Bitcoin’s Next Stop? Analysts Predict $130K as Technicals and Institutional Demand Converge

- What Do the Technical Indicators Say About Bitcoin's Price?

- How Is Institutional Activity Impacting Bitcoin's Price?

- What Macroeconomic Factors Are Supporting Bitcoin's Rise?

- Are There Any Potential Roadblocks to $130K?

- What Are Analysts Saying About Bitcoin's Long-Term Potential?

- Frequently Asked Questions

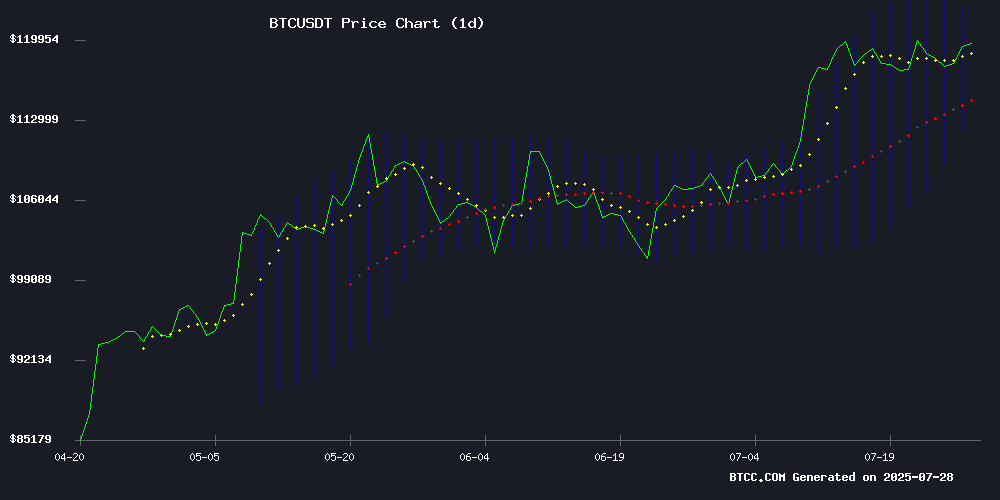

Bitcoin (BTC) is showing all the signs of a major breakout, with technical indicators flashing green and institutional demand reaching unprecedented levels. As of July 28, 2025, BTC trades at $119,617.09, just shy of its all-time high, with analysts from BTCC and other firms pointing to $130,000 as the next likely target. This bullish outlook comes amid strong technical signals, corporate accumulation from firms like MicroStrategy and Metaplanet, and favorable macroeconomic conditions following the recent U.S.-EU trade deal.

What Do the Technical Indicators Say About Bitcoin's Price?

The BTCC technical analysis team notes several bullish signals in BTC's chart patterns. The cryptocurrency is currently trading above its 20-day moving average ($117,935.71), with the MACD showing a positive crossover (MACD line at -1841.8285, signal line at -3869.4763, histogram at 2027.6478). The price is hovering near the upper Bollinger Band at $121,592.64, which typically indicates strong buying pressure.

"When we see this combination of indicators - price above key moving averages, MACD bullish divergence, and upper Bollinger Band tests - it typically precedes significant upward movements," noted a BTCC market analyst. "The $117,935 level now acts as crucial support. If that holds, we could see a rapid MOVE toward $130,000."

How Is Institutional Activity Impacting Bitcoin's Price?

The institutional bitcoin accumulation story has reached new heights in Q3 2025. Metaplanet, the Tokyo-listed firm, recently added 780 BTC to its holdings, bringing its total to 17,132 BTC worth approximately $2.03 billion. Meanwhile, MicroStrategy continues its relentless accumulation strategy, now holding 607,770 BTC valued at $71.8 billion.

| Company | BTC Holdings | Value (USD) |

|---|---|---|

| MicroStrategy | 607,770 BTC | $71.8B |

| Metaplanet | 17,132 BTC | $2.03B |

MicroStrategy's recent $2.8 billion preferred stock offering specifically earmarked for Bitcoin purchases demonstrates the growing sophistication of corporate crypto strategies. "We're seeing corporations treat Bitcoin as both a treasury asset and a yield-generating instrument," commented a financial strategist at BTCC. "This dual utility is creating sustained demand that wasn't present in previous cycles."

What Macroeconomic Factors Are Supporting Bitcoin's Rise?

The recent U.S.-EU trade deal has significantly improved risk appetite across financial markets. The agreement, which reduces tariffs to 15% and includes $750 billion in energy exports, has been viewed by analysts like Fundstrat's Thomas Lee as a major reduction in systemic risk.

"Trade tensions were one of the biggest macro overhangs for risk assets," Lee noted. "With this resolution, we're seeing capital Flow into growth-oriented assets, including Bitcoin." The S&P 500's breach of 6,400 following the deal announcement created a favorable backdrop for Bitcoin's own breakout above $120,000.

Are There Any Potential Roadblocks to $130K?

While the overall picture appears bullish, several factors could potentially derail Bitcoin's ascent:

- Whale Activity: The recent movement of 80,000 BTC ($9 billion) by a dormant whale caused a temporary 3.5% price dip before markets recovered.

- Regulatory Scrutiny: The IMF's questions about El Salvador's Bitcoin strategy highlight ongoing regulatory uncertainties.

- Technical Resistance: The $120,500 and $121,592 levels represent significant resistance zones that could slow upward momentum.

However, the market's ability to quickly absorb the whale's $9 billion sale suggests deepening liquidity. "Five years ago, that size movement WOULD have crashed the market," observed a BTCC analyst. "Today, it's barely a speed bump."

What Are Analysts Saying About Bitcoin's Long-Term Potential?

Beyond the immediate $130,000 target, some analysts are making even bolder predictions. Blockware's Mitchell Askew suggests Bitcoin could reach $1 million within a decade, arguing that institutional adoption has fundamentally changed its market dynamics.

"The launch of U.S. spot ETFs created a new paradigm," Askew explained. "We're seeing less extreme volatility and more consistent accumulation patterns that could support steady appreciation." Glassnode's MVRV pricing bands currently suggest $130,756 as the next major target if Bitcoin can maintain support above $110,000.

Frequently Asked Questions

What is the current Bitcoin price prediction from analysts?

Most analysts are predicting a near-term target of $130,000 for Bitcoin, based on technical indicators and institutional demand. Long-term predictions from some analysts go as high as $1 million within the next decade.

Which companies are buying the most Bitcoin?

MicroStrategy leads with 607,770 BTC, followed by Metaplanet with 17,132 BTC. These corporate accumulations are creating significant demand pressure in the market.

How did the U.S.-EU trade deal affect Bitcoin?

The trade agreement reduced systemic risk and improved risk appetite across financial markets, creating favorable conditions for Bitcoin's price appreciation.

What are the key technical levels to watch for Bitcoin?

Key support sits at $117,935 (20-day MA), with resistance at $120,500 and $121,592. A break above these levels could confirm the path to $130,000.

Are whale movements still impacting Bitcoin's price?

While large transactions can cause temporary volatility, the market has shown remarkable resilience, quickly absorbing a recent $9 billion whale movement with minimal long-term impact.