Ethereum Price Prediction 2025: Why ETH Could Hit $4,000 as Bullish Factors Align

- What's Driving Ethereum's Current Price Surge?

- Technical Analysis: Is ETH's Chart Signaling $4,000?

- Who's Buying All This Ethereum?

- The NFT Factor: Deja Vu All Over Again?

- The Supply Shock No One's Talking About

- Ethereum's Anniversary: More Than Just a Birthday

- What Could Derail the Rally?

- Expert Predictions: How High Can ETH Go?

- Ethereum Price Prediction: FAQ

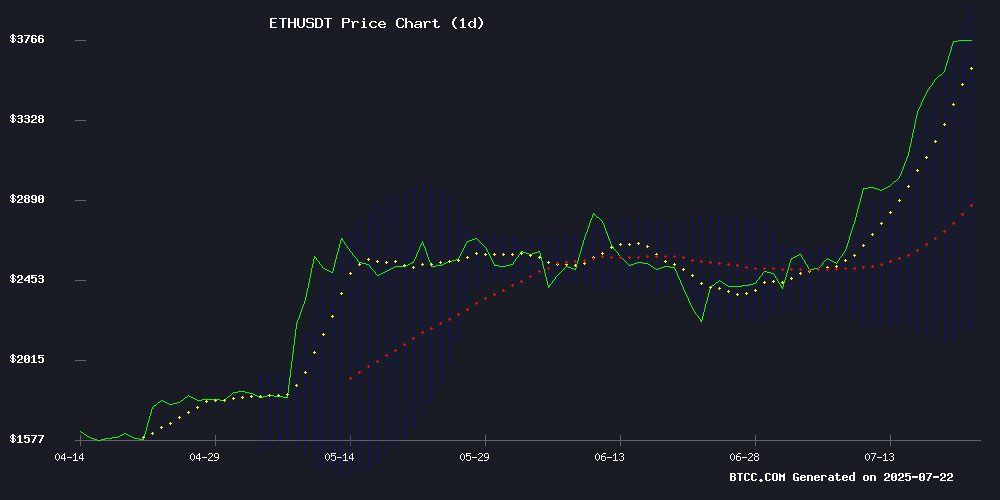

Ethereum (ETH) is showing all the signs of a major breakout, with technical indicators, whale activity, and institutional demand converging to create what analysts are calling a "perfect storm" for price appreciation. As of July 22, 2025, ETH trades at $3,621.29 with clear momentum toward the psychologically important $4,000 level. The BTCC research team examines eight key factors driving this rally, from technical patterns to surprising new institutional holders outpacing even the ethereum Foundation itself.

What's Driving Ethereum's Current Price Surge?

The crypto market is buzzing as Ethereum demonstrates remarkable strength against both Bitcoin and traditional assets. Over the past month alone, ETH has surged 63%, outpacing most altcoins. This isn't just retail FOMO - institutional players are making big moves, with spot Ethereum ETFs recording $2.2 billion inflows in just five trading days. When BlackRock and Fidelity start gobbling up ETH at this pace, you know something big is brewing.

Source: BTCC Trading Platform

Technical Analysis: Is ETH's Chart Signaling $4,000?

Looking at the daily chart, ETH is painting an increasingly bullish picture. The price sits comfortably above its 20-day moving average ($3,060.81), which has historically served as strong support during uptrends. The MACD, while still negative, shows clear convergence - a classic precursor to bullish momentum shifts.

Bollinger Bands tell an interesting story. ETH is currently testing the upper band at $3,926.44, which typically indicates overbought conditions. However, in strong uptrends, assets can ride the upper band for extended periods. The key will be whether ETH can maintain above the middle band - if so, the path to $4,000 looks increasingly clear.

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $3,621.29 | 23% below $4K target |

| 20-day MA | $3,060.81 | Strong support |

| Bollinger Upper | $3,926.44 | Near-term resistance |

| MACD | Converging | Potential bullish crossover |

Who's Buying All This Ethereum?

