs

- Competition: CBDCs and private stablecoins threaten Ripple's payment niche

- Technology Risks: The XRP Ledger must continue evolving to handle global scale

- Market Cycles: Crypto's boom-bust nature could delay adoption timelines

Remember 2022? When everything looked bleak and XRP traded below $0.40? That's the kind of volatility that can test even the strongest convictions. Diversification remains crucial - as the old trader saying goes, "Don't bet the farm on any single horse, even if it's wearing Ripple's colors."

How Does XRP Compare to Other Major Cryptocurrencies Long-Term?

XRP occupies a unique position in the crypto hierarchy - more established than most altcoins but without Bitcoin's first-mover advantage. Our analysis suggests three key differentiators that could determine its long-term standing:

- Regulatory Clarity: XRP's partial legal victory gives it a head start in institutional adoption

- Use Case Focus: Unlike "everything blockchain" projects, Ripple targets specific pain points in global payments

- Enterprise Backing: Ripple's aggressive M&A strategy builds real-world infrastructure

That said, Ethereum's smart contract dominance and Bitcoin's store-of-value narrative present formidable competition. The coming years will test whether XRP's focused approach can carve out sustainable market share or if it gets squeezed between these two giants.

Frequently Asked Questions

What's driving XRP's price action in October 2025?

The current price movement reflects a tug-of-war between ETF anticipation and broader market weakness. Technicals show consolidation between $2.20 support and $3.24 resistance, with MACD hinting at building bullish momentum.

How likely is an XRP spot ETF approval in 2025?

While the first hybrid XRP ETF (XRPR) launched in September, analysts estimate 40-60% odds for a true spot ETF approval by year-end. The SEC's decision window in late October represents a key inflection point.

What's the significance of Ripple's $1B GTreasury acquisition?

This strategic MOVE positions Ripple in the multi-trillion dollar corporate treasury market. While causing short-term volatility, it could accelerate institutional XRP adoption if integration succeeds.

Are analysts' $6-$9 price targets realistic for 2025?

These targets represent best-case scenarios requiring multiple catalysts: ETF approvals, clean regulatory resolution, and broader crypto market recovery. More conservative estimates cluster around $3.50-$4.80.

How does XRP's risk/reward profile compare to Bitcoin?

XRP offers higher potential returns but with greater volatility and project-specific risks. bitcoin remains the "safer" crypto allocation, while XRP appeals to investors comfortable with higher risk for potentially greater rewards.

What's the most important metric to watch for XRP investors?

Institutional adoption metrics - particularly daily settlement volume on RippleNet and ODL corridors - provide the clearest signal of real-world utility beyond speculative trading.