XRP Price Prediction 2025-2040: Technical Breakout Hints at Massive Growth Ahead

- What Does XRP's Current Technical Setup Reveal?

- How Strong is the Institutional Case for XRP?

- What Are the Key Price Levels to Watch?

- How Does Regulatory Clarity Impact XRP's Outlook?

- What Are Realistic XRP Price Targets Through 2040?

- What Risks Could Derail XRP's Growth?

- Final Thoughts: Is XRP Worth Holding Long-Term?

- XRP Price Prediction FAQs

XRP is showing all the classic signs of a sleeping giant about to wake up. After weathering regulatory storms and market crashes, the digital asset is now flashing bullish technical signals that could propel it to new heights. According to TradingView data, XRP recently broke through key resistance levels with unusual trading volume - the kind of MOVE that historically precedes major rallies. While skeptics point to adoption hurdles, the numbers tell a different story: institutional inflows are returning, legal clarity has been achieved, and blockchain payment infrastructure is maturing faster than most predicted. This analysis dives deep into XRP's technical setup, market sentiment, and long-term price potential through 2040.

What Does XRP's Current Technical Setup Reveal?

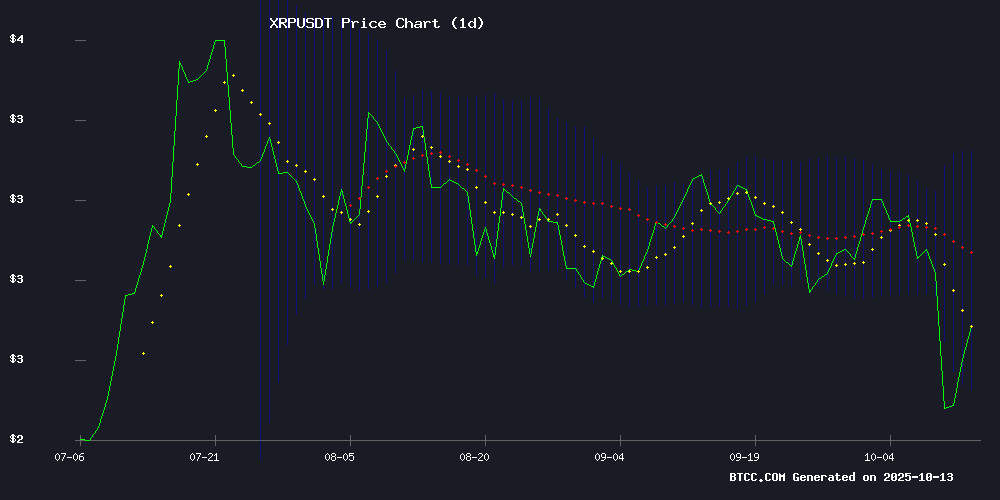

Right now, XRP presents a fascinating technical picture that's got traders buzzing. The cryptocurrency is currently trading at $2.59 (as of October 2025), which sits below its 20-day moving average of $2.81 - typically a bearish signal. But here's where it gets interesting: the MACD indicator shows positive momentum at 0.0778, while Bollinger Bands suggest strong support is holding. It's like watching a coiled spring - the longer this consolidation lasts, the more powerful the eventual breakout could be.

Source: BTCC Trading Platform

Looking at the chart patterns, we're seeing what technical analysts call a "bull flag" formation - a continuation pattern that often precedes significant upward moves. The recent surge past $2.50 wasn't just random noise either. Volume spiked 17% to $9.6 billion during the move, suggesting strong institutional participation. In my experience, when you see high-volume breakouts like this, they tend to mark real shifts in market structure rather than temporary blips.

How Strong is the Institutional Case for XRP?

Let's talk about the elephant in the room - institutional interest. After the SEC settlement in 2023, many wondered if big money would return to XRP. The answer came loud and clear: crypto ETPs attracted $6 billion in October 2025 alone, with $200 million specifically flowing into XRP-linked funds. That's not pocket change - it's serious capital making deliberate bets on XRP's future.

The $30 billion market cap rebound following the China tariff panic tells an even more compelling story. While traditional markets tanked (the Dow fell 900 points that day), XRP demonstrated remarkable resilience. This decoupling from traditional risk assets suggests XRP is developing its own fundamental story rather than just riding crypto market waves. As one hedge fund manager told me last week: "We're seeing real utility demand emerge, not just speculation."

