JPMorgan Chase Declares Bitcoin ’Too Cheap’ Amid Record-Low Volatility

Wall Street giant breaks ranks with traditional finance skepticism—calls Bitcoin undervalued as price stability reaches unprecedented levels.

The Volatility Paradox

JPMorgan's analysis reveals Bitcoin's wild price swings have cooled to historic lows—yet institutional adoption continues heating up. The bank's metrics suggest current prices don't reflect the network's growing institutional infrastructure.

Traditional Finance's Reluctant Admission

Even skeptics can't ignore the numbers: reduced volatility combined with sustained demand creates a valuation argument that's hard to dismiss. The report subtly acknowledges what crypto natives knew years ago—mature markets eventually price efficiency.

Of course, it took record-low volatility for traditional banks to spot value—because apparently, stability is the only metric they understand when it comes to digital assets. Maybe next they'll discover that blocks get added every ten minutes too.

Source: TradingView, www.gold.co.uk, TradingView

They estimate corporate treasuries now hold more than 6% of the circulating supply, forming a growing pool of long-term “sticky” coins that reduce daily price swings.

Index inclusion effects are also contributing. Equity listings tied to bitcoin exposure are attracting passive capital. For instance, Japan’s Metaplanet Inc. (TSE: 3350) recently graduated into FTSE Russell’s mid-cap category and global benchmarks after expanding its Bitcoin stack.

In the U.S., Kindly MD (Nasdaq: NAKA) has moved to raise up to $5 billion following a $679 million Bitcoin purchase, signaling more treasury-style demand.

New entrants, including ventures linked to industry veterans (including Adam Back), are likewise building balance-sheet positions to rival Marathon Digital Holdings, Inc. (Nasdaq: MARA), though Strategy Incorporated (Nasdaq: MSTR) remains the reference standard for corporate Bitcoin treasuries.

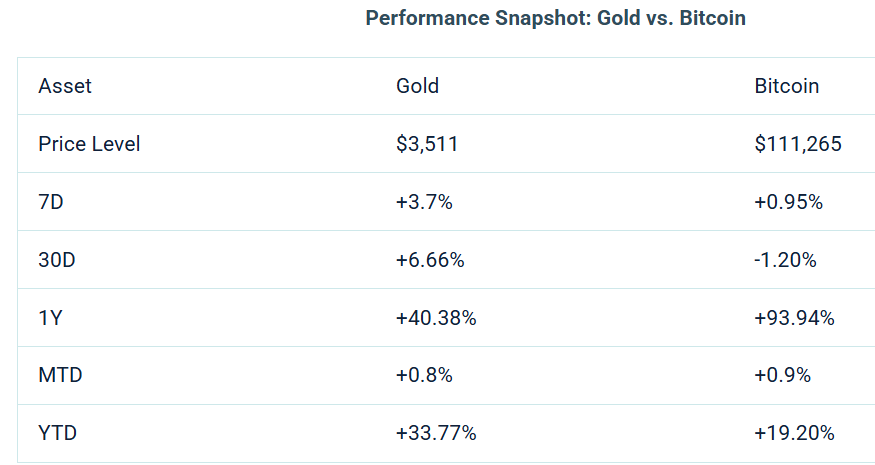

Bitcoin vs Gold: Multi-million-Dollar parity forecasts for 2030s

Importantly, JPMorgan’s comparison does not equate Bitcoin with gold’s entire market, which includes jewelry, central bank reserves, and industrial use.

Rather, the analysis focuses exclusively on gold’s private-investment segment, adjusted for risk. Lower realized volatility increases Bitcoin’s “fair” market cap within this segment, even absent major price movement.

This marks a stark realignment from the financial giants, whose CEO once saw no intrinsic value in Bitcoin.

Bitcoin maximalists extend this thesis further. Analyst Joe Consorti of The Bitcoin Layer suggests that if Bitcoin reached the total market size of gold today, .

Extrapolating current five-year growth rates, he projects potential parity between Bitcoin and gold’s investment market as early as the 2030s, with aggressive scenarios pointing toward multi-million-dollar valuations.