Ripple, Solana & Binance Coin: September 16 Price Predictions That Could Reshape Your Portfolio

Crypto markets pivot as three giants signal potential breakouts.

Ripple's legal clarity fuels institutional momentum—traders eye key resistance levels after recent consolidation patterns suggest accumulation phase.

Solana's ecosystem expansion defies network congestion fears, with DeFi projects launching faster than traditional finance approves paperwork.

Binance Coin leverages exchange dominance while navigating regulatory waves—because nothing says 'financial revolution' like appeasing global watchdogs.

Technical indicators flash bullish divergence across all three assets, though seasoned traders know crypto forecasts have the accuracy of a Wall Street analyst's dartboard.

Watch for volume spikes and BTC correlation breaks—these tokens aren't just riding trends, they're writing the playbook for the next altseason.

Solana Price Forecast: SOL eyes record high as Pantera Capital confirms $1.1 billion exposure

Solana Price Forecast: SOL eyes record high as Pantera Capital confirms $1.1 billion exposure

Solana (SOL) is down nearly 6% from its peak level of $250 last week, trading above $235 at the time of writing on Tuesday. The smart contracts token tested support at $230 the previous day, but growing institutional interest limits downside risks.

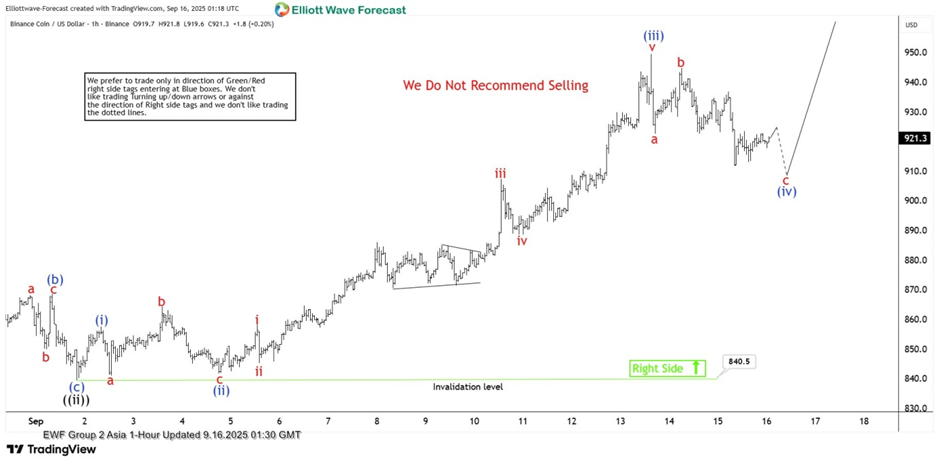

The short-term Elliott Wave outlook for Binance Coin (BNBUSD) shows a rally from the August 26, 2025 low. This move is unfolding as a five-wave impulse. Wave ((i)) peaked at 881.2. Wave ((ii)) dipped to 839.5. The internal structure of wave ((ii)) formed a zigzag pattern. Wave (a) fell to 850.8. Wave (b) climbed to 868.5. The last leg wave (c) dropped to 840.5, completing wave ((ii)).