Ethereum Price Soars: Institutional Demand Shatters Records, $5,000 Target in Sight

Ethereum rockets upward as Wall Street giants pile into crypto—breaking all previous institutional inflow records.

The Institutional Stampede

Massive capital injections from hedge funds and asset managers push ETH toward unprecedented heights. Traditional finance finally wakes up to decentralized potential—though they'll probably try to centralize it again.

Price Momentum Builds

Every resistance level crumbles beneath institutional buying pressure. The $5,000 threshold now appears not just possible but probable as demand completely outpaces supply.

Market Dynamics Shift

This isn't retail FOMO anymore—this is sophisticated money positioning for the long haul. They're not just dipping toes; they're diving headfirst into the deep end.

Just wait until the same firms that called crypto a scam start launching their own ETH ETFs—with 'modest' 2% management fees, of course.

Ethereum is making waves again, reclaiming the $4,500 mark as institutional investors quietly pile in. The second-largest cryptocurrency is showing signs of life that could push it toward $5,000, and traders are starting to wonder: Is a new rally just around the corner?

With steady accumulation and growing confidence, all eyes are on Ethereum’s next move.

Funds Load Up on ETH

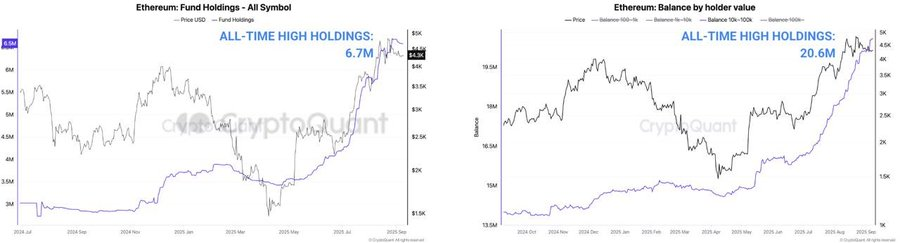

According to the latest data, ethereum fund holdings have climbed to a record 6.7 million ETH, while total wallet balances reached 20.6 million ETH. Together, these numbers tell one clear story, institutions and long-term holders are steadily stacking ETH.

This is important because it proves demand isn’t just coming from quick traders chasing short-term gains. As CryptoBusy highlights, large funds have been consistently adding ETH throughout 2025.

At the same time, wallets of all sizes are also growing their holdings. This mix of big players and retail buyers creates a stronger foundation for Ethereum’s price and future growth.

Long-Term Holders Keep Stacking

Further, CryptoBusy highlights that Ethereum balances by holder value have surged to 20.6 million ETH, marking yet another record milestone. What stands out here is that wallets across different size ranges, from smaller investors to those holding over 100,000 ETH, are increasing their positions.

This suggests the demand isn’t concentrated in a few hands but spread across the broader market.

Ethereum Price Outlook: Support Holding Strong

As of now ethereum price is trading near $4,522, and holding strong above its key support at $4,164. Meanwhile, the bigger challenge now sits between $4,600 and $4,800, a zone that Ethereum must clear before aiming for $5,000.

Technical signals also look supportive. The RSI stands at 58, showing the asset is neither overbought nor oversold. That means there’s room for further growth without the need for a sharp correction first.

However, the bullish scenario stays alive as long as ETH holds above $4,000. Falling below that threshold could open the door to $3,865, and in a deeper slide, even toward $3,213.