Solana Price Forecast: SOL Eyes Explosive Rally to $250 as Open Interest Shatters Records

Solana's gearing up for a monster move—and the numbers don't lie.

Open Interest just hit an all-time high, signaling massive institutional and retail positioning ahead of what could be a historic breakout.

Target? A cool $250.

Traders are piling into SOL futures like there's no tomorrow, betting big on the network's scalability and booming DeFi ecosystem. High open interest often precedes volatile price action—and this time, the momentum looks overwhelmingly bullish.

Even the skeptics are starting to pay attention. When derivatives markets speak this loudly, you listen—or risk missing the next leg up. Just don’t act surprised when the “smart money” takes profits right as the retail crowd FOMOs in. Classic move.

DeFi Development Corp adds more SOL amid recovery

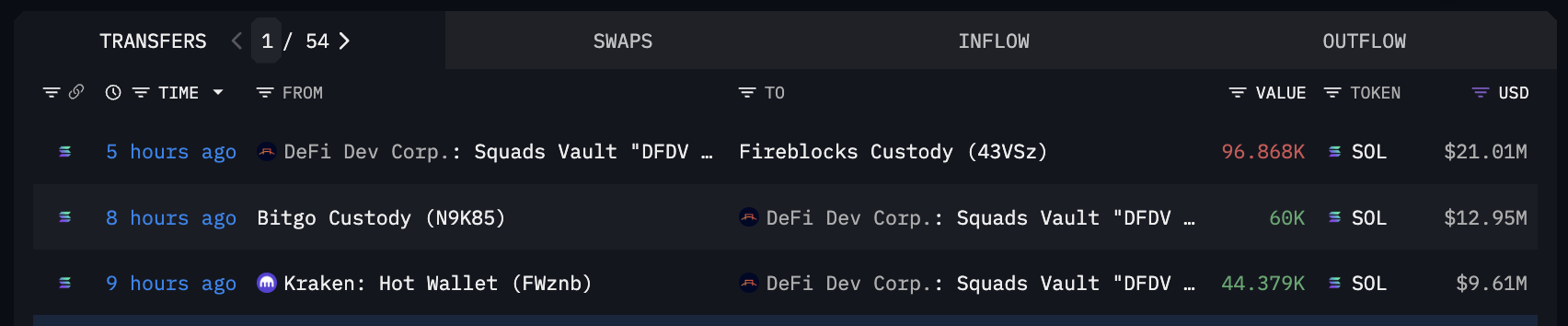

Arkham Intelligence data shows that DeFi Development Corp (DFDV), a NASDAQ-listed solana treasury company, acquired 104,379 SOL (over $22 million) on Tuesday in two on-chain transactions via Bitgo for 60,000 SOL and Kraken for 40,379 SOL.

Following the acquisition, DFDV shifted 96,868 SOL to Fireblocks' custody. As of Wednesday, the DeFi Dev Corp holds 192,462 SOL worth over $42 million.

DeFi Dev Corp wallet activity. Source: Arkham Intelligence

Rising optimism drives Solana Open Interest to a record high

Solana is gaining traction as the risk-on sentiment returns to the cryptocurrency market. The SOL Open interest (OI) reaching a record high is indicative of the improved market sentiment.

CoinGlass data shows that the Solana OI has increased by over 8% in the last 24 hours, reaching $14.68 billion. Supporting the optimism, trading volume holds steady at $25.19 billion.

Furthermore, the liquidation data shows $10.38 million in short liquidations outpacing the $6.97 million of long liquidations, indicating a larger wipeout of bearish-aligned traders as risk-on sentiment builds among investors.

Solana Derivatives. Source: CoinGlass

Solana nears a crucial resistance level breakout

Solana edges higher by over 0.50% at press time on Wednesday, extending the 1.45% rise from the previous day. The high-performance blockchain token maintains an uptrend for the fourth consecutive day, trading NEAR an eight-month high.

Solana faces opposition at the 61.8% Fibonacci level at $219, which is retraced from the $295 high from January 19 to the $95 low from April 7. If SOL surpasses this crucial resistance, it WOULD confirm a breakout rally, potentially targeting the 78.6% Fibonacci level at $252.

The Moving Average Convergence Divergence (MACD) crosses above its signal line on Monday, signaling a bullish trend reversal. Additionally, the Relative Strength Index (RSI) at 61 bounces off the halfway line, indicating that the buying pressure is increasing with further space for recovery before reaching the overbought level at 70.

SOL/USDT daily price chart.

Looking down, if Solana reverses from the $219 resistance level, it could retest the 50% retracement level at $195.