Pi Network Price Forecast: Recent Spike Tests Channel Breakout Despite Waning Retail Demand

Pi Network's latest surge pushes technical boundaries while mainstream interest falters—classic crypto divergence in action.

Technical Breakout or False Signal?

The network's price action defies conventional retail patterns, punching through resistance levels while everyday investor enthusiasm cools. Trading volumes tell two different stories: institutional moves versus retail hesitation.

Market Mechanics Exposed

Whales accumulate during retail skepticism—proving once again that crypto markets favor those who understand momentum over sentiment. Retail traders chase pumps while smart money builds positions during uncertainty.

Another day in digital assets where the 'dumb money' worries about demand while the sharp players stack sats quietly. Some things never change on the blockchain.

CEXs' reserve surge signals waning retail demand

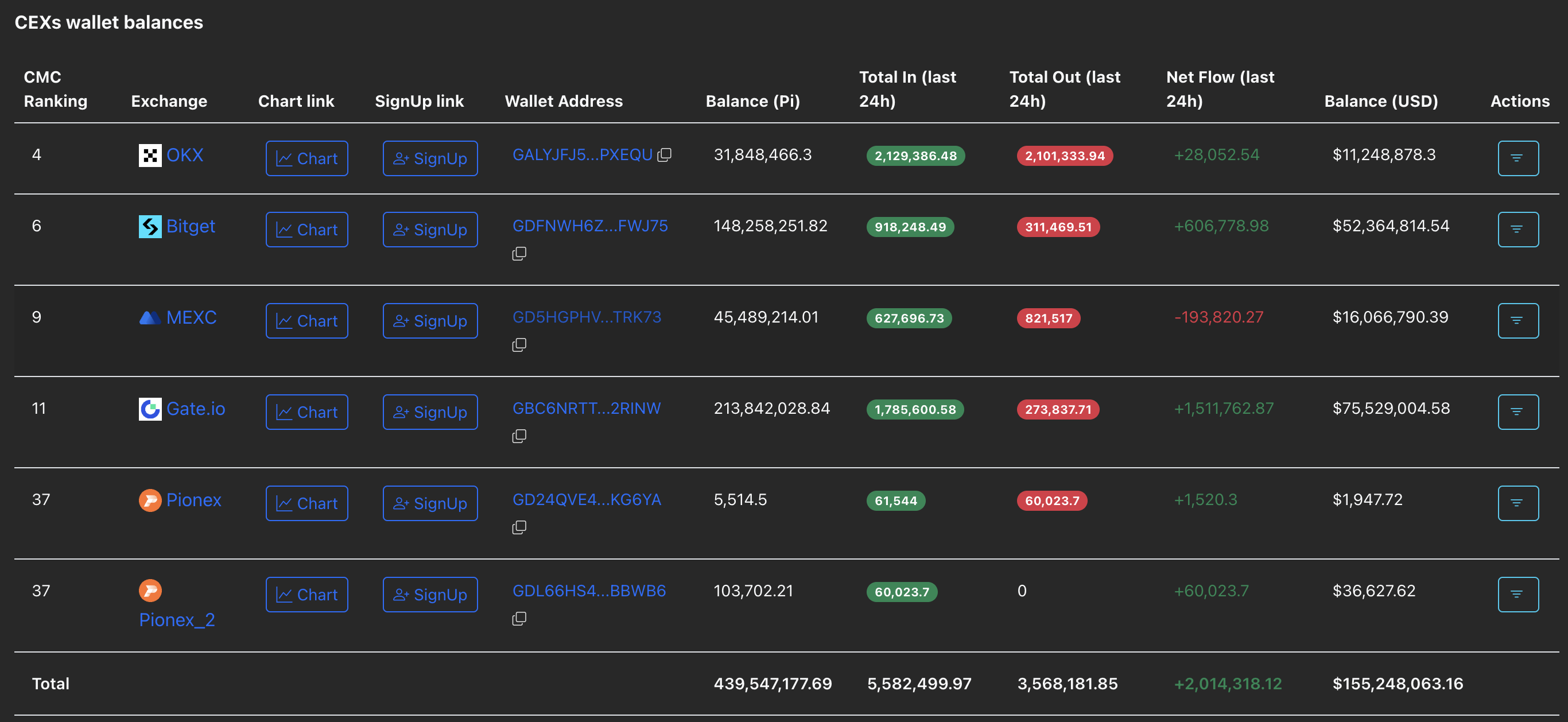

A surge in CEX reserve relates to an increase in user deposits, suggesting a decline in investors’ confidence. PiScan data shows that the CEX wallet balances have increased by 2.01 million Pi tokens over the last 24 hours, indicating that the retail demand is slowing down.

CEXs wallet balances. Source: PiScan

Pi Network eyes channel breakout to the 50-day EMA

Pi Network edges higher by over 3% at press time on Friday, testing the upper boundary of a falling channel pattern on the daily chart. The intraday recovery following the cool-off period of over a week hints at a potential channel breakout.

A decisive close above this trendline at $0.3610 would confirm the channel breakout. In this scenario, PI could face the 50-day Exponential Moving Average at $0.3836 as the next key obstacle.

Adding to the possibility of a trend reversal, the Moving Average Convergence Divergence (MACD) and its signal line hold a stable uptrend on the daily chart, indicating a steady rise in bullish momentum. Furthermore, the Relative Strength Index (RSI) has reached neutral levels close to 50, with the recent spike indicating a recovery in buying pressure.

PI/USDT daily price chart.

Looking down, if PI fails to close decisively and reverses from the overhead trendline, it could retest the all-time low of $0.3220 from August 1.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.