Crypto Millionaires Explode 40% as Bitcoin Drives Market to $3.3 Trillion Milestone

Digital wealth surges while traditional finance scrambles to catch up.

The Bitcoin Bull Run Effect

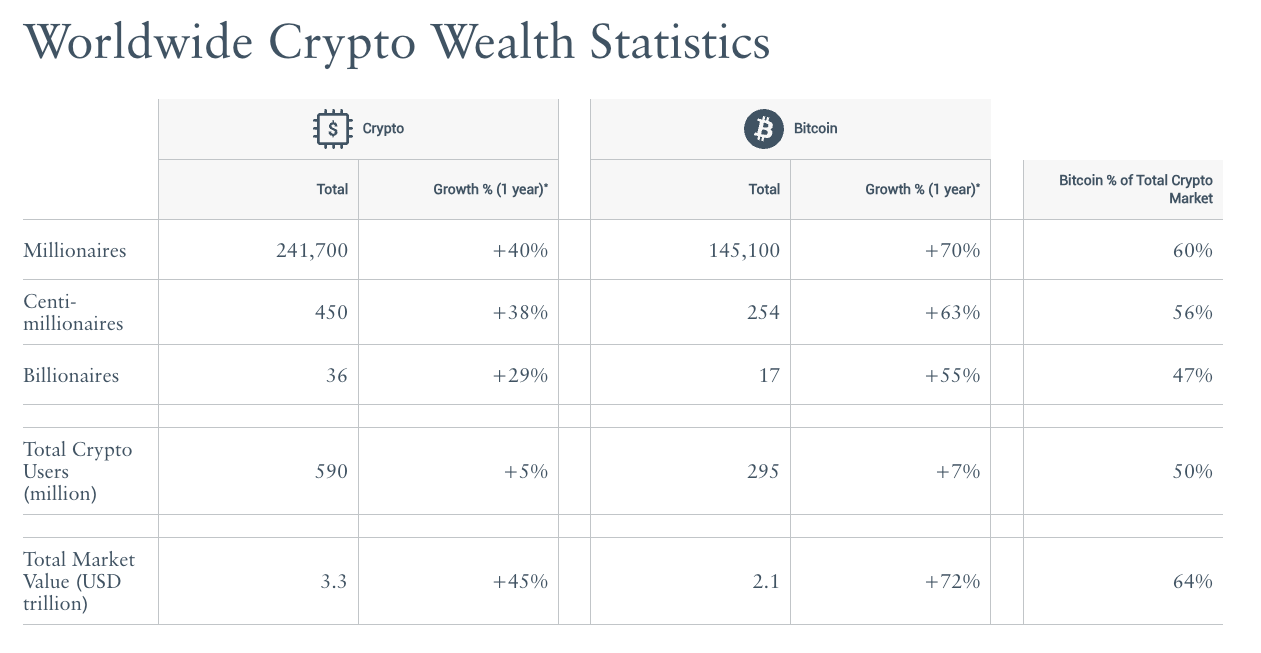

Bitcoin's relentless ascent creates millionaires at record pace—forty percent more joined the ranks as markets smashed through the $3.3 trillion barrier. No fancy derivatives or overpriced hedge funds needed.

Market Cap Meteoric Rise

That staggering valuation isn't just paper gains—it represents real wealth redistribution happening faster than Wall Street can spin up another ETF proposal. The numbers don't lie: forty percent growth in high-net-worth crypto holders signals mainstream adoption is here.

Wealth Creation 2.0

Forget waiting decades for compound interest—this wealth explosion happened in market time, not banker time. Meanwhile, traditional finance still charges 2% management fees for underperforming index funds. The revolution will be decentralized.

The report points to a shift in how digital assets are used, with Bitcoin increasingly treated as collateral rather than a speculative play. This evolution, observers say, is transforming the token into the base layer of a parallel financial system.

"Bitcoin is becoming the foundation of a parallel financial system, where [it] is not merely an investment for speculation on fiat price appreciation, but the base currency for accumulating wealth.” Philipp A. Baumann, founder of Z22 Technologies, said in the report.

Bordeless wealth

Crypto’s decentralized nature is also redrawing patterns of global wealth. Analysts note that investors are pursuing citizenship and residency programs to navigate regulatory uncertainty while securing access to banking and tax-efficient jurisdictions.

Henley’s annual Crypto Adoption Index ranks Singapore, Hong Kong, the U.S., Switzerland, and the UAE as the top five destinations for digital asset investors.

With over $14 trillion in wealth moving across borders last year, the report argues that crypto’s portability—secured by little more than a seed phrase—marks a fundamental break from centuries of place-based financial systems.

"Today, cryptocurrency has made geography optional — with nothing more than 12 memorized words, an individual can secure a billion dollars in Bitcoin, instantly accessible from Zurich or Zhengzhou alike," said Dominic Volek, Group Head of Private Clients at Henley & Partners.