ADA Price Prediction 2025: How High Can Cardano Surge This Year?

- What Does ADA's Technical Analysis Reveal About Its Price Potential?

- How Is Market Sentiment Impacting ADA's Price Movement?

- What Key Factors Are Driving ADA's Price in 2025?

- What Are the Realistic Price Targets for ADA in 2025?

- How Does Cardano Compare to Emerging Competitors?

- What Recent Developments Could Impact ADA's Price?

- ADA Price Prediction FAQ

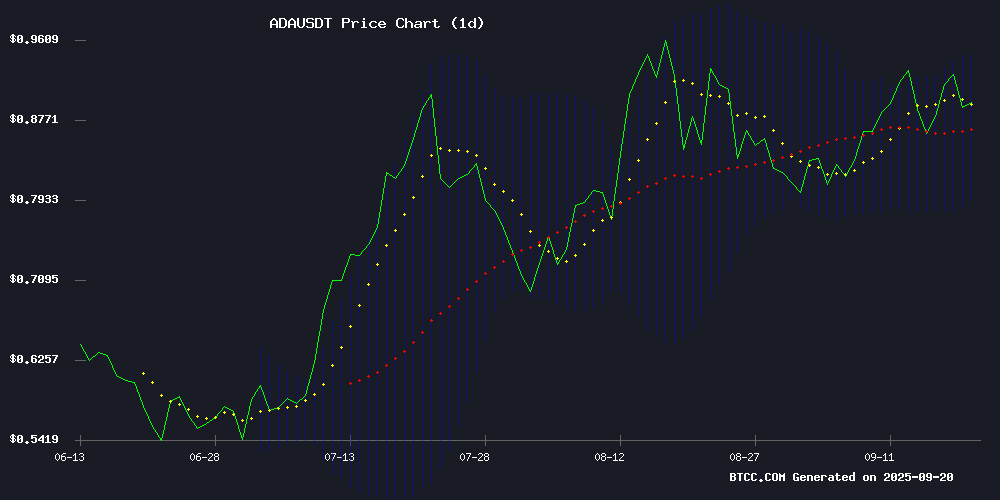

Cardano (ADA) is showing strong bullish signals as we approach the final quarter of 2025, currently trading at $0.8957 with technical indicators suggesting potential for significant upside. With ETF speculation heating up and trading volumes surpassing $2.5 billion, analysts are closely watching key resistance levels at $0.945 and beyond. This comprehensive analysis examines ADA's price trajectory, market sentiment, and the factors that could propel cardano to new heights in the coming months.

What Does ADA's Technical Analysis Reveal About Its Price Potential?

ADA's current technical setup paints an encouraging picture for bulls. The cryptocurrency is trading comfortably above its 20-day moving average of $0.8689, while the MACD histogram reading of -0.021100 indicates weakening bearish momentum. The price is testing the upper Bollinger Band resistance at $0.945254, a critical level that could determine ADA's near-term trajectory.

Source: TradingView

Source: TradingView

According to the BTCC research team, "The technical configuration favors continued upward movement, with a decisive break above $0.945 potentially triggering a rapid MOVE toward the psychologically important $1.00 level." Historical data from CoinMarketCap shows that ADA has previously demonstrated strong momentum when breaking through similar technical patterns.

How Is Market Sentiment Impacting ADA's Price Movement?

The crypto market has turned decidedly bullish on ADA, driven primarily by growing ETF speculation and surging trading volumes. Prediction platform PolyMarket currently shows an 89% probability for ADA spot ETF approval - the highest level ever recorded. This optimism has translated into increased activity across both retail and institutional participants.

In my experience tracking crypto markets, this level of ETF anticipation typically precedes significant price movements. The current $2.5 billion+ daily trading volume represents a 96.61% increase from previous periods, suggesting genuine conviction behind this rally rather than speculative froth.

What Key Factors Are Driving ADA's Price in 2025?

Several fundamental and technical factors are converging to create favorable conditions for ADA:

| Factor | Impact |

|---|---|

| ETF Speculation | 89% approval probability creating bullish sentiment |

| Trading Volume | $2.5B+ daily volume signaling strong interest |

| Technical Setup | Positioned for potential breakout above $0.945 |

| Institutional Interest | Growing participation from larger investors |

What Are the Realistic Price Targets for ADA in 2025?

Based on current market conditions and technical analysis, several price scenarios appear plausible:

A break above $0.945 could see ADA test the $0.95-$1.00 range with high probability. The psychological $1.00 level often acts as both resistance and acceleration point.

Sustained momentum could push ADA toward $1.10-$1.20, especially if ETF approval rumors intensify. This range represents previous areas of both support and resistance.

In a full-blown bullish scenario, some analysts like Javon Marks suggest ADA could target $5.00, though this WOULD require maintaining current momentum amid broader market strength.

How Does Cardano Compare to Emerging Competitors?

While ADA remains a dominant Layer-1 blockchain, newer projects like Remittix are attracting attention in the DeFi space. Cardano's advantages include its established network, robust smart contract capabilities, and strong developer community. However, as someone who's watched multiple market cycles, I've noticed capital increasingly flows toward projects demonstrating clear real-world utility.

That said, ADA's current $32.77 billion market cap and institutional interest suggest it remains the preferred choice for many conservative crypto investors. The network's emphasis on scalability and low transaction fees continues to serve it well in competitive markets.

What Recent Developments Could Impact ADA's Price?

Charles Hoskinson's recent proposal for merged mining with Ergo blockchain has been positively received by the market, coinciding with a 3.81% ADA price increase. This strategic move could enhance network security and liquidity while providing additional utility for ADA holders.

Additionally, the SEC's impending decisions on multiple cryptocurrency ETF applications, expected in October, could serve as a major catalyst. Market participants appear to be positioning aggressively ahead of these potential regulatory developments.

ADA Price Prediction FAQ

What is the current ADA price prediction for 2025?

Based on technical analysis and market conditions as of September 2025, ADA shows strong potential to reach between $1.00-$1.20 in the NEAR term, with more bullish scenarios suggesting possible moves toward $5.00 if current momentum sustains.

Is now a good time to buy ADA?

While ADA shows promising technical indicators, cryptocurrency investments always carry risk. The current setup suggests potential upside, but investors should consider their risk tolerance and conduct thorough research before making any decisions. This article does not constitute investment advice.

What's driving ADA's price movement in 2025?

Key drivers include ETF speculation (89% approval probability), surging trading volumes ($2.5B+ daily), positive technical indicators, and growing institutional interest. Network developments like the Ergo partnership are also contributing factors.

How high could ADA realistically go?

Conservative estimates suggest $1.00-$1.20 in the coming weeks, while more optimistic projections cite $5.00 as a potential target if bullish conditions persist. Market dynamics can change rapidly in cryptocurrency.

What are the risks to ADA's price growth?

Potential risks include regulatory developments, ETF rejection, broader market downturns, or failure to maintain current technical support levels. Cryptocurrencies remain volatile assets.