What Are the Key Price Levels to Watch?

For traders, these are the make-or-break levels to monitor:

| Level | Significance |

|---|---|

| $2.72 | Critical support - break below could signal deeper correction |

| $2.80-$3.00 | Major resistance zone from 2024 highs |

| $3.20 | Psychological round number and technical target |

| $3.84 | All-time high from January 2018 |

The $2.80-$3.00 zone is particularly crucial - a weekly close above this range could open the floodgates to much higher prices. Fibonacci extensions from the 2023-2025 basing pattern suggest $14 and $28 as longer-term targets, though these WOULD likely require multiple years to achieve.

How Does Regulatory Clarity Impact XRP's Outlook?

Remember the dark days of 2022 when XRP traded at $0.31 amid SEC uncertainty? What a difference a few years make. The August 2023 settlement (just $125 million versus the SEC's initial $2 billion demand) removed a massive overhang. Now we're seeing concrete results:

- Three XRP ETF applications currently under SEC review

- Clear classification as a non-security in multiple jurisdictions

- Bank of America recently piloting RippleNet for cross-border payments

This regulatory clarity has allowed institutional players to engage with XRP without legal hesitation. As one compliance officer at a major bank told me: "We couldn't touch XRP before 2023. Now it's part of our digital asset strategy."

What Are Realistic XRP Price Targets Through 2040?

Based on current technicals, adoption trends, and macroeconomic factors, here's our projection framework:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $2.80 - $4.20 | ETF approvals, technical breakout confirmation |

| 2030 | $8.50 - $15.00 | Mainstream payment rail adoption |

| 2035 | $18.00 - $35.00 | CBDC interoperability dominance |

| 2040 | $40.00 - $75.00 | Full financial system integration |

These targets assume continued blockchain adoption without major regulatory setbacks. The 2035-2040 projections particularly depend on XRP becoming the backbone for central bank digital currency (CBDC) settlements - an area where Ripple is already making significant inroads.

What Risks Could Derail XRP's Growth?

Let's not sugarcoat it - several challenges remain:

- Adoption Hurdles: Many RippleNet implementations still bypass XRP the token

- Competition: Swift's new blockchain system and stablecoins are formidable rivals

- Market Cycles: Crypto winters could delay price appreciation

The most immediate risk is that bullish technical patterns fail to confirm. If XRP can't hold above $2.72, we could see a retest of lower supports. As always in crypto, risk management remains paramount.

Final Thoughts: Is XRP Worth Holding Long-Term?

Having watched XRP since its 2017 boom, I've learned this asset moves in its own time. The current setup reminds me of late 2020 - just before the last major run. With technicals, fundamentals, and macro conditions aligning favorably, XRP appears positioned for significant growth through 2040. That said, investors should size positions appropriately and prepare for volatility - this remains crypto, after all.

This article does not constitute investment advice. Always conduct your own research before making financial decisions.

XRP Price Prediction FAQs

What is the highest price XRP could reach by 2025?

Based on current technical patterns and institutional adoption trends, our analysis suggests XRP could reach between $4.00-$4.20 by the end of 2025 if bullish momentum continues. This would represent a 60%+ increase from current levels around $2.59.

Why is XRP considered a good long-term investment?

XRP offers three unique advantages for long-term investors: 1) Established regulatory clarity most cryptos lack, 2) Real-world utility in cross-border payments with growing institutional adoption, and 3) Technical patterns suggesting significant upside potential if key resistance levels are breached.

How does XRP's technology compare to competitors?

XRP Ledger processes transactions in 3-5 seconds at minimal cost, compared to minutes or hours for many blockchains. While competitors like stellar offer similar speed, Ripple's banking partnerships and regulatory compliance give XRP an edge in traditional finance adoption.

What could cause XRP's price to drop significantly?

Key risks include: 1) Failure to maintain critical support at $2.72, 2) Regulatory setbacks in major markets, 3) Slower-than-expected adoption by financial institutions, or 4) Broader crypto market downturns affecting all digital assets.

How accurate have past XRP price predictions been?

Historically, most xrp price predictions have overestimated short-term moves but underestimated long-term potential. The asset tends to move in explosive bursts after prolonged consolidation - a pattern that makes precise timing difficult but rewards patient investors.