Ethereum Price Prediction 2025: Technical Strength and Bullish Catalysts Signal Major Reversal

- What Does Ethereum's Technical Setup Reveal?

- Why Are Institutions Bullish on Ethereum?

- What Risks Should Investors Consider?

- How Does Ethereum Compare to Other Crypto Opportunities?

- What's Next for Ethereum's Price Action?

- Ethereum Price Prediction 2025: Your Questions Answered

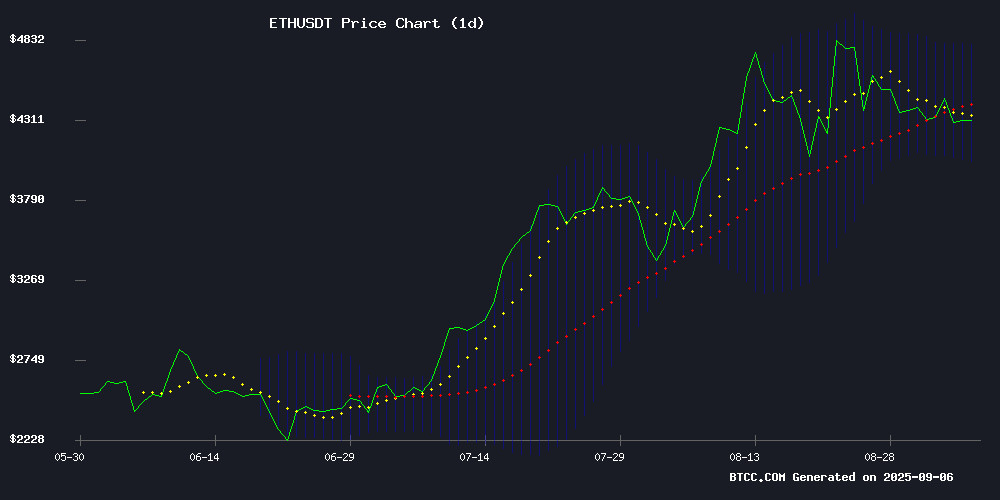

As we enter September 2025, Ethereum (ETH) presents a fascinating case study in crypto market dynamics. Currently trading at $4,274.30, ETH shows both short-term pressure and strong long-term potential. The technical picture reveals bullish MACD divergence and Bollinger Band support, while fundamental factors like record stablecoin supply and institutional accumulation create a perfect storm for potential upside. This analysis dives deep into the key indicators, market sentiment, and emerging trends that could shape ETH's trajectory through Q4 2025 and beyond.

What Does Ethereum's Technical Setup Reveal?

Ethereum's current price sits below its 20-day moving average ($4,421.59), which typically signals short-term bearish pressure. However, the MACD tells a different story - with a positive histogram of 130.12, we're seeing clear bullish divergence. The Bollinger Bands placement is particularly interesting, with ETH hovering NEAR the lower band at $4,039.62. In my experience, this often marks an accumulation zone before upward moves.

Source: TradingView

The BTCC team notes: "This technical setup mirrors previous accumulation phases we've seen before major rallies. While retail traders might panic about the price being below the MA, seasoned investors recognize the MACD crossover and Bollinger positioning as classic buy signals."

Why Are Institutions Bullish on Ethereum?

Behind the scenes, some powerful fundamental factors are building. Ethereum's stablecoin supply just hit an all-time high - a strong liquidity indicator that often precedes price appreciation. On-chain data shows whales accumulating at these levels, with institutional ETH ETF flows showing $450 million in net inflows despite recent outflows.

What's really caught my attention is the Layer-2 innovation. Vitalik Buterin's recent endorsement of Codex, a stablecoin-focused L2 solution, signals Ethereum's push to dominate this crucial sector. Having watched multiple market cycles, I've found that when Core developers double down on infrastructure during price dips, it usually pays off long-term.

What Risks Should Investors Consider?

It's not all sunshine - August saw phishing scams hit $12.17 million in losses, the highest monthly total this year. EIP-7702 related exploits accounted for much of this, reminding us that security remains an ongoing challenge. Also concerning is the LTH NUPL metric crossing 0.65, historically a signal of profit-taking saturation.

| Indicator | Value | Implication |

|---|---|---|

| Price | $4,274.30 | Below MA - Accumulation Zone |

| 20-Day MA | $4,421.59 | Resistance Level |

| MACD Histogram | +130.12 | Bullish Momentum |

| Bollinger Lower Band | $4,039.62 | Strong Support |

How Does Ethereum Compare to Other Crypto Opportunities?

While ETH dominates attention, projects like BullZilla and Hedera are making waves in their niches. BullZilla's innovative tokenomics and Hedera's enterprise adoption show the market's diversification. However, Ethereum's established DeFi ecosystem and institutional backing give it a stability edge that newer projects can't match yet.

What's Next for Ethereum's Price Action?

The convergence of technical support and fundamental catalysts creates an intriguing setup. While short-term volatility may continue as long-term holders take profits, the underlying institutional demand appears robust. Key levels to watch include the $4,421 resistance and $4,039 support - breaks in either direction could determine the next major move.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

Ethereum Price Prediction 2025: Your Questions Answered

Is now a good time to buy Ethereum?

From a technical perspective, current levels offer an attractive risk-reward ratio with strong support nearby. However, investors should consider their time horizon and risk tolerance.

What could drive Ethereum's price higher?

Continued institutional adoption, successful L2 scaling solutions, and growth in stablecoin usage are three key potential catalysts.

How concerning are the recent phishing scams?

While concerning, these security issues aren't new to crypto. The ecosystem continues developing better safeguards, and scams haven't historically derailed long-term adoption.

What's the outlook for Ethereum ETFs?

Despite recent outflows, the overall institutional interest remains strong. ETF flows tend to be volatile but have shown net positive over time.