Three Key Factors Behind Bitcoin’s August Plunge Below $112,000

Bitcoin's bull run hit a brutal wall in August—here's what really triggered the drop.

Regulatory Tremors Shake Confidence

Fresh regulatory crackdowns spooked institutional players, triggering massive sell-offs across major exchanges. Uncertainty became the market's worst enemy.

Leverage Liquidation Cascade

Over-leveraged positions got obliterated as Bitcoin breached critical support levels. The domino effect amplified losses beyond anyone's predictions.

Macroeconomic Pressure Intensifies

Traditional finance woes finally caught up with crypto—because nothing says 'safe haven' like watching your portfolio drop six figures in a week. Classic hedge fund behavior flooded the market with panic selling.

Sometimes the market takes profits—other times, profits take you.

Bitcoin sold off as Ethereum took the spotlight

On August 25, bitcoin plunged to $110,000, only three days after climbing above $117,000 following Powell’s comments on potential rate cuts.

Observers quickly noticed that the drop coincided with on-chain data showing whales selling Bitcoin to accumulate Ethereum.

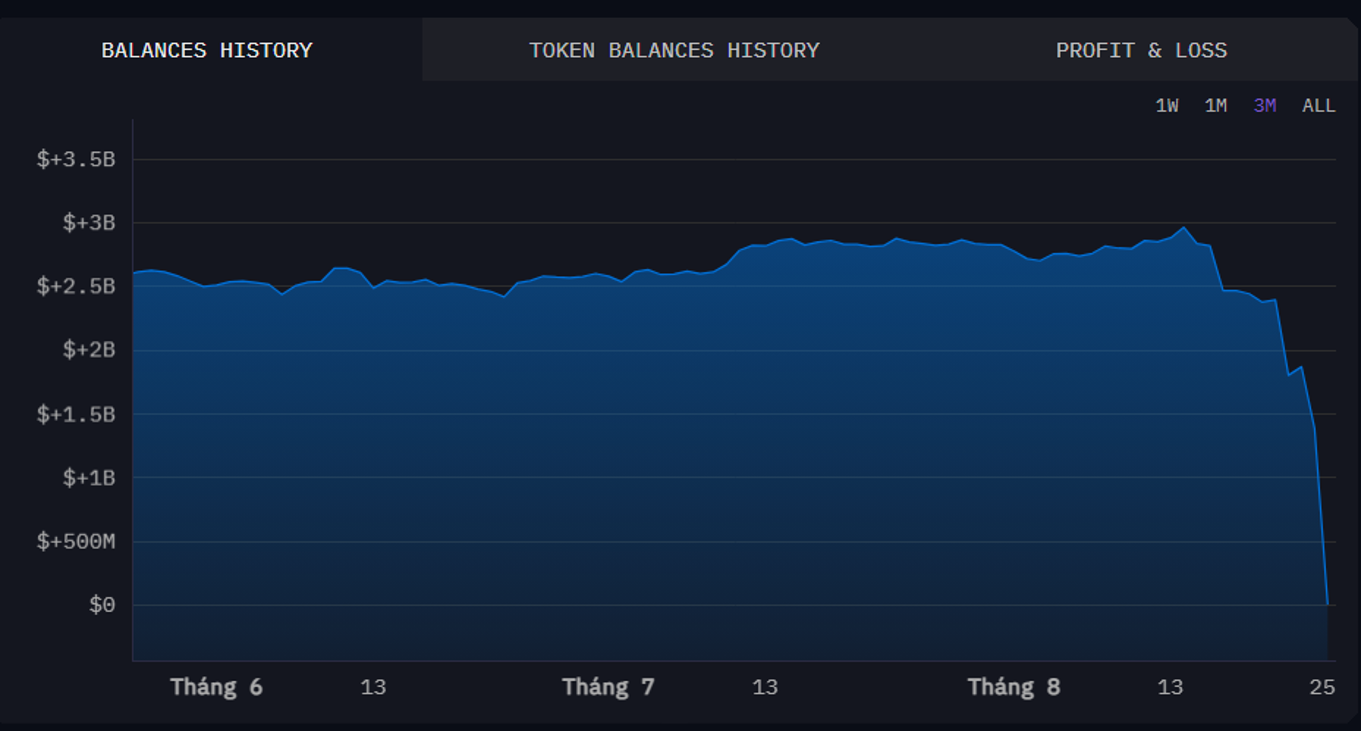

Arkham data revealed that an OG whale wallet, “19D5J8,” which held 23,969 BTC worth nearly $3 billion, suddenly moved most of its funds on August 25 after five years of inactivity.

