Trump-Backed WLFI Token Tanks in Trading Debut—Here’s Why It Stumbled

Trump-endorsed WLFI token crashes out the gate as hype collides with crypto reality.

Rough Opening

The much-hyped launch saw immediate selling pressure—no presidential tweet could save it from a classic pump-and-dump vibe. Early buyers got rekt within minutes as liquidity vanished faster than a politician's promise.

Meme Meets Market

Celebrity-backed tokens always walk a fine line between momentum and manipulation. This one tripped right out of the gate. When the 'Trump trade' becomes the Trump trap, you know sentiment's flipping.

Same Playbook, New Day

Another day, another token leveraging fame over fundamentals. Welcome to crypto—where the only thing more volatile than the charts is the credibility of its influencers.

WLFI token dipped to a low of $0.2335 on Tuesday (Source: TradingView)

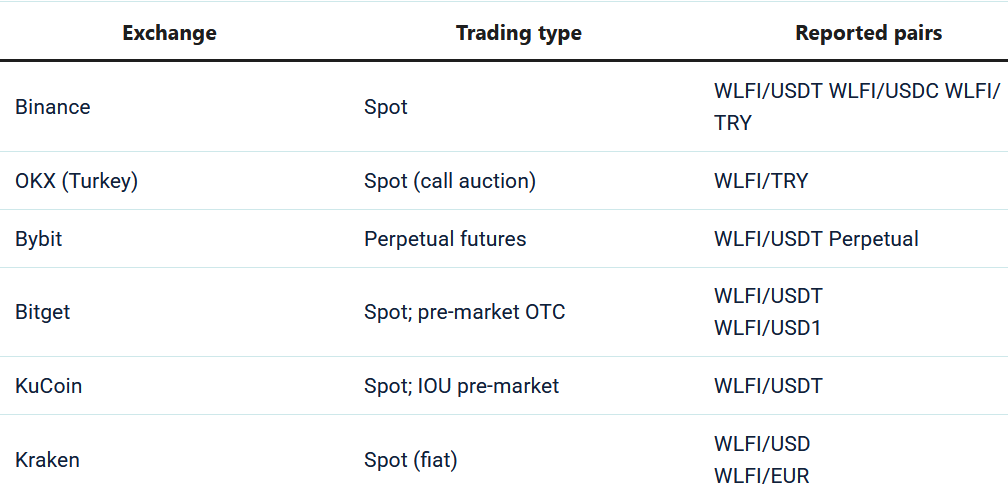

The debut was amplified by immediate listings on major exchanges, including Binance, OKX, and Bybit, a MOVE that granted the token broad access but also introduced significant volatility.

A critical factor influencing the token’s early price action is its release structure. Only a small portion of the total supply came into circulation at launch, with early investors permitted to sell up to 20% of their holdings.

Tokens allocated to founders, the team, and advisors remain locked for a longer duration, with any future unlocks contingent on a community vote.

This design creates a thin market for early price discovery, while a large portion of the total supply remains off-exchange. This protocol’s structure and design had drawn criticisms from some corners of the market.

Financial services firm Compass Point had previously warned that WLFI’s debut could destroy retail traders if exchanges slapped on an excessive fully diluted valuation (FDV).

They noted that a small tradable float combined with heavy insider allocations can create an artificially high paper valuation, ultimately leaving retail investors bearing most of the risk post-launch.

The firm also faulted the concentration risk, with over 20% sitting with the TRUMP family.

Trump family’s paper wealth surges amid broader pattern

This substantial concentration of supply and its associated risks is not an isolated phenomenon for Trump-affiliated digital assets. This event is similar to the volatile debut of the $TRUMP and $MELANIA memecoins.

Those assets also exhibited a similar structure, with roughly 80% of supply controlled by insiders.

For instance, the $TRUMP token had an FDV that briefly grew to $44 billion before it plummeted approximately 89% in January.

A key driver of that initial retail frenzy was the quick listing on major platforms like Binance, Coinbase Global, Inc. (Nasdaq: COIN), and Robinhood Markets, Inc. (Nasdaq: HOOD), a move that WLFI now appears to be following.

Ahead of WLFI’s spot debut, traders were already active in derivatives.

On Hyperliquid, pre-launch perpetual contracts (“hyperps”) allowed for speculative price discovery, with implied values starting around $0.43 and settling NEAR $0.250. This pre-market activity established an initial FDV above $25B from its 100 billion supply.

All of that set up the family’s paper windfall at launch. Consequently, when WLFI began spot trading, reports indicated the Trump family’s stake was valued at more than $5 billion on paper following its ownership of 22.5 billion WLFI tokens.

Donald Trump Jr., Eric Trump, and Barron Trump are listed as co-founders of World Liberty Financial, while former President Donald Trump is named “Co-Founder Emeritus.”

Here’s a look at some of the exchanges where WLFI is now available for trading and some of the pairs: