ETH Staking Entry Queue Hits Two-Year Peak as Institutional Players Pile In

Ethereum's staking queue just hit levels not seen since the Merge frenzy—institutional money's flooding the gates.

Wall Street's Crypto Grab

Big players aren't just dipping toes anymore; they're diving headfirst into ETH staking. The entry queue's ballooning as asset managers and hedge funds scramble for yield in a zero-rate environment. They'll chase anything that beats treasury bonds—even if it means dealing with blockchain's equivalent of DMV lines.

Network Pressure Cooker

This isn't retail FOMO. We're watching pension funds and family offices battle for validator slots. The queue surge signals something bigger: traditional finance finally gets that crypto-native yields aren't just meme-driven gambling. Too bad they're two years late to the party.

When institutions move, they move in herds—and right now they're stampeding toward ETH staking. Just don't expect them to understand the tech behind it.

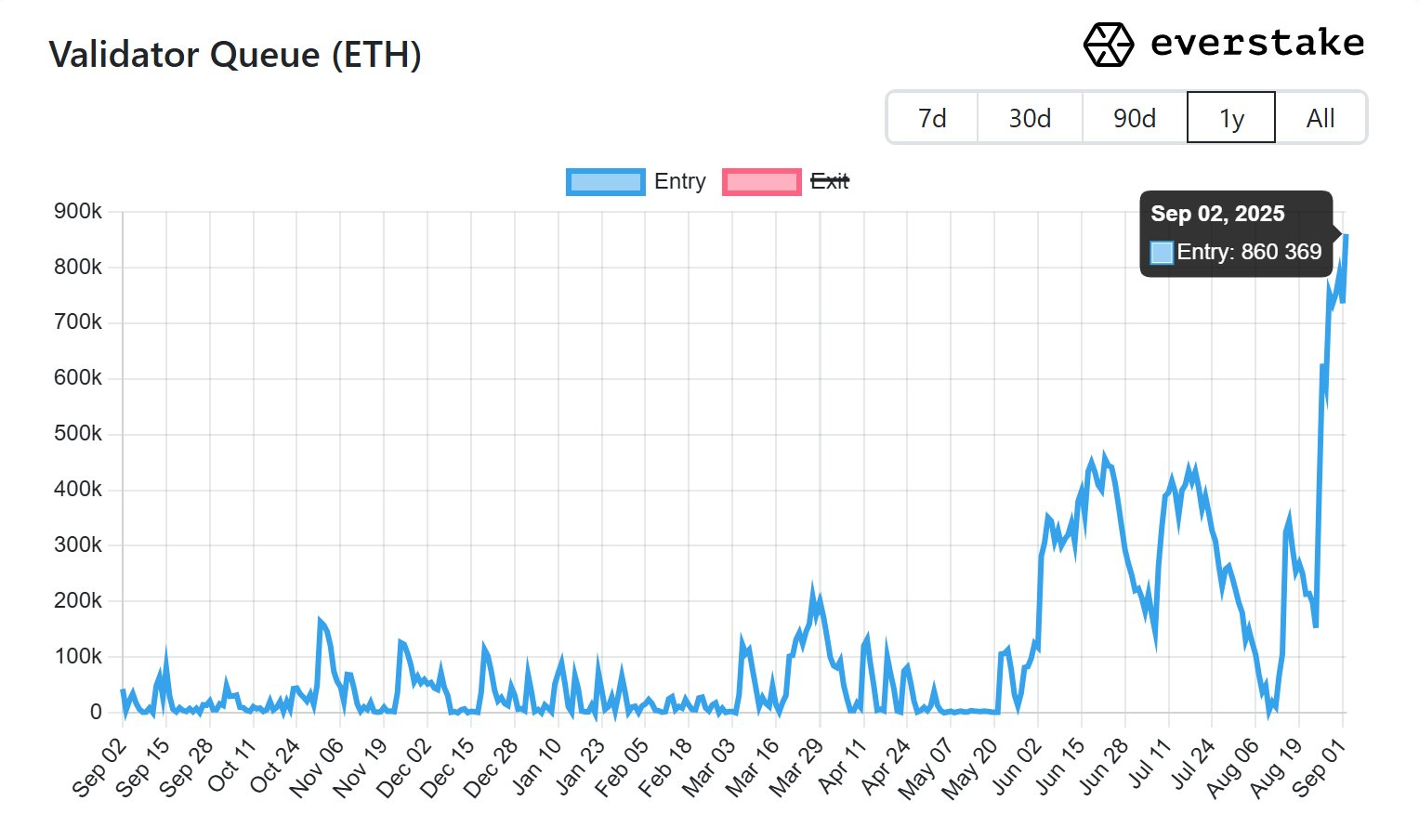

Ethereum staking entry queue surges to two-year high. Source: Everstake

Exit queue retreats from high

The increase in staking allays some of the recent fears that a surge in the staking exit queue WOULD spark a major sell-off following the asset’s all-time high on Aug. 24.

The staking entry and exit queues almost reached parity for the first time since July after the exit queue hit an all-time high of just over 1 million ETH on Aug. 29, since dropping 20% to indicate a slowdown in unstaking Ether.

The blockchain has 35.7 million ETH staked, worth approximately $162 billion, and equating to 31% of the total supply, according to Ultrasound.Money.

ETH treasuries buy and stake amid price drop

Ether corporate treasury funds continue to grow with a total of 4.7 million ETH, or almost 4% of the entire supply worth around $20.4 billion, already purchased by more than 70 participants, according to StrategicEtherReserve.

The majority of these entities have or will stake the asset for additional yields for their strategies, which has boosted the entry queue in recent weeks.

Meanwhile, ETH has retreated a further 1.2% on the day, falling to $4,321 at the time of writing.

Ether has now declined 12.4% from its all-time high on Aug. 24 as profit-taking by retail traders continues.