Ethereum Price Forecast 2025-2040: Will Institutional Adoption Fuel the Next ETH Bull Run?

- Why Is Ethereum Showing Bullish Technical Signals Now?

- How Are Institutions Changing Ethereum's Supply Dynamics?

- What's Driving the Current Whale Accumulation?

- Ethereum Price Predictions: 2025 Through 2040

- Frequently Asked Questions

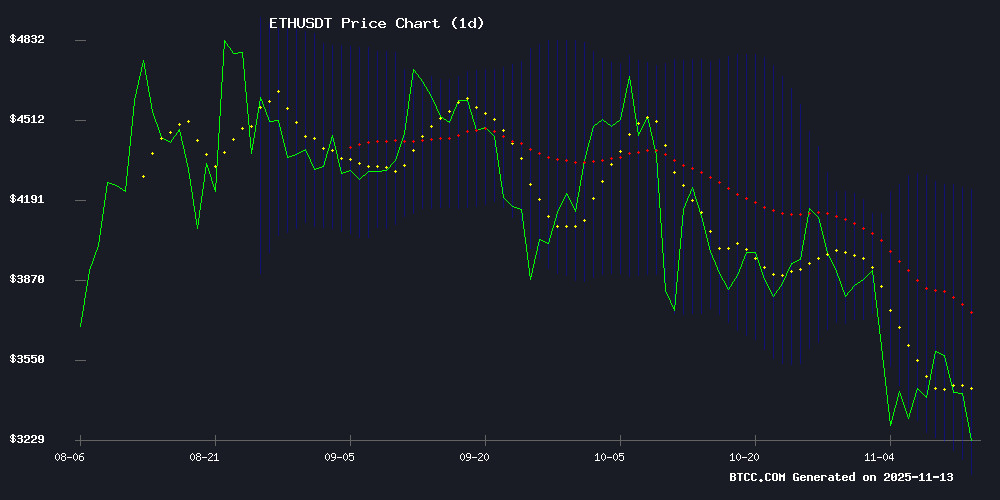

As ethereum consolidates near $3,500, a perfect storm of technical indicators, whale accumulation, and institutional adoption suggests we might be on the cusp of ETH's next major price surge. The BTCC research team analyzes key metrics showing:

- Oversold Bollinger Bands signaling potential reversal

- $350M+ whale purchases during recent dip

- BlackRock/Fidelity driving institutional demand

- Exchange reserves at multi-year lows

Our 2025-2040 projections paint a bullish picture if current trends hold, with potential targets ranging from $4,800 this cycle to $50,000+ as Ethereum becomes the backbone of global finance.

Why Is Ethereum Showing Bullish Technical Signals Now?

Ethereum's current price action presents what technical analysts call a "textbook buy opportunity." The cryptocurrency recently tested its lower Bollinger Band around $3,139 - historically where savvy traders accumulate positions. Meanwhile, the MACD histogram shows building bullish momentum at 49.35 despite prices remaining below the 20-day moving average ($3,677).

"We're seeing classic divergence here," notes Michael from BTCC's analytics team. "Price makes lower lows while momentum indicators make higher lows - that's usually the market whispering 'buy' before the crowd catches on."

How Are Institutions Changing Ethereum's Supply Dynamics?

The institutional embrace of Ethereum is creating what crypto veterans call a "supply shock" scenario:

- BlackRock's BUIDL Fund has tokenized $1B+ in Treasury bonds on Ethereum

- Exchange balances dropped by 700,000 ETH (worth ~$2.45B) in recent weeks

- Whales purchased $350M ETH during the recent dip

Fidelity Digital Assets recently noted that beyond Bitcoin, most meaningful blockchain innovation is happening in Ethereum's ecosystem, particularly around tokenized real-world assets (RWAs). This sector has grown an astonishing 2,000% since January 2024 according to Token Terminal.

What's Driving the Current Whale Accumulation?

On-chain detectives have spotted three massive ETH purchases totaling $350M:

| Transaction | Amount | Venue |

|---|---|---|

| New whale wallet | 20,000 ETH ($70M) | Kraken |

| Institutional OTC | 24,007 ETH ($82M) | Galaxy Digital |

| DeFi whale | $206M | Aave |

This buying spree coincides with Ethereum's December Fusaka upgrade, which aims to improve scalability. "Institutions are front-running the upgrade," suggests a BTCC market strategist. "They remember how previous Ethereum upgrades like London and Shanghai triggered major rallies."

Ethereum Price Predictions: 2025 Through 2040

Based on current adoption curves and technical analysis, here's our long-term outlook:

| Year | Price Target | Key Catalysts |

|---|---|---|

| 2025 | $4,800-$5,200 | Fusaka upgrade, potential ETF approvals |

| 2030 | $12,000-$15,000 | Enterprise smart contract adoption |

| 2035 | $28,000-$35,000 | Mass RWA tokenization |

| 2040 | $50,000+ | Global settlement layer status |

These projections assume continued protocol development and favorable regulation. As always in crypto, expect volatility along the way.

Frequently Asked Questions

What's the most bullish factor for Ethereum right now?

The combination of institutional adoption (BlackRock/Fidelity's RWA projects) and decreasing exchange supply creates perfect conditions for a supply shock. When big money wants in but ETH is being pulled off exchanges, prices tend to MOVE aggressively.

How reliable are Bollinger Bands for crypto trading?

While no indicator is perfect, Bollinger Bands have shown particular effectiveness in crypto markets due to their volatility-adjusted nature. The current setup where price touches the lower band while other indicators show strength has preceded several major ETH rallies historically.

Why does the Fusaka upgrade matter for price?

Ethereum upgrades typically bring both technical improvements and market psychology effects. Fusaka's scalability enhancements could make Ethereum more attractive to institutions while triggering the "buy the rumor, sell the news" effect we've seen with previous upgrades.