Bitcoin Price Forecast 2025: Will BTC Hit $125K During This Market Consolidation?

- Bitcoin's Technical Crossroads: Bullish or Bearish?

- The Sentiment Seesaw: Why Traders Can't Make Up Their Minds

- Regulatory Game Changers: How New Laws Could Break Bitcoin's Cycle

- The $125K Question: What Needs to Happen?

- MicroStrategy's Bitcoin Gambit: Genius or Madness?

- FAQ: Your Burning Bitcoin Questions Answered

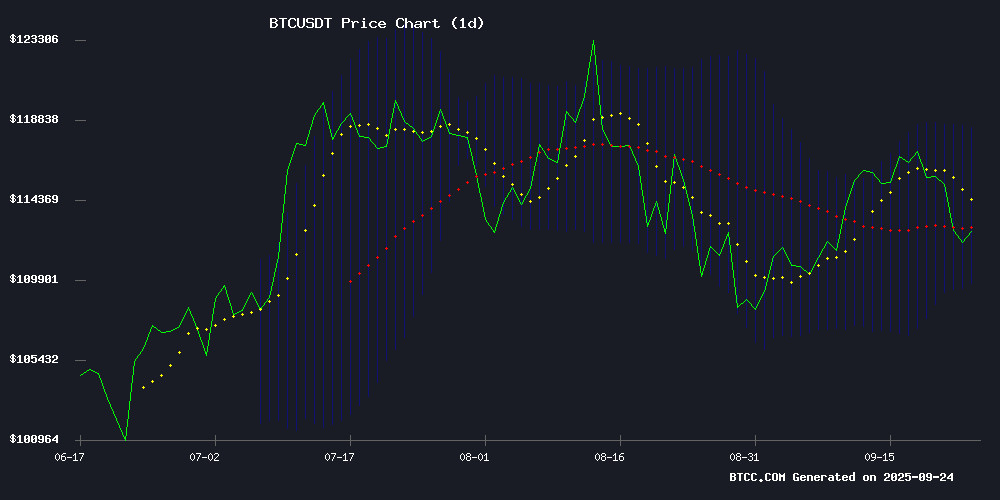

Bitcoin's current market consolidation below $114,000 has traders watching key technical levels like hawks. With improving MACD momentum, substantial institutional accumulation, and mixed sentiment creating a perfect storm of opportunity, analysts are eyeing $125,000 as the next major target. This deep dive examines the critical factors that could propel bitcoin to new heights or trigger another pullback.

Bitcoin's Technical Crossroads: Bullish or Bearish?

As of September 24, 2025, Bitcoin trades at $112,550.38, dancing just below its 20-day moving average ($114,083.28) like a boxer waiting for the right moment to strike. The Bollinger Bands paint an interesting picture - with support at $109,722.06 and resistance at $118,444.49, we're essentially watching Bitcoin do the cha-cha in a tightening range.

Source: BTCC TradingView

The MACD histogram reading of 136.6981 suggests bears are losing their grip, but here's the kicker - until we get a clean break above that 20-day MA, we're stuck in this awkward market limbo. I've seen this movie before in 2023 when BTC consolidated for weeks before its historic run to $100K.

The Sentiment Seesaw: Why Traders Can't Make Up Their Minds

Market sentiment right now reminds me of my indecisive uncle at a buffet - torn between fear and greed. On one hand, you've got analysts like HAMED_AZ warning about potential drops below $100K (yikes!). On the other, institutional players are gobbling up BTC like it's going out of style - 73,702 BTC moved into new wallets just yesterday!

The Fold bitcoin rewards card launch through Visa/Stripe is exactly the kind of real-world adoption we crypto nerds dream about. Though honestly, I can't figure out why FLD stock tanked 15% on the news - 3.5% back in BTC on all purchases sounds like a no-brainer to me.

Regulatory Game Changers: How New Laws Could Break Bitcoin's Cycle

Mike Novogratz dropped some truth bombs recently about how the GENIUS and CLARITY Acts might completely disrupt Bitcoin's four-year cycle. "People can now legally use stablecoins in mainstream apps—that changes everything," he told Bloomberg. And he's not wrong - this isn't your grandma's crypto market anymore.

Coinbase's Brian Armstrong compared the impact to a "freight train" of institutional money. Between this and OranjeBTC's upcoming $400M Bitcoin treasury listing in Brazil, we're seeing institutional adoption at levels that would've seemed crazy just two years ago.

The $125K Question: What Needs to Happen?

Let's break down the path to $125K with some cold, hard data:

| Factor | Current Status | Price Impact |

|---|---|---|

| Technical Resistance | $118,444 (Upper Bollinger Band) | Breakout could accelerate gains |

| MACD Momentum | Improving bullish divergence | Supports upward movement |

| Institutional Accumulation | 73,000 BTC in new wallets | Strong underlying demand |

The wild card? Santiment's warning about "buy the dip" chatter hitting 25-day highs. In my experience, when retail gets this excited, we often see one last shakeout before the real move. Remember March 2024? Everyone was screaming "buy the dip" right before that 18% nosedive.

MicroStrategy's Bitcoin Gambit: Genius or Madness?

Let's talk about Michael Saylor's wild ride. MicroStrategy now holds 214,246 BTC ($14B), making their $115M software revenue look like pocket change. Their stock has outperformed Bitcoin itself - up 2,000% vs BTC's 940% over five years. Love him or hate him, the man's conviction is paying off.

But here's what keeps me up at night - they're using BTC as collateral to buy more BTC. It's brilliant when prices rise, but if we hit a serious bear market... well, let's just say I wouldn't want to be holding that bag.

FAQ: Your Burning Bitcoin Questions Answered

What's the most realistic price target for Bitcoin in 2025?

The BTCC analysis team maintains a $125,000 medium-term target, contingent on breaking through the $118,000-$120,000 resistance zone. Historical patterns suggest this could occur within Q4 if accumulation continues at current rates.

Why are analysts warning about potential declines below $100K?

Technical analysts point to the breakdown of an ascending trendline and rejection at the 61.8% Fibonacci level. The $110,500-$112,000 zone has become critical support - if that fails, we could see a retest of psychological support at $100,000.

How significant is the recent institutional BTC accumulation?

The 73,702 BTC moved into new wallets on September 23 represents about $8.3 billion at current prices. This level of fresh capital entering the market typically precedes upward moves, as seen before the 2024 rally.

What makes the current regulatory changes so important?

The GENIUS and CLARITY Acts provide unprecedented legal clarity for stablecoins and jurisdictional oversight. This removes major barriers for institutional investors who previously avoided crypto due to regulatory uncertainty.