Ethereum Price Surge: Technical Breakout and $2B Institutional Demand Fuel Rally to $4,100 Target

- What Do the Technical Indicators Say About ETH's Price Movement?

- How Is Institutional Activity Impacting Ethereum's Price?

- What Ecosystem Developments Are Supporting ETH's Value?

- Where Could ETH Price Go From Here?

- Frequently Asked Questions

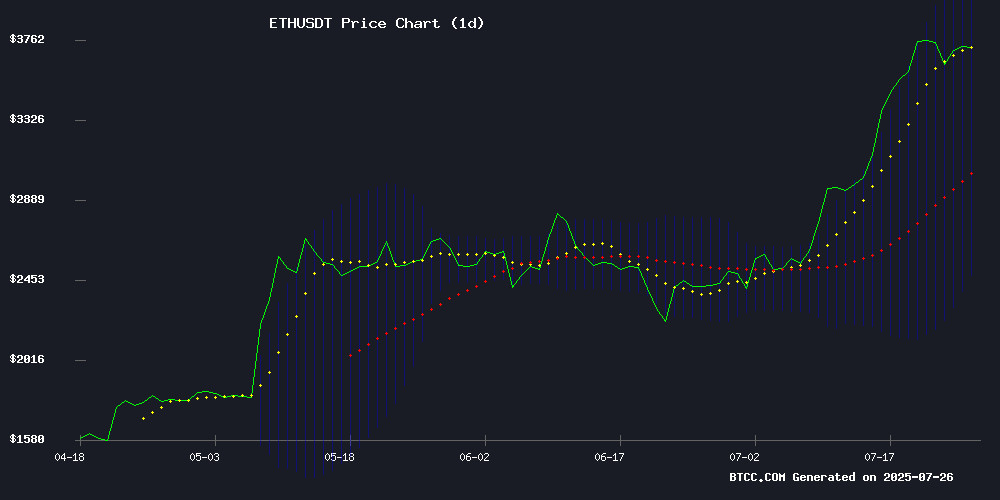

Ethereum (ETH) is showing strong bullish signals as technical indicators align with growing institutional demand. Currently trading at $3,746.46, ETH has broken through key resistance levels with analysts pointing to $4,100 as the next major target. The combination of a technical breakout above the 20-day moving average ($3,298.08), decreasing bearish momentum on the MACD, and expanding Bollinger Bands suggests significant upside potential. Meanwhile, institutional players like Bitmine have accumulated over 566,000 ETH ($2B+) in corporate treasuries, creating a supply shock that could propel prices higher. This article examines the technical and fundamental factors driving ETH's price action and what traders can expect in the coming weeks.

What Do the Technical Indicators Say About ETH's Price Movement?

ETH/USDT is currently exhibiting several bullish technical signals that traders should watch closely. The price has sustained above the 20-day moving average of $3,298.08, which historically serves as strong support during uptrends. The MACD histogram shows decreasing bearish momentum (-51.5957) as the fast line (-535.1594) converges toward the slow line (-483.5637), suggesting a potential bullish crossover in the making.

Bollinger Bands indicate volatility expansion with price testing the upper band at $4,118.33. "The breakout above the 20-MA with MACD convergence often precedes major upward moves," noted a BTCC analyst. "The $3,500 level has now flipped from resistance to support, creating a launchpad for potential tests of the $4,100 upper Bollinger Band."

How Is Institutional Activity Impacting Ethereum's Price?

Institutional demand for ethereum has reached unprecedented levels in recent weeks. Bitmine Immersion Technologies has aggressively expanded its Ethereum reserves, now exceeding $2 billion in value (566,000+ ETH). This accumulation follows a $250 million private placement and demonstrates growing institutional confidence in ETH as both a store of value and foundational blockchain platform.

The institutional narrative gained further credibility when SharpLink Gaming appointed Joseph Chalom, BlackRock's former Head of Digital Assets Strategy, as co-CEO. Chalom's move signals growing institutional interest in Ethereum's financial infrastructure, with spot Ethereum ETFs continuing their bullish streak of 15 consecutive days of net inflows.

What Ecosystem Developments Are Supporting ETH's Value?

Ethereum's ecosystem continues to expand with significant partnerships and technological advancements. AIDEN (an AI-powered Web3 search engine) has partnered with INTMAX Hub to develop smarter, scalable decentralized applications on Ethereum. Meanwhile, Octo Gaming has teamed up with Starknet to launch "Bro Jump," a rollup-powered game that leverages Ethereum's Layer 2 scaling solutions.

These developments come as Ethereum's validator exit queue hits a one-year peak of 521,000 ETH ($1.9 billion), requiring 19 days to process. Market analysts interpret this not as capital flight but as validators optimizing their positions within the growing ecosystem.

Where Could ETH Price Go From Here?

Based on current technicals and market structure, ETH shows strong potential to test the $4,118 upper Bollinger Band in the NEAR term. The combination of technical indicators and fundamental factors creates a compelling bullish case:

| Indicator | Bullish Signal |

|---|---|

| Price vs 20-MA | 12.6% above moving average |

| MACD | Bullish convergence forming |

| Bollinger Bands | Price hugging upper band |

When coupled with institutional accumulation and developer activity, $4,100 appears achievable before potential profit-taking emerges. A weekly close above $3,800 WOULD confirm the next leg up in this rally.

Frequently Asked Questions

What is the current Ethereum price prediction?

Based on technical analysis and institutional demand, analysts predict Ethereum could reach $4,100 in the near term, with potential to test all-time highs if bullish momentum continues.

Why is institutional demand for Ethereum increasing?

Institutions are attracted to Ethereum's growing ecosystem, upcoming protocol upgrades, and its position as the leading platform for decentralized applications and smart contracts.

What technical indicators suggest Ethereum's price will rise?

Key indicators include the price sustaining above the 20-day MA, MACD showing bullish convergence, and price testing the upper Bollinger Band at $4,118.

How does Ethereum's validator queue affect its price?

The record-high validator exit queue (521,000 ETH) indicates network participants are optimizing their positions rather than exiting, suggesting long-term confidence in Ethereum's ecosystem.