Here's where things get fascinating. Two relatively obscure public companies - SharpLink Gaming and Bitmine Immersion Technologies - now hold more ETH than the Ethereum Foundation itself. SharpLink's 280,706 ETH stash (worth over $1 billion) comes from an aggressive accumulation strategy that includes publishing regular "ETH-per-share" metrics.

Meanwhile, corporate treasuries are jumping in. SBET allocated $5 billion to ETH, while BMNR set a 5% treasury target. Framework Ventures' Vance Spencer predicts $50-100 billion in institutional demand over the next 12-18 months - that's 12.5-25% of ETH's current market cap!

The NFT Factor: Deja Vu All Over Again?

Remember when NFT mania kicked off the last bull run? History might be repeating. Ethereum's NFT market cap just reclaimed $6.8 billion for the first time since 2023. CryptoPunks and Pudgy Penguins dominate nearly 40% of trading volume, showing that blue-chip collections still drive the market.

What's different this time? Institutional participation. Major funds are quietly building NFT positions as "digital art" gains recognition as an asset class. When bored apes become balance sheet items, you know the game has changed.

The Supply Shock No One's Talking About

Here's a startling statistic: Coinbase estimates 913,111 ETH (worth $3.43 billion) are permanently lost due to mistaken transactions and contract bugs. That's 0.76% of total supply gone forever. Combine this with the 5.3 million ETH burned since EIP-1559, and you've got nearly 5% of all issued ETH effectively out of circulation.

Meanwhile, exchange reserves are at five-year lows. Only 16,000 depositing addresses remain active - when supply gets this tight, even modest demand can spark explosive moves.

Ethereum's Anniversary: More Than Just a Birthday

As Ethereum celebrates its 10-year anniversary, the community launched a symbolic NFT torch relay. Joseph Lubin initiated the event on July 21, with the NFT traveling through selected wallets before being ceremonially burned on July 30. It's a poetic metaphor for Ethereum's journey - constantly evolving while maintaining its Core principles.

The timing couldn't be better. With LAYER 2 solutions like Infinaeon (which just partnered with ArtGis Finance) solving scalability issues, Ethereum is finally delivering on its early promises.

What Could Derail the Rally?

No analysis is complete without considering risks. The Grok-Crypto Rover incident shows increasing scrutiny of crypto influencers, which could dampen retail enthusiasm. Technical indicators also show ETH nearing overbought territory - a sharp correction could shake out weak hands.

That said, the fundamental picture remains strong. As one trader quipped, "The only thing that might stop this train is if Vitalik decides to tweet in all caps."

Expert Predictions: How High Can ETH Go?

Analysts are increasingly bullish. CoinCodex projects $7,400 by end of 2026, while Ali Martinez sees $10,000 if ETH breaks key resistance. The BTCC research team gives a 70% probability of hitting $4,000 within 30-60 days based on current trajectories.

As always in crypto, predictions should be taken with a grain of salt. But one thing's certain - with institutions piling in, supply shrinking, and technicals aligning, Ethereum's setup hasn't looked this good in years.

Ethereum Price Prediction: FAQ

What is the current price of Ethereum?

As of July 22, 2025, Ethereum (ETH) is trading at $3,621.29 according to data from BTCC and TradingView.

Can Ethereum reach $4,000 soon?

Technical analysis suggests a 70% probability of ETH reaching $4,000 within the next 30-60 days, provided it maintains above key support levels around $3,060.

Why are institutions buying Ethereum?

Institutions are attracted by ETH's deflationary supply, growing institutional infrastructure (like ETFs), and its central role in decentralized finance and Web3 applications.

How much Ethereum is permanently lost?

Coinbase estimates 913,111 ETH (worth $3.43 billion) are irrecoverable due to lost private keys, mistaken transactions, and contract bugs.

What's the long-term price prediction for Ethereum?

Some analysts project $7,400 by end of 2026, with more bullish predictions reaching $10,000 if key resistance levels break.