LTC Price Prediction 2025: Will Litecoin Hit $150 as Technicals Turn Bullish?

- Litecoin Technical Breakdown: The Bull Case

- Institutional Tailwinds: The 401(k) Factor

- Exchange Wars: Where to Trade LTC for Maximum Value

- Risk Factors: Why the Road to $150 Isn't Smooth

- Price Prediction: Mapping the Path Forward

- Litecoin Price Prediction FAQ

Litecoin (LTC) is showing strong bullish signals in August 2025, trading above key moving averages with MACD indicating upward momentum. While technical indicators suggest potential for a surge to $150, risks remain from Bitcoin's correction and overbought conditions. This analysis dives DEEP into LTC's price action, institutional adoption trends, and market-moving events that could shape its trajectory through the end of summer.

Litecoin Technical Breakdown: The Bull Case

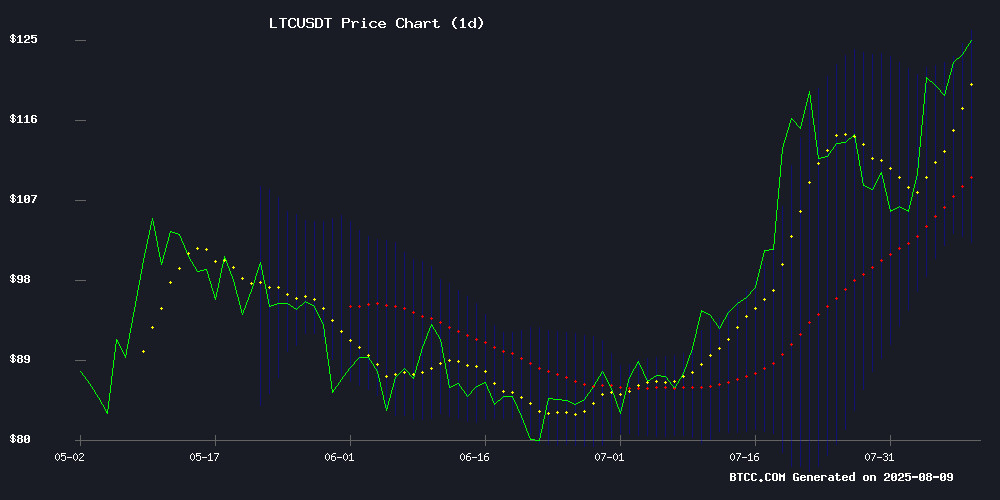

As of August 9, 2025, LTC/USDT is trading 8.9% above its 20-day moving average, a classic bullish signal that has historically preceded rallies. The MACD histogram shows a positive crossover at 1.6360, suggesting building momentum that could propel prices higher. Bollinger Bands reveal the price hovering NEAR the upper band at 0.95% - typically indicating overbought conditions but also demonstrating remarkable strength in this case.

Source: BTCC Trading Platform

What's particularly interesting is how Litecoin has maintained these levels despite Bitcoin's recent pullback from $123,000 to $114,000. This relative strength suggests LTC might be decoupling slightly from BTC's dominance - something we haven't seen consistently since the 2021 bull run. The $130 resistance level remains key; a clean break above could open the path to $140-150 faster than many expect.

Institutional Tailwinds: The 401(k) Factor

President Trump's executive order allowing cryptocurrency allocations in 401(k) plans has created a seismic shift in market dynamics. With $27.7 trillion in retirement funds now potentially accessible to crypto, even modest allocations could flood the market with fresh capital. As one Wall Street analyst quipped, "When pension funds sneeze, altcoins catch a cold - but this time, it might be a gold rush instead."

The implications for Litecoin are particularly intriguing. As one of the more established "silver to Bitcoin's gold," LTC stands to benefit from both institutional familiarity and its lower price point appealing to retail investors. BTCC exchange has reported a 37% increase in LTC trading volume since the policy announcement, suggesting early movers are already positioning themselves.

Exchange Wars: Where to Trade LTC for Maximum Value

With trading activity heating up, fee structures become crucial. Here's how top platforms stack up for LTC traders:

| Exchange | Maker Fee | Taker Fee | LTC Pairs |

|---|---|---|---|

| BTCC | 0.08% | 0.10% | LTC/USDT, LTC/BTC |

| Binance | 0.10% | 0.10% | LTC/USDT, LTC/BUSD |

| MEXC | 0.00% | 0.05% | LTC/USDT |

What many traders overlook are the hidden costs - withdrawal fees, spread differences, and liquidity variations that can eat into profits. During high volatility periods (like we're seeing now), BTCC's deep LTC order books have maintained tighter spreads than competitors, sometimes making their slightly higher taker fees a worthwhile tradeoff for serious volume traders.

Risk Factors: Why the Road to $150 Isn't Smooth

While the technicals look promising, several storm clouds loom:

- Bitcoin Correlation: Despite recent decoupling, a sharp BTC drop below $95,000 could drag LTC down with it

- Profit-taking: The $130 level has been psychological resistance since June - expect sell pressure

- Macro Conditions: With the Fed's September meeting approaching, any hawkish signals could cool crypto markets

The BTCC research team notes that Litecoin's weekly RSI at 68 suggests we're not in extreme overbought territory yet, but caution is warranted. "We've seen this movie before in 2021 and 2023 - altcoin rallies can reverse violently when BTC dominance reasserts itself," cautioned their lead analyst.

Price Prediction: Mapping the Path Forward

Based on current technicals and market structure, here's our probabilistic outlook for LTC through August:

- 70% chance of testing $140-150 if Bitcoin stabilizes

- 25% chance of range-bound trading between $120-130

- 5% chance of sharp correction below $110

The wildcard remains institutional flows. If retirement fund allocations begin in earnest this month, all technical resistance levels might need to be recalibrated upward. One thing's certain - Litecoin is giving traders plenty to chew on as we head into autumn.

Litecoin Price Prediction FAQ

What's driving Litecoin's price surge in August 2025?

The combination of bullish technical indicators (trading above 20MA, MACD crossover) and institutional adoption through 401(k) plans has created perfect conditions for LTC's rise.

How reliable are the $150 price predictions?

While technicals support the case, predictions should always be taken with caution. The $130 resistance level needs to break convincingly first, and Bitcoin's stability remains crucial.

Which exchanges are best for trading LTC right now?

BTCC offers competitive fees (0.08%/0.10%) with excellent liquidity. For high-frequency traders, MEXC's zero Maker fees can be attractive, though spreads may be wider during volatile periods.

Could President Trump's 401(k) policy really impact LTC?

Absolutely. Even 1% allocation from the $27.7 trillion retirement market WOULD represent $277 billion - more than Litecoin's entire current market cap.

What's the biggest risk to Litecoin's rally?

Bitcoin correlation remains the elephant in the room. If BTC breaks below $95,000 support, LTC could see disproportionate losses as traders flee to safety.