Ethereum Price Forecast 2025: Can ETH Break $5,000 Despite Current Resistance?

- Ethereum's Current Market Position

- Technical Analysis: The Path to $5,000

- Fundamental Strengths Supporting ETH

- Scalability Solutions: Plasma vs Sharding

- Market Sentiment and Seasonal Trends

- Potential Roadblocks

- Ethereum Price Prediction FAQ

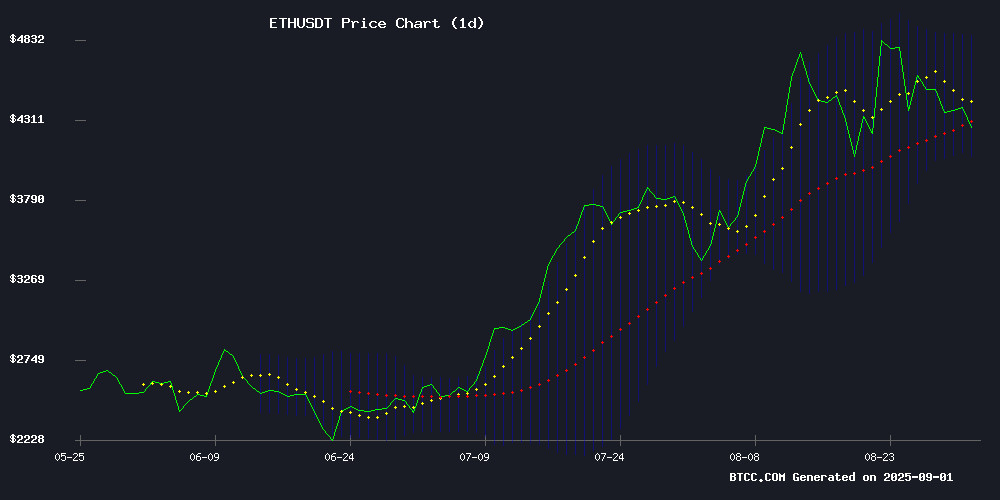

As we enter September 2025, ethereum stands at a critical juncture - currently trading at $4,264 but facing strong resistance at $4,468. This comprehensive analysis examines the technical and fundamental factors that could propel ETH to $5,000 or trigger a pullback. From exchange reserves hitting 9-year lows to China's landmark $70M tokenized bond issuance, we explore the complex dynamics shaping Ethereum's price trajectory.

Ethereum's Current Market Position

As of September 2, 2025, ETH trades at $4,264.27, struggling below its 20-day moving average of $4,467.77. The MACD shows conflicting signals with a reading of -4.05 (bearish momentum) but a histogram at 107.88 (potential reversal). Bollinger Bands place ETH NEAR the lower band at $4,076.32, with middle resistance at $4,467.77 and upper resistance at $4,859.21.

Source: BTCC Trading Platform

Technical Analysis: The Path to $5,000

The $4,468 level represents a critical inflection point. According to TradingView data, this resistance has rejected three separate breakout attempts in August. A decisive close above this level could trigger algorithmic buying and open the path to $4,859 (upper Bollinger Band) and ultimately $5,000.

| Key Level | Price (USDT) | Significance |

|---|---|---|

| Current Price | 4,264.27 | Immediate support |

| 20-Day MA | 4,467.77 | Key resistance |

| Upper Bollinger | 4,859.21 | Next target |

| Psychological Target | 5,000.00 | Major milestone |

Fundamental Strengths Supporting ETH

Ethereum's fundamentals paint a bullish picture despite technical resistance:

Institutional Adoption Accelerates

China's Futian Investment Holding made history by issuing a $70M tokenized bond on Ethereum - the first public offering of its kind. This real-world asset (RWA) tokenization signals growing institutional confidence in Ethereum's infrastructure.

Exchange Reserves Hit 9-Year Low

CryptoQuant data shows just 16 million ETH ($70.37B) remains on exchanges - levels not seen since 2016. This supply squeeze could amplify upward momentum if demand persists.

Korean Capital Rotation

South Korean investors have moved $253M into Ethereum proxies after pulling $657M from Tesla in August. This capital rotation highlights shifting retail preferences toward crypto assets.

Scalability Solutions: Plasma vs Sharding

Ethereum's scalability race intensifies as both Plasma and sharding solutions evolve:

Vitalik Buterin's sidechain solution minimizes mainchain congestion but creates throughput/decentralization tradeoffs.

This partitioning approach promises linear scalability but faces complex cross-shard communication challenges.

Interestingly, Layer 2 solutions like Polygon and Arbitrum currently lead in real-world adoption despite both technologies' potential.

Market Sentiment and Seasonal Trends

Historical data shows September often brings weakness but Q4 tends to flip bullish. The liquidity heatmap reveals concentrated sell orders near current levels, but the macro narrative remains constructive.

Analyst Merlijn The Trader notes ETH has completed its accumulation below $2,750 and now responds to global M2 liquidity trends more than speculative hype.

Potential Roadblocks

While the outlook appears positive, several challenges remain:

- Gas fees spiked past 100 gWei during WLFI token launch

- Crypto fundraising slowed in August despite Binance Wallet's strong performance

- Technical indicators show weakening momentum (MACD at -4.05)

Ethereum Price Prediction FAQ

What's the key resistance level for ETH?

The 20-day moving average at $4,467.77 represents the immediate hurdle. Breaking this could open path to $5,000.

How do exchange reserves affect ETH price?

With reserves at 9-year lows, reduced selling pressure creates potential for explosive upside if demand increases.

Is institutional adoption really growing?

Yes - landmark developments like China's $70M tokenized bond show traditional finance embracing Ethereum's infrastructure.

What are the main scalability solutions?

Plasma (sidechains) and sharding (network partitioning) are the two primary approaches, though LAYER 2 solutions currently lead adoption.

Could ETH really hit $5,000 soon?

While possible, ETH must first overcome technical resistance at $4,468. Strong fundamentals support the bullish case long-term.