Ripple Price Forecast: XRP’s Path to $2.50 Reignites as Retail Interest Fades

XRP's rally hits a wall as mom-and-pop investors pull back—putting that $2.50 target back on the radar.

Retail Exodus Shakes Confidence

Retail demand isn't just cooling—it's freezing over. Traders are jumping ship, leaving XRP vulnerable to a deeper correction. Without fresh capital from everyday buyers, the token struggles to hold momentum.

Technical Breakdown Accelerates

Selling pressure mounts as key support levels crack. The dip below critical moving averages signals more pain ahead—and a retest of lower price zones becomes inevitable.

Institutional Apathy Compounds the Slide

Big money isn't stepping in yet. While retail flees, whales stay sidelined—classic crypto drama where the little guys bleed first before the suits decide it's cheap enough to buy.

Will XRP Find a Floor?

All eyes are on whether institutional players or a sudden market shift can stop the bleed. But for now, the path of least resistance points down—way down. Another classic case of 'number go down' theology in crypto—where everyone's a genius in a bull market and a ghost in a bear one.

XRP faces weak fundamentals amid suppressed on-chain activity

The drop in xrp price reflects a decline in on-chain activity. According to CryptoQuant data, the number of active addresses has plummeted over the last few weeks, from approximately 50,000 in mid-July to around 24,000.

The Active Addresses metric tracks the number of wallets actively interacting with the XRP Ledger (XRPL) by sending or receiving XRP. Hence, such a significant drop indicates a reduction in risk appetite as investors take a step back, leaving XRP susceptible to supply shocks.

-1756483115579-1756483115580.png)

XRP Active Addresses | Source | CryptoQuant

CoinGlass data mirrors the declining interest in XRP, highlighting a noticeable pullback in the futures Open Interest (OI) from $10.94 billion to $7.97 billion over the same period.

As OI declines, interest in XRP wobbles, implying a lack of conviction in the token's ability to recover or sustain an uptrend. This also increases the likelihood of the downtrend continuing in the short term.

XRP Futures Open Interest | Source: CoinGlass

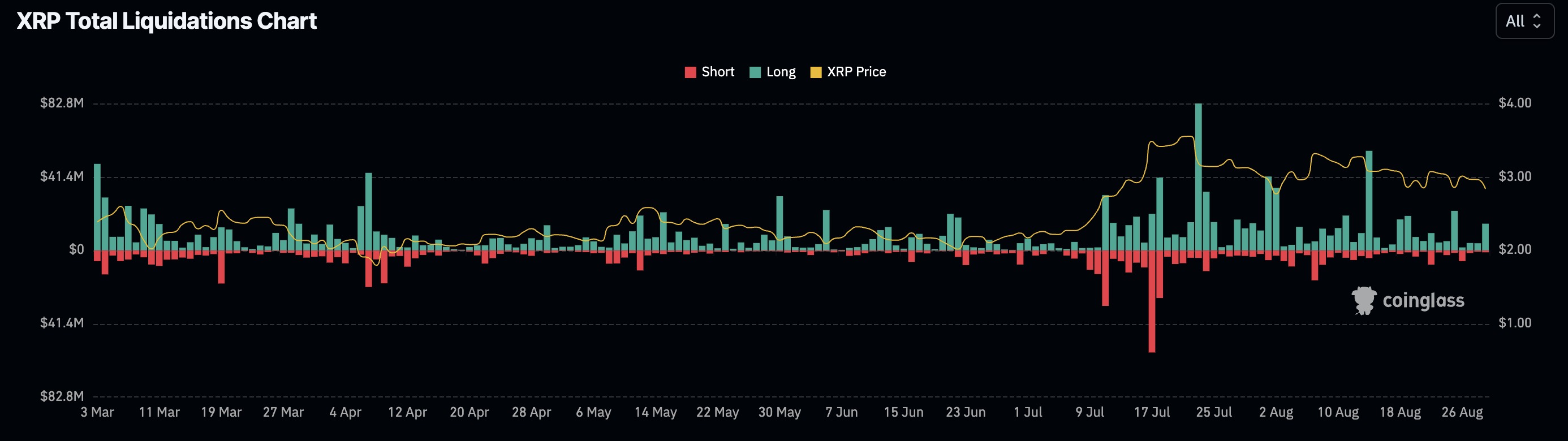

Liquidations have also been on the rise, with over $15 million wiped out in long positions in the last 24 hours. In comparison, short position holders have suffered only $1 million in liquidations, underscoring the risk-off sentiment gripping crypto markets.

