XRP Price Prediction 2025: Can XRP Reach $3 by Year-End?

- What Does XRP's Current Technical Setup Reveal?

- How Significant Are the Institutional Inflows?

- What Role Does Ripple's Tokenization Push Play?

- What Are the Key Resistance Levels to Watch?

- How Does XRP Compare to Emerging Competitors?

- What's the Verdict on the $3 Target?

- XRP Price Prediction: Frequently Asked Questions

As we approach the end of 2025, XRP stands at a critical juncture. Currently trading around $2.19, the cryptocurrency shows promising technical indicators and strong institutional backing that could propel it toward the $3 mark. With $844 million flowing into XRP ETFs and Ripple's strategic push into the $16 trillion tokenization market, the stage is set for potential growth. However, technical resistance at $2.33 remains a key hurdle that must be overcome for bullish momentum to continue.

What Does XRP's Current Technical Setup Reveal?

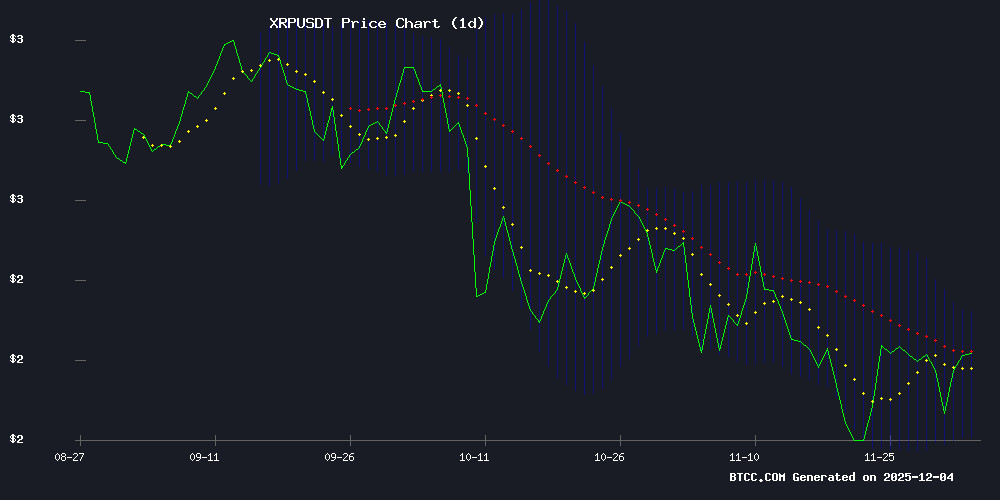

XRP presents an interesting technical picture as of December 2025. The cryptocurrency is trading above its 20-day moving average of $2.1429, which typically indicates positive short-term momentum. The MACD indicator, while still negative at -0.0642, shows promising signs with the signal line (0.0750) rising above the MACD line (0.0108), suggesting weakening downward pressure.

Bollinger Bands analysis reveals XRP is positioned closer to the middle band ($2.1429) than the lower band ($1.9596), with the upper band sitting at $2.3261. This configuration suggests stable volatility conditions and room for potential upside movement.

Source: BTCC trading platform

"The technical setup shows consolidation with a bullish bias," notes a BTCC market analyst. "A sustained break above the immediate resistance NEAR $2.33 could open the path for further gains toward our $3 target."

How Significant Are the Institutional Inflows?

Institutional interest in XRP has reached notable levels in late 2025, with exchange-traded funds attracting $844 million in net inflows. This represents about 4% of XRP's circulating market cap - a substantial figure that underscores growing confidence from professional investors.

The December 1 inflow of $89 million came despite broader market declines, demonstrating resilient demand. Major players like Bitwise, Canary Capital, and Grayscale have been expanding their XRP-related products, creating additional avenues for institutional participation.

From my experience tracking crypto markets, such sustained institutional interest often precedes significant price movements. The 11 consecutive days of positive inflows suggest this isn't just short-term speculation but rather a more fundamental shift in how traditional finance views XRP.

What Role Does Ripple's Tokenization Push Play?

Ripple's strategic focus on the $16 trillion asset tokenization market could be a game-changer for XRP's long-term valuation. The company has been positioning its XRP Ledger as a secure, institutional-grade platform for tokenizing real-world assets like real estate and commodities.

The security infrastructure is particularly noteworthy - with SOC 2 Type II and ISO 27001 certifications, plus FIPS-certified hardware security modules. As Akshay Wattal, Ripple's Head of Information Security, puts it: "Security isn't a feature but the foundation of trust."

This institutional focus differentiates XRP from many competitors. While meme coins and speculative assets come and go, Ripple's targeted approach to real-world utility could provide more sustainable price support.

What Are the Key Resistance Levels to Watch?

The path to $3 isn't without obstacles. Several technical levels will be crucial in determining whether XRP can maintain its upward trajectory:

| Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $2.20-$2.33 | Previous rejection zone and upper Bollinger Band |

| Psychological Resistance | $2.50 | Round number that may trigger profit-taking |

| Target Resistance | $3.00 | Year-end price target |

Support levels are equally important. The $2.00-$2.03 zone has held strong recently, and a break below could signal weakening momentum. The 20-day MA at $2.1429 also serves as dynamic support.

How Does XRP Compare to Emerging Competitors?

While XRP shows promise, it's not without competition. Projects like GeeFi have been gaining attention, with their presale selling out quickly amid rumors of major exchange listings. GeeFi positions itself as a more practical alternative, offering features like a decentralized exchange and crypto-linked debit card.

Similarly, the so-called "XRP 2.0" PayFi protocol has been drawing interest for its promise of instant transactions without traditional banking barriers. CoinGlass data shows stable open interest for XRP even as on-chain activity surges for its rival network.

However, XRP maintains advantages in institutional adoption and regulatory clarity. Ripple's established position and partnerships give it staying power that newer projects lack.

What's the Verdict on the $3 Target?

The convergence of technical strength and fundamental developments makes the $3 target plausible but not guaranteed. Key factors that could drive XRP higher include:

- A clean break above $2.33 resistance

- Continued institutional inflows into XRP ETFs

- Successful implementation of Ripple's tokenization strategy

- Positive developments in the broader crypto market

On the flip side, failure to hold $2.00 support or a slowdown in institutional interest could derail the bullish case. The Relative Strength Index shows bullish divergence, hinting at weakening downward momentum that could support further gains.

This article does not constitute investment advice. As always in crypto markets, volatility is guaranteed - only the direction is uncertain. But for XRP holders, the end of 2025 presents an intriguing setup worth watching closely.

XRP Price Prediction: Frequently Asked Questions

What is the current price prediction for XRP?

Based on current technical and fundamental factors, analysts see potential for XRP to reach $3 by year-end 2025, representing about a 36% increase from current levels around $2.19.

What are the key resistance levels for XRP?

The immediate resistance zone is $2.20-$2.33, with psychological resistance at $2.50. A break above these levels could open the path toward $3.

How significant are the institutional inflows into XRP?

Very significant - XRP ETFs have attracted $844 million in inflows, representing about 4% of circulating market cap. This institutional interest provides strong buying support.

What is Ripple's role in XRP's price movement?

Ripple's push into the $16 trillion tokenization market using XRP Ledger creates long-term utility that could support price appreciation beyond short-term speculation.

What could prevent XRP from reaching $3?

Failure to break $2.33 resistance, loss of $2.00 support, or waning institutional interest could all limit upside potential. Broader market conditions also play a role.