Ethereum on the Brink: What Happens When ETH Plunges Below $4,200?

Ethereum teeters at the edge—a break below $4,200 could trigger a cascade of liquidations and shake investor confidence to its core.

Market Mechanics Under Pressure

Watch leveraged positions unwind fast if support cracks. Traders betting on perpetual upside face margin calls that could amplify the sell-off.

Institutional Reaction

Big money holds its breath. A drop here tests the 'strong hands' narrative—will whales buy the dip or head for stablecoin shelters?

DeFi Domino Effect

Protocols built on ETH collateral feel the strain. Lower prices mean less borrowing power, tighter lending, and potential protocol liquidations—just what the 'decentralized' bankers ordered.

Psychological Threshold

$4,200 isn't just a number—it's a sentiment gauge. Break it, and fear could override fundamentals faster than a hedge fund dumps its bags on retail.

Long-term believers might call it a discount. Realists see another day in crypto's endless cycle of hype and correction—where 'financial innovation' often means losing money with extra steps.

Ethereum (ETH) has long been a key player in the crypto market, but recent volatility has investors on edge. Analysts are now closely watching the $4,200 mark, a crucial support level that could determine ETH’s short-term trajectory. A drop below this threshold is believed to trigger a wave of selling, impact market sentiment, and influence DeFi and NFT ecosystems built on Ethereum. Could the ETH price bounce back to $4,500, or are we heading toward a bearish slide toward $3,800?

Massive Liquidation Risk for ETH Holders

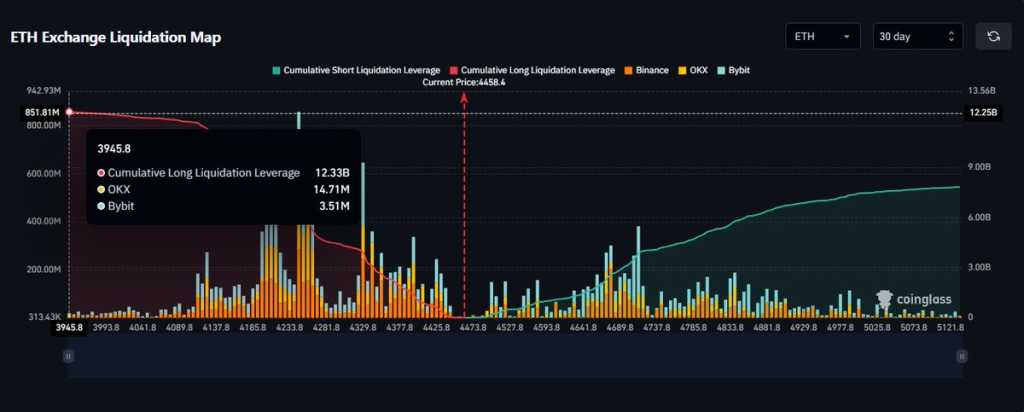

Ethereum has been steadily trading above $4,000 for over a week now, displaying the growing strength of the bulls. The latest ETH exchange liquidation map from Coinglass, shared by Ted, highlights a critical setup for price action. The chart reveals a significant concentration of Leveraged long positions between $3,945 and $4,200. If Ethereum were to dip into this zone, it could trigger a wave of long liquidations, potentially accelerating a move lower as cascading sell orders amplify downside pressure.

On the other hand, a sizable cluster of short liquidations is forming above $4,500 to $4,700. A sustained breakout above these levels could set off a short squeeze, forcing traders to cover their positions and fueling a rapid price rally.

Overall, the data suggests ethereum is approaching a high-volatility zone. Price could either sweep lower liquidity levels before rebounding or break higher and liquidate shorts aggressively. Traders should watch the $4,200 support area closely and monitor whether ETH can reclaim and hold above $4,500, which could open the door to a strong bullish continuation.

What’s Next for the ETH Price Rally?

The ETH price had been facing immense resistance at $4000 as the bears prevented it from rising above the range. Meanwhile, after surpassing the resistance, the bulls have firmly held above the levels. This hints towards a potential breakout that could help price to achieve fresh highs.

Ethereum is consolidating NEAR $4,470 after a strong uptrend that started in May, trading within a well-defined ascending channel. Price action shows ETH holding above its mid-channel support and the 20-day Bollinger Band basis line, signaling sustained bullish momentum. The RSI is hovering near neutral levels around 55, suggesting room for a potential continuation move. Immediate resistance lies at $4,869, while key supports remain at $4,271 and $4,050.

A break above $4,869 could pave the way to $5,000 and the upper channel trendline, whereas a drop below $4,271 could result in a deeper correction toward channel support for the Ethereum (ETH) price rally.