Bitcoin’s Future: Expert BTC Price Predictions for 2025-2040 and Critical Market Factors

- What's Driving Bitcoin's Current Price Action?

- How Are Institutional Players Shaping Bitcoin's Future?

- What Regulatory and Security Challenges Could Impact BTC?

- BTC Price Predictions: 2025-2040 Outlook

- Frequently Asked Questions

As bitcoin continues its volatile journey, analysts are looking beyond short-term fluctuations to predict where BTC might be headed in the coming decades. This comprehensive analysis examines technical indicators, institutional activity, and macroeconomic factors shaping Bitcoin's potential trajectory through 2040. From BlackRock's massive accumulation to quantum computing threats, we break down the key drivers that could propel BTC to $1 million+ or trigger significant corrections.

What's Driving Bitcoin's Current Price Action?

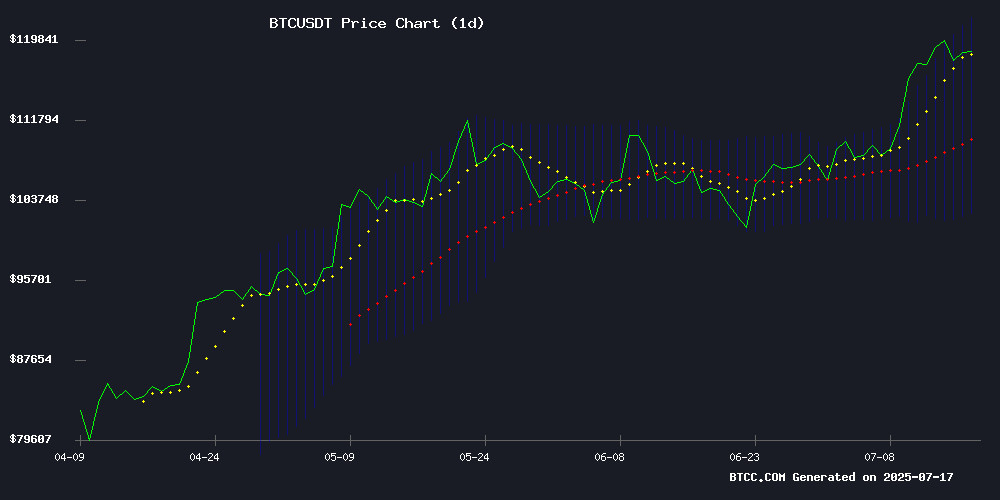

Bitcoin's price has been testing crucial resistance levels around $122,000, with technical indicators painting a mixed picture. The BTCC research team notes that while the MACD hints at a potential trend reversal, institutional inflows continue to battle miner sell pressure and regulatory uncertainties.

Source: BTCC Research/TradingView

Technical Indicators Show Bullish Signals

According to TradingView data, BTC currently trades above its 20-day moving average ($112,299), suggesting near-term bullish momentum. However, the negative MACD reading (-5,233) indicates some bearish pressure remains. The upper Bollinger Band at $122,189 has been tested multiple times in recent weeks.

How Are Institutional Players Shaping Bitcoin's Future?

The institutional landscape for Bitcoin has transformed dramatically in 2025, with traditional finance giants making unprecedented moves into crypto.

BlackRock's $416 Million Bitcoin Purchase

BlackRock recently added $416 million worth of BTC to its holdings, bringing its total to approximately $85.47 billion - about 3.6% of Bitcoin's circulating supply. This aggressive accumulation signals growing institutional confidence in Bitcoin as a strategic asset class.

Bitcoin ETFs: The New Market Whales?

Spot Bitcoin ETFs have absorbed $7.78 billion in net inflows since June 9, with BlackRock's IBIT alone attracting $416 million in a single day. These vehicles now hold more BTC than MicroStrategy's famed treasury, potentially establishing a new support floor for crypto markets.

What Regulatory and Security Challenges Could Impact BTC?

While adoption grows, Bitcoin faces several potential hurdles that could affect its price trajectory.

Quantum Computing Threat

Developers have proposed retiring vulnerable addresses as quantum computing advances. Approximately 25% of all Bitcoin, including Satoshi's holdings, could be at risk if public keys become crackable by quantum machines expected by 2027-2030.

Government Holdings Smaller Than Believed

Contrary to popular belief, the U.S. government holds just 28,988 BTC (about $3.44 billion) - far less than the 200,000 BTC often cited. This revelation could impact supply dynamics and market psychology.

BTC Price Predictions: 2025-2040 Outlook

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 110K - 150K | ETF flows, halving aftermath, institutional adoption |

| 2030 | 300K - 500K | Store-of-value narrative, global regulatory clarity |

| 2035 | 800K - 1.2M | Network effect dominance, scarcity premium |

| 2040 | 2M+ | Potential monetary system integration |

These projections assume sustained adoption curves. The $110K support level in 2025 will be critical - holding there WOULD confirm the bull market's integrity.

Frequently Asked Questions

What's the most bullish factor for Bitcoin's price?

Institutional adoption, particularly through ETFs, has created a structural shift in Bitcoin's market dynamics. The scale of accumulation by traditional finance players dwarfs previous cycles.

Could quantum computing really threaten Bitcoin?

While the risk is real, developers are proactively working on solutions. The proposed BIP would phase out vulnerable addresses before quantum computers reach cryptographically-relevant capabilities.

Why hasn't trading volume increased with Bitcoin's price?

The divergence between price action and volume suggests institutions may be holding long-term rather than actively trading. This could indicate stronger hands entering the market.

How reliable are long-term Bitcoin price predictions?

All long-term projections involve significant uncertainty. While historical patterns and adoption metrics provide guidance, unexpected regulatory changes or technological breakthroughs could alter trajectories.

What's the biggest risk to Bitcoin's price growth?

Beyond technical factors, regulatory crackdowns in major markets or loss of institutional confidence could derail the current bullish narrative. However, the decentralized nature of Bitcoin makes complete suppression unlikely.