Bitcoin Price Forecast 2025-2040: Expert Targets vs Macroeconomic Risks

- Where Is Bitcoin's Price Headed in the Near Term?

- What's Driving Institutional Bitcoin Strategy in 2025?

- How Are Macro Events Impacting Crypto Markets?

- What Are the Long-Term Bitcoin Price Projections?

- Frequently Asked Questions

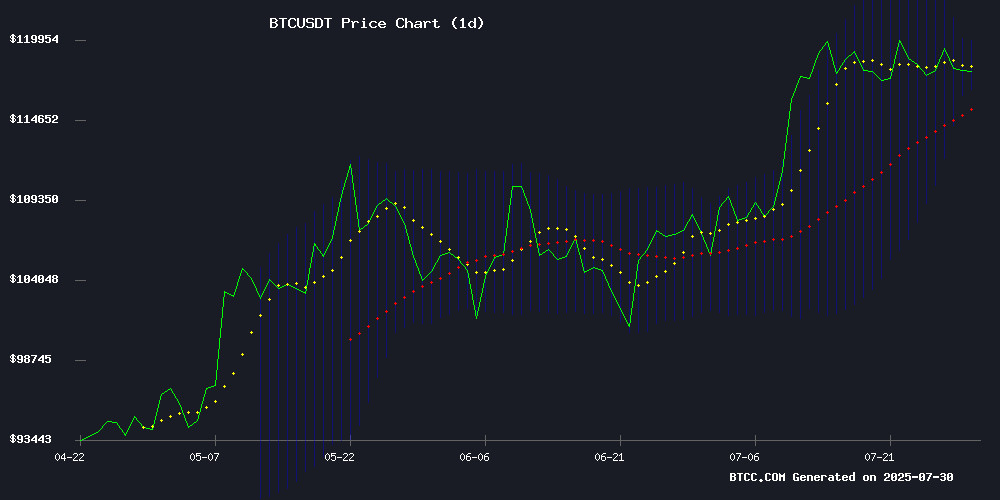

As bitcoin consolidates near all-time highs, analysts are divided between bullish technical targets and growing macroeconomic concerns. The BTCC research team examines key price levels, institutional trends, and regulatory developments shaping BTC's trajectory through 2040. With the Fed decision looming and corporate adoption accelerating, we break down the critical factors every investor should watch.

Where Is Bitcoin's Price Headed in the Near Term?

Bitcoin currently trades at $117,784, testing crucial moving averages that could determine its next major move. The 20-day MA at $118,283 serves as immediate resistance, while the MACD shows early signs of bullish divergence (-834.11 vs -2,838.91 signal line). This technical setup suggests we're either seeing healthy consolidation before another leg up or the early stages of distribution.

Key levels to watch:

- Resistance: $119,898 (upper Bollinger Band)

- Support: $116,669 (lower Bollinger Band)

- Breakout Target: $125,000 psychological level

What's Driving Institutional Bitcoin Strategy in 2025?

The institutional playbook has evolved dramatically from simple "HODLing" to sophisticated yield generation. Public companies like DDC Enterprise have transformed their financial models by partnering with crypto-native firms to implement options strategies, staking, and lending programs. This shift reflects growing shareholder pressure to monetize crypto holdings rather than treat them as passive reserves.

Recent examples include:

- MARA Holdings achieving record-low production costs of $33,700/BTC

- Turkish ride-hailing firm Marti allocating 20% of reserves to Bitcoin

- Galaxy Digital executing an 80,000 BTC OTC block trade

How Are Macro Events Impacting Crypto Markets?

The crypto market faces crosscurrents from several macroeconomic fronts:

| Event | Potential Impact | Market Reaction |

|---|---|---|

| Fed Rate Decision | High - Could shift risk appetite | Coinbase premium turned negative after 60-day streak |

| Trump Crypto Report | Medium - Regulatory clarity | Limited price movement on preview |

| White House Roadmap | Low - No bitcoin reserve mention | Stablecoin-focused proposals |

What Are the Long-Term Bitcoin Price Projections?

Based on adoption curves, miner economics, and monetary debasement trends, here's our multi-year outlook:

| Year | Conservative | Base Case | Bull Case |

|---|---|---|---|

| 2025 | $98K | $135K | $180K |

| 2030 | $250K | $400K | $750K |

| 2035 | $600K | $1.2M | $2.5M |

| 2040 | $1.5M | $3M | $5M+ |

These projections assume Bitcoin captures 10-15% of the global store-of-value market by 2040. The $141K 2025 target aligns with a 2.5x return from current levels, factoring in typical post-halving cycles.

Frequently Asked Questions

What's the most important technical level for Bitcoin right now?

The $118,283 20-day moving average serves as the key pivot point. A sustained break above could trigger momentum toward $125K, while failure to hold may test support at $116,669.

How significant was Galaxy Digital's 80K BTC sale?

It ranks among the largest notional transactions in Bitcoin history, initially spiking the Net Realized Profit metric to $3.2B before stabilizing at $1.4B. The market absorbed this liquidity without structural damage, demonstrating improved depth.

What percentage of companies are moving from HODLing to yield strategies?

While exact figures aren't available, the trend is accelerating among public companies with crypto treasuries. Firms like DDC Enterprise have seen 800% stock surges after implementing active yield programs.

Could the Fed decision trigger a Bitcoin breakout?

Potentially. While rates are expected to hold steady, Powell's commentary on future policy could catalyze movement. The negative Coinbase premium suggests institutional caution heading into the announcement.

How reliable are long-term Bitcoin price predictions?

All long-term projections involve significant uncertainty. Our 2040 estimates assume continued adoption growth, technological resilience against quantum computing, and Bitcoin maintaining dominance as a store-of-value asset.