XRP Price Prediction 2025: ETF Inflows Surge as Ripple Launches XRPL v3.0.0

Ripple just dropped a bomb on the crypto market—and Wall Street is scrambling to adjust its spreadsheets.

XRPL v3.0.0 is live. This isn't a routine update; it's a foundational overhaul designed to supercharge transaction throughput and slash settlement times. Think of it as ripping out the old plumbing and installing a hyperloop. For institutions, that means one thing: operational costs are about to nosedive.

The ETF Effect: A Tidal Wave of Capital

While the tech teams celebrate, the real action is happening in the fund manager suites. The launch has triggered a massive recalculation of XRP's risk-reward profile. Major asset managers—the ones who usually move at glacial speed—are now fast-tracking XRP ETF applications. Inflows into existing crypto ETFs with XRP exposure have spiked, a clear signal that institutional money is positioning itself ahead of the herd.

Analysts are revising their 2025 price targets upward, citing the dual-engine boost of technological utility and unprecedented liquidity. The old argument that XRP was 'just for banks' is dead. The network is now built for scale, and the market is voting with its capital.

The Finance Jab

Of course, the traditional finance crowd is watching with a mix of fear and bemusement. They're used to charging hefty fees for moving money at a snail's pace. Now, an open-source network threatens to bypass their entire rent-seeking model. It's almost poetic.

The bottom line? Ripple didn't just release new software; it lit a fuse. The combination of cutting-edge tech and a wall of institutional money creates a potent mix for 2025. Buckle up.

Image Courtesy: SoSoValue

Image Courtesy: SoSoValue

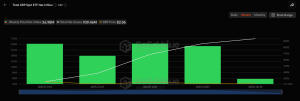

Compared with Bitcoin and ethereum ETFs, XRP ETFs have performed significantly better. According to SoSoValue data, XRP ETFs surged $230 million last week, marking their fourth straight week of consistent inflows.

While XRP remains in the spotlight, a new name, Bitcoin Hyper, rapidly emerges with real utility and a fast-paced presale. As the first Bitcoin layer-2 project, it is attracting investor attention as they shift from large-cap altcoins to explosive contenders for higher upside in the next cycle.

Ripple Launches XRP Ledger v3.0, The Biggest Upgrade in Years

On December 9, Ripple rolled out rippled v3.0.0, one of the largest upgrades in the XRP Ledger in recent years. This version introduces a stronger, more modular architecture to support institutional-grade applications, expanding XRPL’s role beyond fast payments.

Rippled v3.0.0 has officially been released, introducing five new amendments:

• fixAMMClawbackRounding

• fixIncludeKeyletFields

• fixMPTDeliveredAmount

• fixPriceOracleOrder

• fixTokenEscrowV1

XRPK infrastructure is now running on the latest rippled v3.0.0

We urge all… pic.twitter.com/CQIFyKsBls

— XRPKuwait (@XRPKuwait) December 10, 2025

The update improves performance and provides better support for features such as native lending and cross-chain functionality, laying the foundation for the next wave of builders in the XRP ecosystem.

Rippled v3.0.0 also focuses on long-term scalability, ensuring the ledger can handle new DeFi use cases, tokenized assets, and high-volume financial activity as adoption accelerates. It highlights Ripple’s aim to expand the network from a simple settlement LAYER into a broader financial ecosystem.

XRP ETF Inflows Continue to Surge With 18 Consecutive Positive Days

While bitcoin and Ethereum-based ETFs have lost their touch after a mixed broader market sentiment and price volatility, XRP has continued to experience steady inflows. Overall, the demand for XRP-backed ETFs remains exceptionally strong.

Grayscale’s GXRP led the inflows this week with roughly $140 million in fresh capital, followed by Franklin’s XRPZ, which added around $49 million. Bitwise’s XRP fund and Canary’s XRPC also made significant contributions, bringing in approximately $21 million and $20 million, respectively.

The four listed XRP exchange-traded products have now recorded 18 straight sessions of net inflows, pushing cumulative additions to around $954 million. The most impressive thing is that no day of net outflows has been reported since their launch.

XRP Price Prediction: Can It Break the Descending Channel?

XRP has been moving in a downtrend pattern for the past few months, dropping over 40% from its recent July highs. Although the price action has been bearish since Q2 2025, investors remain optimistic for a trend reversal.

However, due to the considerable decline over the past few months, sentiment has surely shifted from quick profit-taking to long-term value holding. The xrp price is still in a corrective phase, with momentum remaining negligible as per the MACD oscillator.

XRP has been trading within a descending channel for over two weeks, down over 11% from the recent high. A breakout above the $2.23 resistance level could spark a recovery towards the medium-term moving averages, which hover near $2.60. In contrast, a slip below the key $2 mark could give sellers complete control over the price structure.

On a fundamental front, steady ETF inflows and a significant upgrade give XRP price prediction an asymmetric upside potential if technical oscillators regain upward momentum.

Bitcoin Hyper: The First Ever Bitcoin Layer-2 Project

With market sentiment shifting and capital rotating into high-potential early-stage projects, Bitcoin Hyper is positioning itself as one of the most compelling contenders in the current market conditions.

Being the first-ever layer-2 on Bitcoin, it has gained significant momentum among traders seeking higher returns than established assets can offer at present. Bitcoin Hyper gives investors the opportunity to get in early on the next big layer-2 project, introducing a brand-new Bitcoin network that is scalable, fast, and programmable.

Bitcoin Hyper introduces a native canonical bridge that enables users to MOVE their BTC from the Bitcoin mainnet to the Hyper Layer-2 network. This bridge is designed to allow for lightning-fast, low-cost transactions and access to advanced on-chain features such as staking, dApps, and gaming utilities.

How Bitcoin Hyper became the standout presale:

- Opening up multiple real-world utilities for Bitcoin holders

- Securing $2.93 million so far, with interest in the presale growing each day

- Offering ICO participants an attractive 39% annual staking yield

- Offering HYPER at prices lower than listing value – currently $0.013415 per token

- Completing security audits from Coinsult and Spywolf

Overall, Bitcoin Hyper is positioning itself as one of the most promising early-stage Bitcoin Layer-2 projects. With a fast-growing presale and strong technical foundation, it is not just another early-stage token but represents the path for Bitcoin’s next phase.

As investors shift away from slow-moving assets and toward innovative players, HYPER witnesses a surge in retail inflows, making it one of the best presales to participate in ahead of the upcoming bull cycle.

Buy Bitcoin Hyper Here

The post XRP price Prediction 2025: ETF Inflows Surge as Ripple Launches XRPL v3.0.0 appeared first on icobench.com.