XRP Futures Liquidations | Source: CoinGlass

Technical outlook: XRP bearish structure taking shape

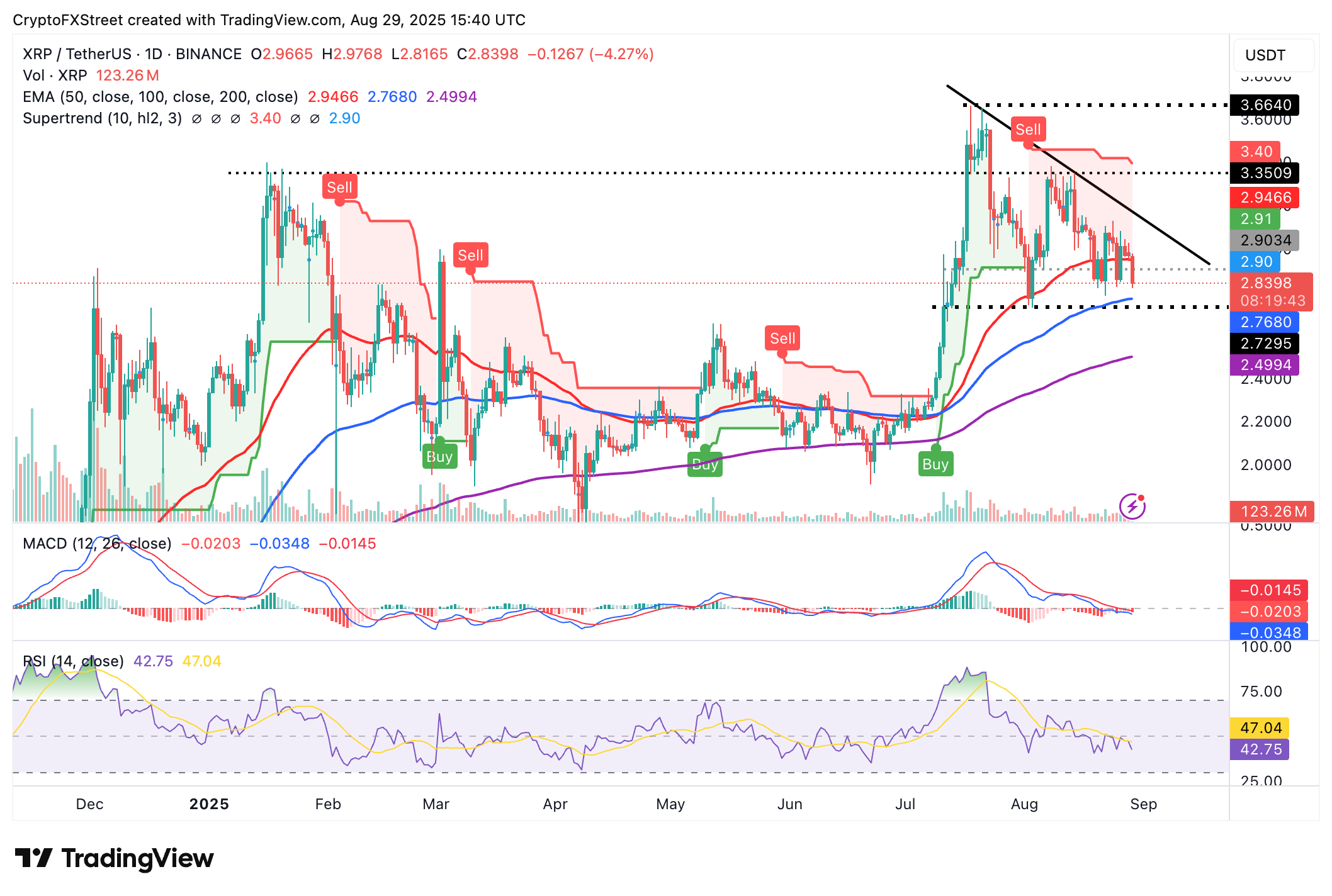

XRP price is trading below two key levels: the pivotal $3.00 and the 50-day Exponential Moving Average (EMA), signaling a shift in sentiment from bullish in July to bearish heading into September. Historically, September has been a bearish month in crypto, which could further cause sentiment to deteriorate.

The Moving Average Convergence Divergence (MACD) indicator's sell signal underlines the bearish outlook, with traders likely to continue de-risking to protect their capital.

A sharp decline in the Relative Strength Index (RSI) below the 50 midline indicates a reduction in buying pressure. Should the RSI at 40 extend the decline toward oversold territory, the path of least resistance could remain downward.

XRP/USDT daily chart

Key areas of interest to traders in the short term are the 100-day EMA at $2.76, which is poised to absorb selling pressure and prevent XRP from extending the pullback toward the 200-day EMA at $2.49.

Still, traders cannot ignore the possibility of a knee-jerk rebound, especially after Friday's sell-off across the crypto market. A reversal above $3.00 could restore retail interest in XRP and reinforce the bullish grip, paving the way for a breakout targeting its $3.66 record high.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.