Bitcoin whale wallet address balances awaken after five years of hibernation. Source: Arkham

“They transferred 12k just today and are still actively selling, which is likely

contributing to the ongoing price drop,” Sani, founder of TimechainIndex, commented.

Meanwhile, investor MLM flagged another whale wallet that sold more than 18,000 BTC to buy Ethereum.

This trend suggests investors are shifting toward ETH, driven by strategic accumulation campaigns from companies like Bitmine and SharpLink. Such momentum could prompt more whales to rotate out of Bitcoin, fueling further sell pressure.

Weekend liquidity deepened the decline

The second reason lies in weekend market dynamics.

Crypto markets typically see thin liquidity over weekends, and August 2025 was no exception. Data from CryptoQuant highlighted “liquidity traps” that triggered manipulation, especially on Sundays when trading volumes dropped sharply.

In other words, with fewer participants over the weekend, a single large sell order from a whale was enough to spark heavy volatility.

Weekend Market Characteristics

- Liquidity drops compared to weekdays.

- Spot and derivatives volumes fall, leaving order books thin.

- Stop-loss orders get triggered more easily, causing cascading sell-offs.

— XWIN Research Japan, via CryptoQuant, commented.

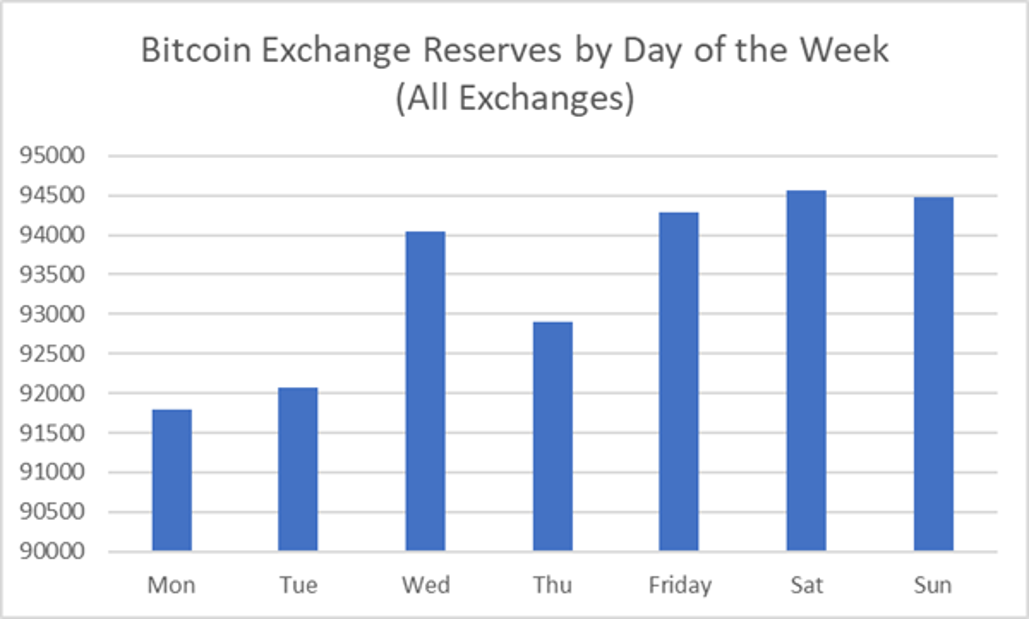

Additionally, XWIN Research Japan noted that the third reason is related to the Bitcoin reserves on the exchange, which tend to increase during weekends.

Bitcoin exchange reserves by day of the week. Source: CryptoQuant.

“BTC inflows to exchanges often spike before weekend dips, signaling sell pressure. The chart shows reserves are consistently higher on weekends (Sat–Sun), making the market more fragile,” XWIN Research Japan added.

In short, whale activity, thin liquidity, and rising exchange reserves created a “perfect storm” for Bitcoin in the final week of August 2025. For now, these pressures outweigh the positive sentiment generated by Jackson Hole.