Pi Network Price Forecast: Pi ETP Launch Ignites Bullish Frenzy

Pi ETP hits markets—traders pile in as institutional validation sends shockwaves through crypto.

Market Momentum Builds

The once-mobile-mining project just got Wall Street's stamp of approval. Pi's exchange-traded product debut isn't just another listing—it's a legitimacy play that's got retail and pros alike reassessing its ceiling.Price Speculation Heats Up

Analysts who dismissed Pi as 'just another testnet token' are now scrambling to update models. The ETP wrapper solves liquidity concerns that plagued early adopters—suddenly this isn't just play money anymore.Regulatory Green Light?

Listing an ETP requires compliance hurdles most tokens never clear. Pi's passage suggests regulators aren't entirely allergic to innovation—just skeptical of anything that doesn't come with paperwork. Because nothing says decentralization like filing forms in triplicate.The first-ever Pi Network ETP launch

Valour, a subsidiary of the London Stock Exchange (LSE) listed DeFi Technologies, announced the launch of eight new crypto-focused ETPs. Capturing the attention of Pi Network users, commonly referred to as Pioneers, was the Pi-focused ETP, Valour Pi (PI) Swedish Krona (SEK) ETP.

Pi Network’s bullish sentiment is on the rise with the launch of the first-ever ETP. CoinMarketCap ranks Pi Network among the top 10 crypto assets with the strongest bullish sentiment over the last 24 hours, with an 87.7% bullishness rating.

Most bullish sentiment crypto projects. Source: CoinMarketCap

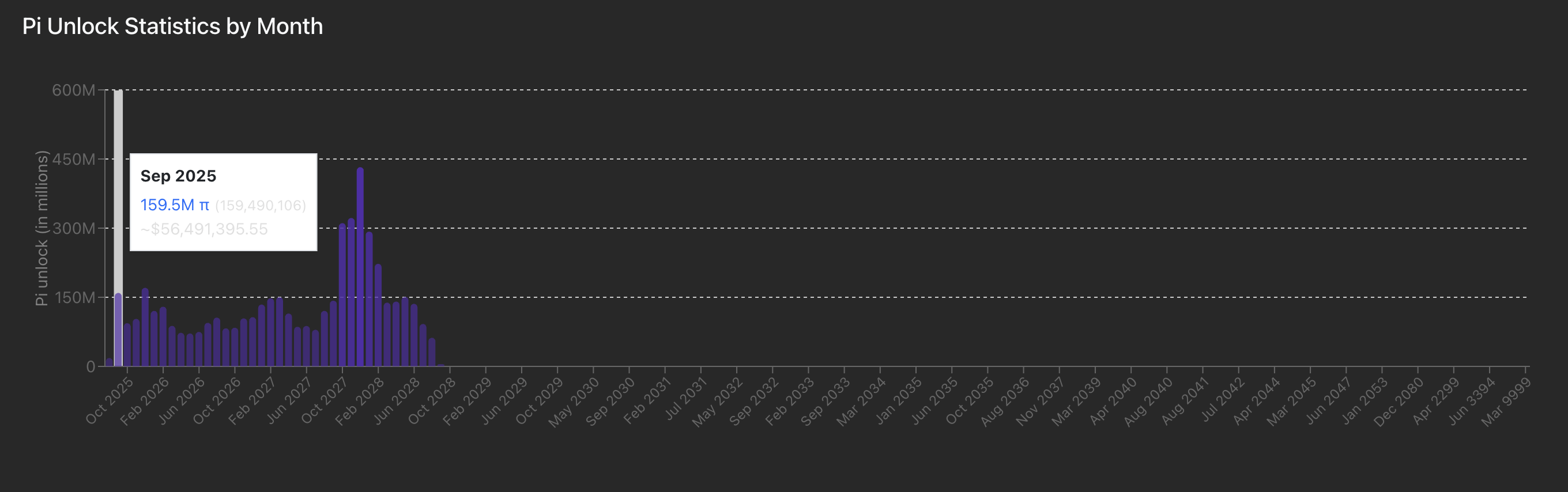

Supply dump risks amid September token unlock

PiScan data shows nearly 159.5 million PI tokens will be released into circulation in September through daily unlocks. This massive token unlock could increase the overhead supply pressure on PI, risking further losses.

Pi token unlock. Source: PiScan

However, the launch of the recent Linux version of Pi Node and the Pi ETP has increased confidence, which could decrease the supply dump chances.

Pi Network eyes a leg higher in the falling channel pattern

Pi Network trades at $0.3578 at press time on Friday, having risen from an intraday low of $0.3521. The short-term rise increases the possibility of a bullish extension to the 5% rise from Thursday, which WOULD mark an upcycle within the falling channel pattern on the daily chart.

A potential uptrend continuation in Pi coin could target the 50-day Exponential Moving Average (EMA) at $0.4096.

The momentum indicators on the daily chart suggest a steady rise in a bullish trend. The Relative Strength Index (RSI) reaches 44, indicating a slow rise from the oversold region, which suggests enduring growth in buying power.

Additionally, the Moving Average Convergence Divergence (MACD) diverges from its signal line to avoid a cross below. This indicates a revival in bullish momentum.

PI/USDT daily price chart.

Looking down, if Pi slips under the $0.3442 level, marked by the August 5 close, it could test the all-time low of $0.3220 from August 1.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.