Ethereum Price Prediction 2025: Will ETH Shatter $5,000 This Week Amid ETF Frenzy?

- Ethereum Technical Analysis: The Bullish Case

- Institutional Catalysts Fueling the Rally

- Risks to Monitor

- Market Sentiment: Greed or Growth?

- FAQ: Your Ethereum Questions Answered

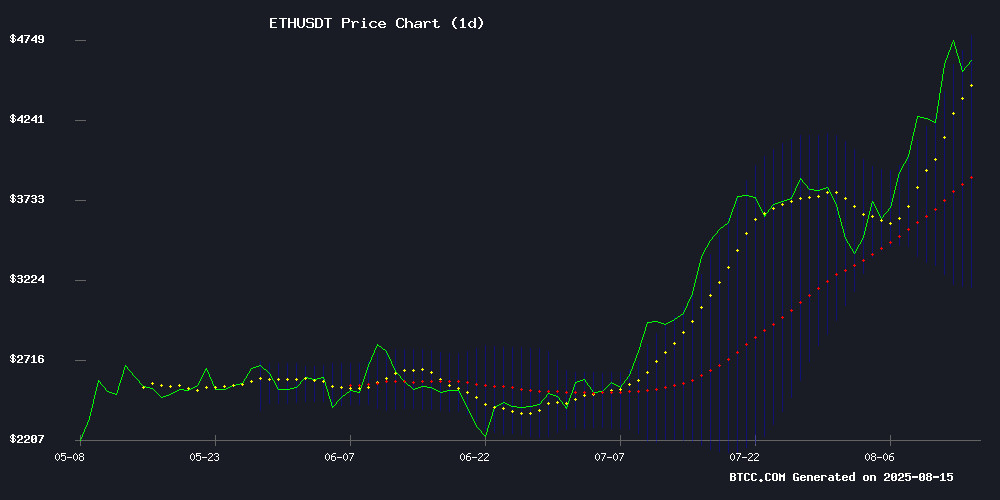

Ethereum stands at a critical juncture in August 2025, trading NEAR $4,550 with bullish technical indicators and massive institutional inflows. Analysts are divided - will we see ETH smash through $5,000 resistance or face a correction? Let's examine the data driving this pivotal moment.

Ethereum Technical Analysis: The Bullish Case

As of August 15, 2025, ETH shows strong technical strength according to TradingView data. The cryptocurrency maintains position above its 20-day moving average ($3,973), with the MACD histogram showing narrowing bearish momentum (-120.21). The Bollinger Bands suggest potential volatility ahead, with the upper band at $4,764 and lower at $3,182.

Source: BTCC Market Data

Institutional Catalysts Fueling the Rally

The ETF revolution has arrived for Ethereum. U.S. spot Ethereum ETFs have drawn $3.71 billion in inflows over just eight days, with BlackRock's fund leading at $519.7 million. Standard Chartered made waves by raising its 2028 ETH price target to $25,000, while Fundstrat projects $10,000-$15,000 by late 2025.

| Institution | ETH Price Target | Timeframe |

|---|---|---|

| Standard Chartered | $25,000 | 2028 |

| Fundstrat | $10,000-$15,000 | Late 2025 |

| BTCC Research | $5,000 | Near-term |

Risks to Monitor

Not all signals are green. The validator exit queue recently ballooned to 727,000 ETH ($3.2 billion), marking one of the largest staking withdrawals in a year. Some analysts interpret this as profit-taking after ETH's 60% rally since June.

Market Sentiment: Greed or Growth?

The crypto market thrives on cycles - from ICOs to NFTs to today's Real World Assets (RWAs). Ethereum has been the backbone of each innovation wave. As Geoff Kendrick of Standard Chartered notes, "Ethereum's infrastructure is becoming the backbone of institutional crypto adoption."

FAQ: Your Ethereum Questions Answered

Is now a good time to buy Ethereum?

With ETH trading near all-time highs, timing is everything. The technical structure remains positive as long as the $4,500 support holds, but investors should be prepared for volatility.

How high can Ethereum realistically go?

Analyst projections vary widely from $5,000 near-term to $25,000 by 2028. Much depends on ETF inflows, institutional adoption, and broader market conditions.

What are the biggest risks to Ethereum's price?

Validator exits, regulatory changes, and macroeconomic factors like inflation data could trigger corrections. However, the long-term supply dynamics remain favorable.